It`s an established fact that all over the world – even in advanced countries like France, the United Kingdom, United States of America, Germany etc. – the taxes levied have been used to develop their economies. When we travel to those places we see and admire them.

In a recent report published by the Organisation for Economic Cooperation and Development (OECD), it ranked Netherlands as the country with the highest national income tax rate of 52 percent – more than 12 percentage points higher than even the U.S. top federal individual income rate of 39.6 percent.

The concept of levied taxes is not so different from African countries – except that while the taxes are paid, it doesn’t match the level of development one would expect to see. So, generally, paying tax is good for governments to undertake developmental projects to transform the economy.

In the last few months, one major issue that has confronted many countries by impeding growth and increasing cost of living is the level of inflation. In a recent report by the British Broadcasting Corporation (BBC) published on 18th May 2022, UK inflation hit a 40-year high of 9% – up from 7% – as energy bills soar. The surge came as millions of people saw an unpresented £700 a-year increase in energy costs during the previous month.

In the United States of America price rises slowed in April, but the annual inflation rate remained close to a 40-year high – leaving many Americans struggling to afford necessities including food, shelter and fuel. At 8.3%, the annual rate of inflation in April was down from 8.5% in March but remained at a level unseen since the 1980s.

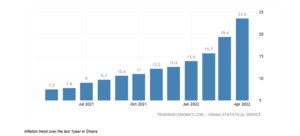

As advanced economies are battling to tame the surge in inflation, Ghana has not been spared. Ghana’s inflation rate climbed to the highest level in more than 18 years in April; while the Bank of Ghana`s inflation target was set and to be achieved at 8% (+/-2), we have seen inflation hitting 23.6% in April 2022, increasing from 19.4% from March 2022. Inflation has more than doubled the central bank’s target; and if what industry analysts are saying is anything to go by, Ghana will witness a hyperinflation of more than 50%. That said, the geopolitical war between Russia and Ukraine as well as lingering COVID-19 effects have had significant impacts on the general economy – but several countries are managing the situation much better.

In all this, I think the major challenge to curbing inflation in Ghana is the disconnect between the Monetary Policy approach in inflation-targetting and the Fiscal Policy measures to reduce the appreciable increase in prices of Goods and Services. As you may know, Inflation-targetting is the central bank strategy of specifying an inflation rate as a goal and adjusting monetary policy to achieve that rate.

In using its Inflation-targetting approach, the central bank strategises to specify an inflation rate as a goal and works around the monetary policy to achieve that rate at 8% (+/-2). It is primarily focused on maintaining price stability, but is also believed by its proponents to support economic growth and stability.

While the central bank’s approach may be somehow difficult to achieve, many economists suggest that the monetary policy enacted by the central bank is more effective for reducing inflation. Some analysts however believe that a focus on inflation-targetting for price stability creates an atmosphere in which unsustainable speculative bubbles and other distortions in the economy – such as those which produced the 2008 financial crisis – can thrive unchecked.

Again, even though there is a school of thought that money supply growth is the cause of inflation – faster money supply growth causes faster inflation. I believe the use of Contractionary fiscal policy to fight the surge in inflation may be the best approach in the current situation where we find ourselves as Ghanaians. In this case, it may be prudent to decrease taxes and decrease government spending in an attempt reduce the total level of spending. Though government is making frantic efforts to cut public expenditure by some 20%, I believe the ripple-effect on the economy is yet to be seen.

The reason I firmly believe that inflation can tackled from the fiscal side is on the basis that Ghana as a country is heavily import-dependent and produces less for consumption. When you look at the major constituent of inflation in Ghana, food-price growth quickened to 26.6% in April 2022 from 22.4% in March 2022.

Also, non-food inflation climbed to 21.3% from 17% in the prior month, led by higher prices of transport (33.5%), household equipment and maintenance (28.5%); and housing and utilities (25%). On a monthly basis, consumer prices rose by 5.1%. So, food is effectively the major driver of inflation in Ghana.

The hard truth is that most of consumables are imported and attract huge taxes at the clearing port. Under the ECOWAS Common External Tariffs, Ghana now operates Five-Band Tax Rates as listed in the table below:

The above enumerated tax rates are not in respect of Import Duty only; they is also an imposition of the following: Value Added Tax, National Health Insurance Levy, Ghana Education Trust Fund, Import Excise Duty, Examination Fee, African Union Levy, ECOWAS Levy, Processing fee, Special Import Levy, Import Levy, Interest charge, State Warehouse Rent.

The above enumerated tax rates are not in respect of Import Duty only; they is also an imposition of the following: Value Added Tax, National Health Insurance Levy, Ghana Education Trust Fund, Import Excise Duty, Examination Fee, African Union Levy, ECOWAS Levy, Processing fee, Special Import Levy, Import Levy, Interest charge, State Warehouse Rent.

Even though government is bent on increasing domestic revenue as per the 2022 budget to about GH¢57m, drastic issues requires radical decisions. What government can do is to reduce levies on some major specific imported goods at the ports which have significant impact on the economy. While I am mindful of the revenue shortfall in the short-term, this may be the panacea to address an elevated inflationary level.

Again, take for example cement manufacturing companies which may be importing clinker into the country to produce cements for the local market. They will be made to pay over 13 taxes before goods can be cleared at the harbour. What this means is that the expensive nature of the clearing system ensures charges are passed on to the retail consumer, which increases the general level of prices for goods and services. There are several examples like this which I may not be able to highlight, but they eventually affect household consumption.

In summary, the idea that fiscal activism might lower the inflation target is not new. Fiscal policy promotes macroeconomic stability by sustaining aggregate demand and private sector incomes during an economic downturn, like we see today, and by moderating economic activity during periods of strong growth. The impact of current inflation numbers on household consumption and real income has become alarming. Government through the Ghana Revenue Service should reconsider the levies and tariffs, and take stringent decisions on levies that can be scrapped or reduced at the port.

Thank you for reading.

Disclaimer: The views expressed are personal views and don’t represent those of the media house or institution the writer works for.

About the writer

Carl is a Banking, Finance, and Investment professional. Director, Banks & Broker Dealers with an International Bank in Ghana. Contact: [email protected], Cell: +233 200301110