By Joshua Worlasi AMLANU

As part of efforts to reinforce the country’s financial safety net and improve payout readiness during institutional distress, the Ghana Deposit...

The Founder and Senior Partner of AB & David Africa, Dr. David Ofosu Dorte (Esq.), has expressed concerns over the common practice in Ghana's...

By Surv. Prof. Forster Sarpong

Six months into the ambitious “Ghana Reset Agenda” championed by President John Dramani Mahama in his second administration, the national...

...calls for global governance reforms

By Kizito CUDJOE & Juliet ETEFE

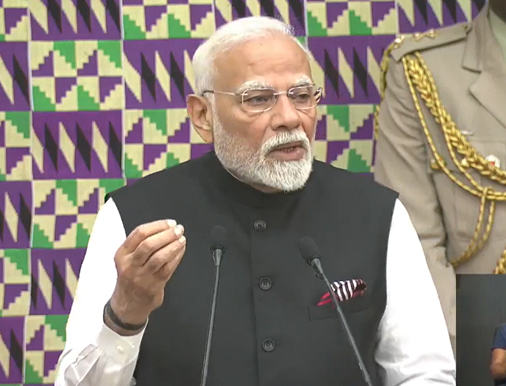

Indian Prime Minister Narendra Modi on Thursday expressed India’s commitment to strengthening economic and strategic...

Over the past decade, we have witnessed how big concerts of hip-hop musicians and other artists influenced not just the people but economies all...

On the Ghana Stock Exchange (GSE), several listed companies such as Cocoa Processing Company (CPC), State Insurance Company (SIC), GOIL Plc, and even MTN...

By Evelyn ARTHUR, Tema

Stakeholders at Port Tema have declared their full support for government’s proposed 24-hour economy model, set to be rolled out across...

Africa is not a continent of lack—it is a continent of abundance. Africa is not a problem to be solved—it is a promise to...

By Surv. Prof. Forster SARPONG

In the midst of Ghana’s determined effort to exit one of the most turbulent economic crises in its Fourth Republic...

There is quiet gold beneath our feet. Yet, I can’t find plantain to buy, and it frustrates me. Some time ago, watermelon was also...