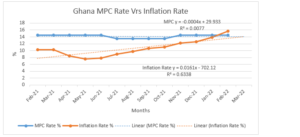

The monetary policy rate since 2021 has always been higher than the inflation rate. The average difference between these two rates for the past year has been 3.5%. As the February 2021 inflation rate was 15.7%, it is anticipated that the MPC rate for the coming quarter should be set at a range of 15.8% to 19.2% by the Bank of Ghana (BoG). This means an estimated 130 to 470 basis points increase in the MPC rate for March 2022.

Therefore, it is projected that 200 basis points may be added to increase the MPC rate from 14.5% for March 2022 outcome. Should BoG try to address the Ghana cedi’s free-fall against foreign currencies, then the MPC rate must be set at 19.2%.

This might cause interest rates to increase and make government securities attractive, and prevent hoarding of foreign currency as an investment. The impact will be that the cost of funds will be expensive and thus slow down the economy as a short-term strategy.

Table 1

MPC Rate verse Inflation Rate

| Months | MPC Rate % | Inflation Rate % | Difference % |

| Feb-21 | 14.5 | 10.3 | 4.2 |

| Mar-21 | 14.5 | 10.3 | 4.2 |

| Apr-21 | 14.5 | 8.5 | 6 |

| May-21 | 14.5 | 7.5 | 7 |

| Jun-21 | 14.5 | 7.8 | 6.7 |

| Jul-21 | 13.5 | 9 | 4.5 |

| Aug-21 | 13.5 | 9.7 | 3.8 |

| Sep-21 | 13.5 | 10.6 | 2.9 |

| Oct-21 | 13.5 | 11 | 2.5 |

| Nov-21 | 14.5 | 12.2 | 2.3 |

| Dec-21 | 14.5 | 12.6 | 1.9 |

| Jan-22 | 14.5 | 13.9 | 0.6 |

| Feb-22 | 14.5 | 15.7 | -1.2 |

| Average | 14.19 | 10.7 | 3.5 |

Source: BoG and GSS website

Figure 1

Trend Analysis of MPC Rate and Inflation Rate

The writer is Chief Finance Officer of Valley View University

Email: [email protected]