…understanding the basics

Regulation is a buzzword that is mentioned at various stages of business and social engagements – international, regional, national, industry and firm levels. It is an important issue that concerns governments, investors, professionals, consumers, and the public. Regulation, which I define as the act of controlling a group of persons, or activity, with common interest between the regulator and the regulated. Regulations provide enabling environment for businesses to thrive through trust, confidence, assurance, safety, and soundness. In this paper, we shall focus on understanding the thinking behind regulation, and its application in Africa’s fintech ecosystem.

Regulatory Thought

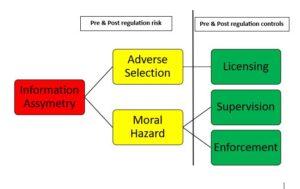

Regulators in Africa are guided by relevant theories in developing frameworks to control fintechs operating in the ecosystem. These theories are like what regulators use in managing traditional banks and other non-bank financial institutions. There are several applicable theories, but we will focus on a common one known as the theory of information asymmetry.

Information asymmetry theory is the thought that two parties forging a relationship or going into a contract, will not have the same level of information. It is most likely that the party offering the service will have more information in terms of how the service works, among others, than the party subscribing to the service. This risk can occur before or after completing the transaction. The former risk is known as adverse selection and the latter risk, moral hazard. Without sounding technical, let us summaries information asymmetry as risks that can occur before or after a transaction due to the different level of information held by each party. The essence of regulation is to manage the information gap between fintechs offering financial inclusion products and services that may not meet the needs of consumers and ensure that the consumer is protected and not abused. In my next paper, I will share with you thoughts on fintech consumer protection.

Regulators also regulate because they have the interest of consumers and the responsibility to protect. In essence, consumers are the reference point for regulators because they contract with fintechs to enjoy their services, and because of possible information difference at the time of contracting, the regulator sets in as “referee” to ensure fintechs provide as much information as they can for the consumer to make informed decision before consenting to contract. This explains why fintechs are required to disclose and be transparent with information about their products and services.

The question is how does the regulator achieve this objective? There are two broad ways, namely, licensing and supervision. While licensing addresses risk of information difference before fintechs contract consumers, supervision addresses risk of information difference after fintechs subscribe consumers to their products and services.

Regulatory Thought: Application

With the risk of information difference occurring before and/or after fintechs contracting consumers, regulators define practical steps to managing the risks. These steps include developing various regulatory instruments such as Acts, legislative instruments, guidelines, directives, notices, moral suasion, among others.

Licensing

Licensing refers to the process of pre-defining requirements for prospective fintechs to seek initial approval to formally operate in the ecosystem. With the aim of managing the information gap, the licensing process focuses on capital, governance, systems, people, products/services, know your customer/customer due diligence (KYC/CDD), business plan, relevant policies, etc. This compels fintechs to provide adequate information about their entity for clearer understanding of their identity and intended scope of financial inclusion products and services. Regulators need this minimum information to give them reasonable evidence that their interest and that of the consumer is assured.

It is also for the reason of information asymmetry risk why regulators require already licensed entities to seek regulatory approval for new products and services they intend to offer to consumers. This ensures that the regulator is abreast with prevailing financial inclusion products and services and their corresponding exposure consumers.

Lastly, licensing gives power to the regulator, granting it authority to supervise fintechs and their operations.

Supervision and Enforcement

Supervision and enforcements are considered as post licensing tools, also implemented with the objective of managing risk of information asymmetry after fintechs secure their licenses based on information submitted. Basically, it is to ensure that fintech strictly comply with the conditions for which their licenses were issued and strictly operate within the approved permissible activities. In the spirit of innovation, some fintechs abuse their license to offer financial inclusion services that defeat the reason for which they were licensed.

Supervision could be undertaken remotely or on the field. The former is executed through reviews of reports on financial inclusion products submitted periodically by fintechs. The latter supervision is when the regulator visits the premises or site of the fintech to perform operational reviews including details on consumer engagements. Although the objective of both offsite and onsite supervision is to manage the risk of information asymmetry in the interest of the consumer, observations from the exercise could be a source of revision input to the licensing requirements. This approach improves risk management from a prevention perspective.

Enforcement is considered as a major tool for regulators as it ensures that fintechs and the ecosystem players comply with regulatory requirements and standards. It starts with the regulator being consistent and open about requirements for regulating financial inclusion products and services, application of penalty to revocation of fintech licenses. It is important for regulators to act in timely and appropriate manner to ensure the interest of consumers are considered paramount in the operations of the ecosystem players.

Conclusion

At the centre of fintech regulation is the consumer’s interest. While fintechs are seeking to provide need-based financial inclusion products and services to consumers, regulators envisage the risk that, some fintechs may abuse consumers and in a worse case scenario, use the fintech products and services to perpetuate adverse activities other than what they are licensed to undertake. With the consumer interest in mind, regulators are entreated to be proportionate in their requirements definitions and supervision processes in order not to overregulate, but rather create a win-win situation for both fintechs and consumers and the ecosystem at large.

About the Author

Samuel Eduam is a Policy and Regulatory Expert with experience in Banking, Fintech, Consulting and International Cooperation. He may be reached via [email protected]