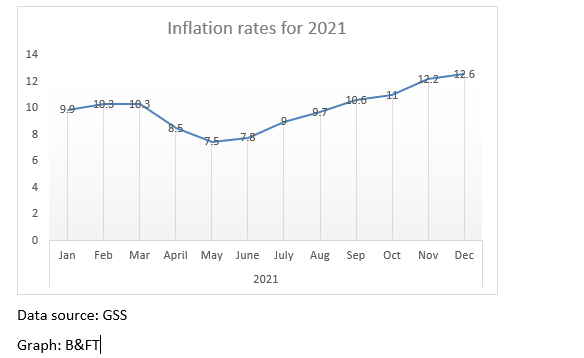

- Ends 2021 at 12.6%, highest in 29 months

The general price of goods and services, measured by the consumer price index, has hit its highest since rebasing of the basket was done in August 2019 – becoming another albatross around the neck of the economy’s managers.

Data published by the Ghana Statistical Service (GSS) show that inflation ended 2021 at 12.6 percent, becoming the highest rate to be recorded in close to two and half years.

According to the GSS, food products recorded a slightly higher inflation compared to non-food, probably due to high demand for food during the festive season. Food inflation was 12.8 percent while that of non-food is 12.5 percent.

However, food’s contribution to the national inflation has declined to 45.2 percent compared with the over-50 percent it was recording some few months ago. On the other hand, the non-food basket has taken over as the main driver of inflation, since housing, water, electricity, gas and other fuels continue to see rises in their price.

At the regional level, overall year-on-year inflation ranged from 7.4 percent in the Eastern Region to 18.6 percent in the Upper West Region. Eastern Region recorded the highest month on month inflation at 4.8 percent. All regions recorded positive month-on-month inflation rates, with Upper East Region recording the lowest with 0.1 percent.

Inflation for imported goods was 10.4 percent, higher than the 9.8 percent recorded in November; while the inflation for locally produced items was 13.3 percent, up from the 13 percent recorded the previous month.

The hike in inflation, over the past six consecutive months, creates a very unconducive atmosphere for the economy as rising prices of goods and services seem not to be going away anytime soon – given the cause is from both external and internal factors. The domestic cause of rising prices is mainly pushed by the persistent increase in fuel prices, which naturally increases the cost of production with the final burden transferred to consumers.

And on the international front, supply change challenges, rising oil prices among other things, keep pushing up prices of products. With the country being overly import-dependent, such prices are also automatically imported into the country with ease. The above factors signal uncertainty over price stability in the short-term.

Impact on cedi

The cedi, last year, saw a 4 percent depreciation against the US dollar; a situation that the Centre for Economics Finance and Inequality Studies (CEFIS) has said can contribute to weakening the local currency if inflation is not tamed.

“The increasing level of monetary policy rates over the recent quarters does not predict a decrease in price levels. This coupled with the not too pleasant macroeconomic variables all point to the fact that inflation will largely continue to rise in 2022, albeit at a slow rate.

Furthermore, liquidity tightening on the international financial market – coupled with the uninspiring debt sustainability level for Ghana measured by the Debt to GDP ratio – may mean that government will have to contract debt at a higher cost than before. This will inch-up inflation, which will affect the Ghana cedi negatively,” the CEFIS report stated.

Impact on lending

The rising inflation has also created uncertainty for interest rates in the country, as the Monetary Policy Committee (MPC) of the Bank of Ghana is yet to decide the policy rate for the first few months of the year.

At its 103rd meeting late last year, the MPC hiked the rate to 14.5 percent as it raised concerns over inflationary pressures.

“Headline inflation has risen consistently from the low of 7.5 percent in May 2021 to 11 percent in October, driven by both food and non-food price increases. In addition, all the Bank’s core measures of inflation have increased, indicating broad-based underlying inflation pressures, with the potential of de-anchoring inflation expectations.

“Currently, headline inflation is above the upper limit of the medium-term target band; and the Committee noted significant risks to the inflation outlook. These risks include rising global inflation, high energy prices, uncertainties surrounding food prices and investor behaviour.

“The Committee further noted that these elevated inflationary risks require prompt policy action to re-anchor inflation expectations, so as to safeguard the central bank’s price stability objective. Given these considerations, the Committee therefore decided to raise the policy rate by 100 basis points to 14.5 percent,” the statement said.

This means any hope of the private sector having a cheaper lending rate remains an illusion, given inflationary pressures continue to exist with uncertainty around its future