…highlights realisation of digital strategy

Subsequent to its merger with CFC Savings and Loans in 2017, Bayport Savings and Loans has recorded significant strides in its transformational agenda, its Chief Executive Officer, Nii Amankra Kwashie Tetteh, has revealed.

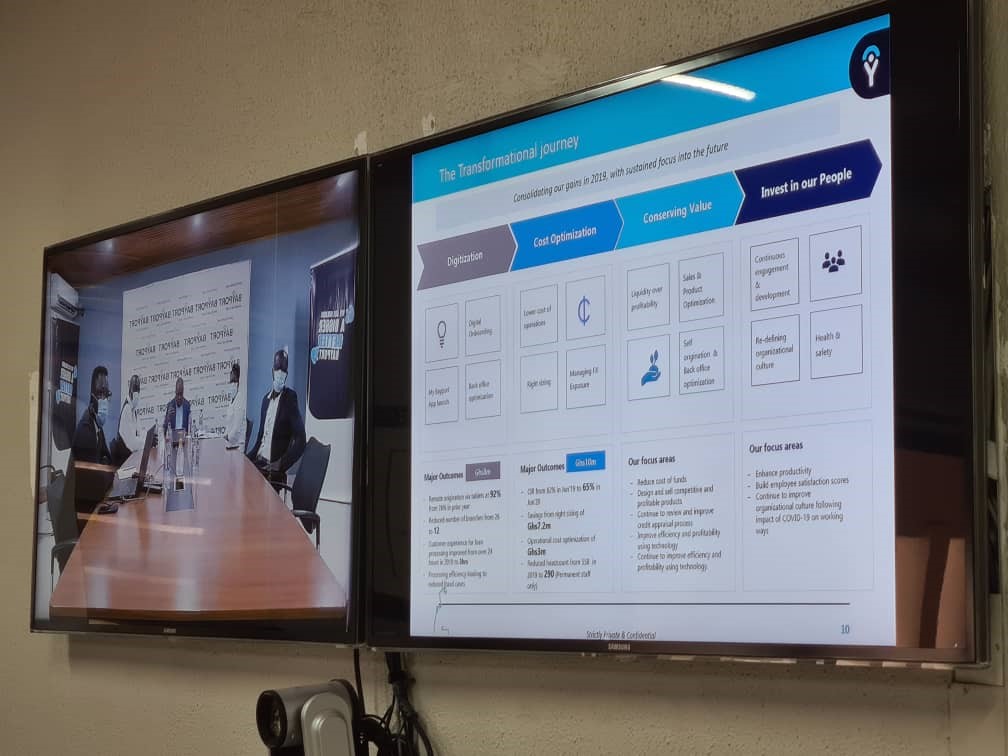

According to him, the consolidated gains have been spurred on largely by an aggressive digital strategy which predates the advent of the ongoing pandemic. This, he said, has not only positioned the company to stay afloat, but is on course to achieve its projected targets for the year.

Speaking at a ‘Facts behind the Figures’ session hosted virtually by the Ghana Stock Exchange (GSE), he stated that the digital drive has led to increased cost optimisation, reduced number of leakages, particularly from incidents of fraud, improved customer experience and efficiency across all spheres of Bayport’s operations.

As an example, he stated, “we’ve reduced the number of our branches from 26 to 12 and we’ve also heightened customer experience – it used to take us about a day to process our loans but currently we do it in about three hours and the intention is to shorten this process even further.”

Furthermore, whilst the digital adoption rate hovered around the 72 percent mark, the onset of COVID-19 has moved it north of 90 percent. “Currently, more than 92 percent of all our transactions are digitally originated,” he revealed.

Digital onboarding, he added, is fully operational through the ‘My Bayport’ app with disbursement of loans via mobile money platforms and customer self-origination via USSD codes and tools like WhatsApp in various stages of adoption.

The figures

Taking her turn, Chief Finance Officer, Dzifa Abla Cofie, disclosed that Net Interest Income grew marginally, by 4 percent compared to the same time last year. This, she claimed was primarily due to the volumes of trade as well as a minor adjustment of the prices on the loans offered.

She added that the Cost-to-Income ratio also reduced particularly as a consequence of the cost optimisation processes as total operating expense reduced by seventeen percent. This was driven mainly by the reduction in staff headcount as well as cost of operations.

The headcount had reduced from an original figure of more than 850 when the merger was finalized in 2017 to 558 in 2019 and currently sits at 290 permanent members of staff.

Payout to redundant staff during the rightsizing process in the second half of 2019 accounted largely for the total comprehensive loss of GH¢13.86 million in 2019. However, the exercise has resulted in GH¢10 million saved cross the board translating to a reduction in the Cost to-Income ratio from 82% to 65% as at June of 2020. Also, the loan book which is comprised of 95 percent payroll loans and 5 percent non-payroll loans grew by 9 percent year-on-year.

“In terms of shareholder loan, we promised to pay all dollar-denominated shareholder loans and as at the end of June, we had totally paid off the shareholder loan that we held. The total amount of bonds we are currently holding is GH¢181 million, following the maturity of the GH¢25 million that was paid in August.”

Dzifa Cofie added that whilst Bayport would not hesitate to seek shareholder loans if necessary, it is committed to its primary task of increasing customer deposits to fund the business. On expectations for the upcoming year, Mr. Tetteh stated that with a gradual return to normalcy, a key goal of the firm is to provide a unique customer digital experience that differentiate Bayport from other players in the sector.

From the GSE

Delivering the closing remarks, Deputy MD of the Exchange, Abena Amoah, extended an invitation to Bayport – and consequently other financial firms – to list equity on the market. “We invite the Bayport team to take advantage of the GSE’s full bouquet of offerings and whilst you’ve done great on the debt market, we also take this opportunity to invite you onto our equities market.

“On the subject of your capital structure and consider raising equity, you’ve tested the market, you are known to Fund managers, Trustees and investors alike. You have honored your bond obligations and this is a good opportunity for you to also consider listing some equity securities to diversify your capital base.”