In spite of the annihilative impact of the coronavirus pandemic on the country’s local currency, making it record its highest depreciation against the US dollar since the beginning of the year, the Bank of Ghana (BoG) says it expects the cedi to gain stability as pressure on it has started easing.

After hitting its ‘hattrick’ by appreciating against the US dollar for the first quarter of the year, the cedi started losing grip on the dollar after the pandemic triggered capital flight to safety from emerging and developing economies.

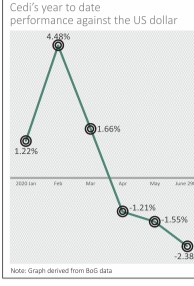

As of the end of April, the cedi had depreciated by 1.21 percent against the US dollar; depreciated 1.55 percent at the end of May; and further depreciated by 2.38 percent as of June 29, 2020, its sharpest depreciation in the year (using BoG mid-rate figures).

However, it appreciated 1.22 percent at the end of January, 4.48 percent at the end of February, and 1.66 percent at the end of March 2020, recording three months consecutive gains against the US dollar, a feat that has not been achieved in memorable recent past. These indicate that the currency’s bad performance in the second quarter was, among other factors, largely stirred by the pandemic-induced capital flights from the country which put enormous pressure on the cedi.

Governor of the Bank of Ghana, Dr. Ernest Addison underscored this last week before the Public Account Committee of Parliament when he said: “The cedi reflects many factors. It reflects our domestic economy.

It reflects developments in the global economy and If you look at what has happened worldwide, we have seen capital leave jurisdictions such as ours into the advanced economies. Now, when that happens, it has an impact on the availability of dollars in Ghana and that can trigger a depreciation of the currency.”

But as many investors have come to the realisation that the pandemic is not going away anytime soon; coupled with the fact that the advanced economies have been badly hit by the impact of the pandemic more than developing and emerging ones – making them no safe haven, some investors have backtracked from moving out, thereby, easing the exchange rate pressure. It is against this background that the central bank says it expects the cedi to gain stability going forward.

“Recent pressures on the local currency have eased somewhat, on the back of inflows from the mining sector, positive sentiments of the early issuance of the Eurobond and US$1billion Rapid Credit Facility from the IMF, and forward auctions sales. In addition, the flight to safety from emerging market economies at the start of the pandemic has eased somewhat in April. These are expected to support the current stability of the cedi,” the bank is stated in its Inflation Outlook and Analysis report for May 2020.

Prior to the bank’s forecast, other analysts had also projected the cedi to gain strength given the inflow of the US$1 billion from IMF and forex measures introduced by the Bank of Ghana.

“The recent approval of US$1 billion by the IMF for Ghana’s COVID-19 responses should also provide forex inflows to shore up the country’s foreign currency reserves. This would significantly enhance the Bank of Ghana’s capacity to support the Cedi against extreme shocks. We expect these developments to mitigate the pressure on the Ghana Cedi in quarter two of 2020,” the Data Bank Research (May 2020) commented.

And the Director of the Institute of Social, Statistics and Economic Research (ISSER) at the University of Ghana, Prof. Peter Quartey, also underscored this point in an earlier interview with the B&FT, saying: “With the US$1 billion from IMF, it will add to the supply of foreign currency and hopefully bring down the exchange rate.”