Eight months after a surprise return to orthodox economic policies, Turkish officials are continuing to signal their commitment to reform. The Central Bank of the Republic of Turkey (CBRT) has raised interest rates by 36.5 percentage points since June, while the government, steered by Finance Minister Mehmet Şimşek, has tightened fiscal policy, notably by increasing indirect taxes and adjusting regulated prices.

Both fiscal and monetary authorities have repeatedly emphasized Turkish President Recep Tayyip Erdoğan’s support for these efforts, seeking to calm fears of an abrupt policy reversal. Remarkably, for the first time ever, Erdoğan himself presented the country’s medium-term economic program in September, vowing to bring inflation down to single digits with the help of “tight monetary policy.”

Equally important, the Turkish economy has begun to enjoy the fruits of normalization. Over the last six months, the risk premium on Turkish government bonds has decreased significantly, from 679 to 280 basis points.

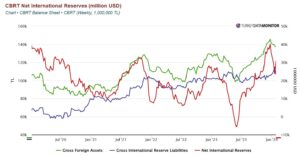

The CBRT’s net international reserves rose from minus $3 billion to $30.7 billion.

Although short-term capital inflows were initially sluggish, owing to investor skepticism about the new team’s staying power, they accelerated in the five weeks leading up to January, signifying a positive trend.

But repairing the damage caused by years of unorthodox policies is a formidable challenge, and many signs point to a prolonged recovery. Turkey’s inflation rate hit 65% at the end of 2023 and is forecast to reach roughly 75% by mid-2024, before gradually tapering to around 50% by the end of 2024.

Anticipating a spike in inflation, consumers are expediting their purchases, which is offsetting the impact of aggressive policy tightening. Adjustments of regulated prices and the decision to increase the minimum wage by almost half ahead of local elections in March have also contributed to persistent inflationary pressures.

The slower-than-expected progress on curbing inflation might test Erdoğan’s patience. Moreover, the effects of these stringent measures on the economy are likely to intensify this year, with conditions worsening before they get better. The country may even need to lower its 2024 growth target of 4% if the CBRT remains committed to its year-end inflation goal of 36%.

As the chart below illustrates, inflation expectations remained pessimistic and only recently began to show signs of moderation. This lag can be attributed to the incremental approach that the CBRT initially took following the appointment of Hafize Gaye Erkan as governor in early June. The increase in the policy rate by 6.5 percentage points later that month and 2.5 percentage points in July disappointed expectations of a more aggressive tightening. It wasn’t until the monetary policy committee was overhauled in late July that the CBRT adopted a more aggressive stance, culminating in several substantial rate hikes.

If the CBRT had frontloaded interest-rate increases, the adjustment in inflation expectations and the corresponding influx of capital would likely have begun earlier, even if the peak policy rate ultimately remained the same. Given that the CBRT had lost considerable credibility after four governors were dismissed in five years and inflation soared from 8.5% in September 2019 to 83.4% in September 2022, decisive action was needed to regain financial markets’ trust. Moreover, the CBRT’s initial approach led bond investors to delay their purchases until the cycle’s peak to optimize returns. Only after the CBRT indicated that it was nearing the end of its tightening cycle in November did capital inflows increase markedly.

The CBRT’s timid messaging has further undermined efforts to restore its credibility. In July and October, Erkan signaled that she would not consider compromising growth for the sake of disinflation. While plausible in theory, the effective implementation of this idea paradoxically requires a more assertive approach that demonstrates the bank’s unwavering dedication to mitigating inflationary pressures. For example, US Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde have demonstrated their willingness to accept economic slowdowns as a necessary trade-off for controlling inflation, thereby reinforcing their commitment in the eyes of the markets. In November, Erkan finally acknowledged that the CBRT would pay a higher cost to contain inflationary pressures.

Moreover, CBRT and senior government officials frequently use phrases like “monetary tightening” or “quantitative tightening” in their policy communications, while avoiding more direct terms such as “rate hikes.” This choice of language, coupled with Erdoğan’s well-documented aversion to interest rates, casts a shadow over the CBRT’s independence.

Lastly, while Erkan’s resignation as governor on February 2, owing to reports of her father’s unofficial involvement in the central bank, calls to mind the revolving door of the past five years, when Erdoğan pursued his unorthodox economic experiment, it is unlikely to lead to a shift in policy. For starters, Deputy Governor Fatih Karahan, who began his career as an economist at the Fed and later became a principal economist at Amazon, was appointed as her successor.

More importantly, in contexts where a central bank’s independence is either exceptionally strong or notably weak, the governor’s identity and personal views have minimal influence over the trajectory of monetary policy. In countries with limited institutional independence, like Turkey, political authorities are perceived as the ultimate decision-makers. The pivotal moment for the shift back to orthodox economic policy was thus the appointment of the widely respected Şimşek as finance minister. So long as he remains in his post, the CBRT’s policy stance is unlikely to shift significantly – regardless of whether Erkan or Karahan is governor.

Selva Demiralp, Professor of Economics and Chair of Yapi Kredi Economic Research at Koç University, is Director of the Koç University-TUSIAD economic research forum.

Copyright: Project Syndicate, 2024.

www.project-syndicate.org.