…as T-bills, deposits provide succor

The banking sector has remained ‘stable, sound, liquid and profitable’ even as banks continue to rebound from impacts of the Domestic Debt Exchange Programme (DDEP), Bank of Ghana (BoG) Governor Dr. Ernest Addison has stated.

Last year, following the debt swap initiative’s impact, mark-to-market losses on investments, higher impairments on loans and rising operating costs, banks – which held in excess of 33 percent domestic securities – in the industry posted total after-tax losses of GH¢6.6billion.

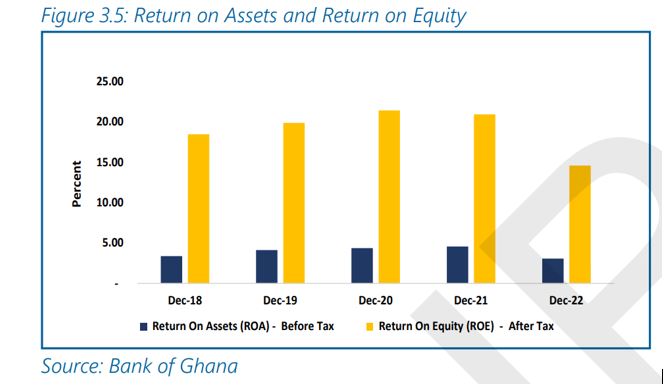

This happened as the main profitability indicators – namely return on assets and return on equity – turned negative in 2022 because of the industry’s loss position. Return on equity declined from 20.9 percent in December 2021 to 14.6 percent in December 2022. Similarly, return on assets saw a decrease from 4.6 percent to 3.1 percent during the same timeframe.

Speaking during a press briefing at the 115th meeting of the central bank’s Monetary Policy Committee (MPC) conclusion – the final for 2023 – Gov. Addison stated that the return to profitability witnessed during the year has been sustained, primarily on account of investments in the Treasury-bill end of the market.

“The banking sector remains stable, sound, liquid and profitable, even as banks continue adjusting to impacts of the DDEP… Profitability continues to improve as banks continue to invest in high-yielding, short-dated BoG and GoG instruments. The banking sector showed some resilience, as the various stress tests on banks’ capital – following adverse macroeconomic shocks – pointed to stability,” the Governor said.

Official data indicate that as of end-September 2023, total assets of the banking industry reached GH¢250.7billion; reflecting a year-on-year growth of 14.9 percent from GH¢218.1billion in September 2022. Furthermore, the industry experienced a notable increase in profit after tax, registering a growth of 43.8 percent to GH¢6.2 billion in September 2023; in contrast to growth of 19.5 percent for September 2022.

Expansion of the industry’s assets was evident in the rise of deposits and borrowings throughout the assessment period. Deposits exhibited year-on-year growth of 33.2 percent, reaching GH¢195.5billion as of end-September 2023.

This growth surpassed the 28.9 percent increase observed in September 2022. The heightened deposit growth was attributed to both the upsurge in collection of domestic currency deposits and revaluation impact of foreign currency-denominated deposits.

Money market impact

The ongoing activity of banks in the money market resulted in the 91-day and 182-day Treasury bills concluding October 2023 at rates of 29.4 percent and 31.37 percent respectively. This marked a slight decrease from their rates of 31.53 percent and 32.61 percent in October 2022. Conversely, the rate on the 364-day instrument increased to 33.16 percent from 32.32 percent over the corresponding period.

In the third week of November, the Treasury’s offering of 91-day to 364-day bills garnered total demand amounting to GH¢5.01billion – surpassing the auction target by approximately 40 percent. The Treasury accepted 99.4 percent of the bids, achieving 1.39 times the target and 1.49 times the maturity coverage. Yields continued their downward trend, with the 91-day, 182-day and 364-day tenors decreasing by 24 basis points, 12 basis points and 21 basis points, respectively settling at 29.5 percent, 31.76 percent and 33.23 percent.

The upcoming T-bill auction scheduled for Thursday, November 30, 2023 aims for a gross issuance of GH¢5.62billion (a 72 percent week-on-week increase) across the 91-day to 364-day bills to refinance anticipated maturities of GH¢3.45billion.

“We believe the Treasury is building liquidity buffers from excess uptakes of the recent issuances against budget financing and liability management obligations early in 2024,” analysts at GCB Capital have suggested regarding the trend.

While the liquid domestic market can support the target size at the next auction, an expected decline in the clearing yields could moderate and the Treasury will be accumulating a sizable refinancing risk into the future, they posited.

Financial soundness

Dr. Addison noted that the industry’s capital adequacy levels remain above the minimum regulatory level, with most banks carrying excess liquidity. Nonetheless, the industry’s Financial Soundness Indicators (FSIs) recorded mixed trends.

The adjusted Capital Adequacy Ratio (CAR), factoring-in regulatory reliefs, stood at 13.8 percent in September 2023. Although this is higher than the revised prudential minimum of 10 percent, it represents a decline from the 16.4 percent recorded in September 2022. The decrease in CAR is attributed to losses incurred by banks on their investments following the DDEP (Phase I).

During the review period there was a deterioration in asset quality, as indicated by an increase in the industry’s non-performing loans (NPL) stock in relation to growth in total loans. The NPL ratio rose to 18.3 percent in October 2023, up from 14.0 percent in October 2022 and 15.7 percent in January 2023. This reflected heightened credit risk associated with delayed impacts of the macroeconomic crisis from 2022.

In September 2023, the NPL ratio further increased to 18 percent compared with 14.1 percent for September 2022. When adjusted for the fully provisioned loan loss category, the industry’s NPL ratio rose to 6.7 percent from 3.5 percent during the same review period.