- records 124.32% growth in profit

The Nzema Manle Rural Bank PLC at Aiyinase in the Ellembelle district of the Western Region has posted an impressive performance in most of its financial indicators for the 2022 year under review, recording a remarkable 124 percent profit after tax.

The bank recorded a post-tax profit of a little over GH₵1.4million – representing 124.23% growth in the 2022 year under review as against GH₵632,000 recorded for 2021.

Total Assets of the bank during the 2022 year under review stood at little over GH₵77m compared to GH₵61.2million recorded in 2021, representing 26.25% growth.

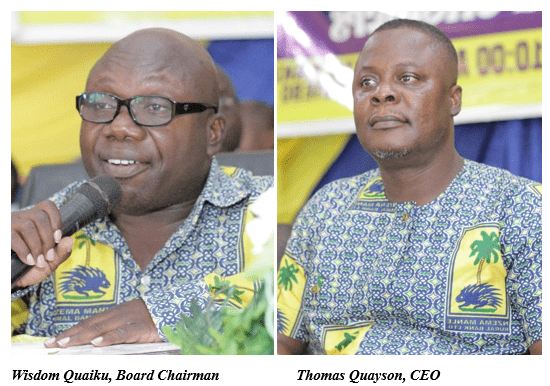

Chairperson-Board of Directors, Wisdom Quaiku, announced these and more at the bank’s 40th Annual General Meeting (AGM) of shareholders held recently.

He explained that even though the year under review was characterised by regulatory changes, technological advancements and the Domestic Debt Exchange Programme, the banking sector displayed remarkable resilience and adaptability.

In view of this, Nzema Manle Rural Bank embraced innovation to enhance customer experience, streamline operations and ensure that it remains at the forefront of providing cutting-edge financial solutions.

Operational Environment

According to him, during the past fiscal year the country’s macroeconomic environment was marked by a series of noteworthy developments that have both influenced and shaped operations at Nzema Manle Rural Bank PLC. Despite the challenges posed by inflationary pressures and exchange rate fluctuations, the country has continued to demonstrate resilience and growth in its economy.

Government’s steadfast commitment to fiscal discipline and prudent monetary policies has contributed significantly to maintaining stability and boosting investor confidence. The bank has closely monitored these macroeconomic trends and adapted its strategies to navigate this dynamic landscape successfully.

In spite of the challenging macroeconomic environment, coupled with other domestic operational challenges that pertained during the reviewed year, the bank managed to pull an impressive operational performance in almost all financial indicators for 2022 – as indicated in the table below.

Year-on-Year Performance

| NO. | INDICATOR | 2022 | 2021 | % CHANGE |

| 1 | Total Income | 12,376,693 | 8,630,159 | 43.41% |

| 2 | Total Operating Cost | 10,081,087 | 7,451,848 | 35.28% |

| 3 | Deposits | 67,290,372 | 54,160,100 | 24.24% |

| 4. | Investments | 25,990,555 | 30,411,689 | -14.54% |

| 5. | Advances (Net) | 18,699,886 | 13,636,704 | 37.13% |

| 6 | Shareholders’ Funds | 4,956,095 | 4,098,634 | 20.92% |

| 7. | Paid-up Capital | 1,370,490 | 1,269,571 | 7.95% |

| 8. | Profit Before Tax | 2,295,606 | 1,178,311 | 94.82% |

| 9. | Profit After Tax | 1,417,791 | 632,038 | 124.32% |

| 10. | Total Assets | 77,231,340 | 61,173,277 | 26.25% |

| 11. | Capital Adequacy Ratio | 13.00% | 14.19% | 8.39% |

Dividend

Mr. Quaiku, in aligning with directives from the central bank which prohibit payment of dividends for the current fiscal year, said the bank could not pay dividends to the shareholders. He however assured them that this measure has been taken to safeguard the bank and its shareholders’ long-term interests, and it will remain focused on preserving and enhancing shareholders’ value. He emphasised that this decision is to help ensure the financial sector’s stability.

Corporate Social Responsibility (CSR)

As part of the bank’s commitment to its Corporate Social Responsibility (CSR) initiatives which ensure it makes a positive impact on communities where it operates, an amount of GH₵24,940 was spent to support critical areas such as education, healthcare and community development projects.

Awards

The board chairman, while expressing excitement, announced to shareholders that Nzema Manle Rural Bank PLC was recognised as 1st runner-up for Best Bank-Loan Financing at the 4th Rural Banks Excellence Awards held in Koforidua last year. This accolade validates the bank’s dedication to providing innovative and customer-centric financial solutions.

Future Outlook

The bank’s Chief Executive Officer, Thomas Quayson, in an interview with Business & Financial Times said it will continue putting in pragmatic measures to ensure positive growth and achievement of its Strategic Plan.

He stressed that the bank will intensify loan recovery, embark on intensive deposit mobilisation, strengthen internal controls, and maintain quality assets to increase profitability.

He has also emphasised that the bank’s business focus in 2023 is on driving growth, innovations, efficiency and service as the main pillars in achieving profitability.

Mr. Quayson stressed the bank will develop its human capital to meet demands of functioning profitability, as well as achieving the objective of overcoming shocks from the unfriendly macro economy and rising cost of living, as well as its devastating effects.