The economy recorded 72 new projects worth US$274.74million between January and June this year, the Ghana Investment Promotion Centre’s semi-annual investment report has revealed.

This, however, is lower – in terms of value and number of projects – than the first half of 2022 when a total of 117 projects worth an estimated US$279.51million were recorded.

A breakdown of the 2023 half-year amount shows that foreign direct investments (FDIs) amounted to US$229.82million, while the local component contributed US$44.92million. In the same period of 2022, the FDI and local components from investments stood at US$238.62million and US$40.88million respectively.

The report indicated that US$17.54million of the 2023 total amount has already been transferred into the economy.

Of the 72 projects recorded in the first six months of this year, 51 were entirely foreign-owned while 21 were joint ventures. These projects are anticipated to generate a total of 6,247 jobs at full capacity. Among these jobs, 5,644 – 90.35 percent – will go to locals while the remaining 603 will be for non-Ghanaians.

The manufacturing sector is expected to gain from these projects with a total 3,227 jobs for locals.

Project distribution

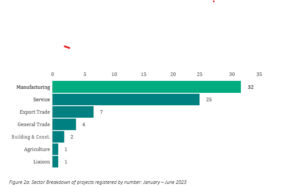

Of the 72 registered projects, the manufacturing sector has the highest number with 32. Following closely were the services and export trade sectors with 25 and 7 projects respectively. General trade accounted for four projects, while the building and construction sector had two – with the agriculture and liaison sectors each having one project.

In terms of FDI value, the manufacturing sector led with an investment value of US$156.29million. The services and export trade sectors followed with FDI values of US$37.95million and US$27.55million respectively.

Some leading sources of Investments

China led with 16 projects attracting a FDI value of US$120.10million, followed by the USA with nine projects at US$19.50million. The Netherlands had one project worth US$16.88million, Australia was next with four worth US$14.4million and Mauritius had two projects valued at US$11.06million.

Regional distribution

In terms of the projects’ siting, four regions stood out. Greater Accra Region led the way with 63 projects, making up 87.5 percent of all the registered projects. Meanwhile, Ashanti Region had seven projects and Upper-East and Western North Regions had one project each.

Locally-owned projects

Additionally, during the first half of 2023, there were 32 projects owned entirely by Ghanaians, with a combined estimated investment value of US$593.81million.

The foreign portion of investment in these wholly Ghanaian-owned projects totalled US$400.02million. These projects spanned various sectors including agriculture, building and construction, general trading, manufacturing and services.

Advancing industrialisation

Commenting on the development, Chief Executive Officer (CEO) of the Ghana Investment Promotion Centre, Yofi Grant, said government remains steadfast in its industrialisation agenda.

“In that light, creating an enabling environment that supports all sectors – including marginalised communities and small- and medium-sized businesses – remains one of government’s top priorities,” he stated.

Mr. Grant added that: “Having identified the attraction of significant investments – and most importantly partnership investments – as key to meeting some of the targets outlined in the PC-PEG, government holds a strong view that encouraging partnership investments is a step in the right direction and has a great tendency to promote economic growth and development”.

What to expect in the second-half

Looking ahead to second-half of the year, Mr. Grant assured that the GIPC will continue to focus on sustaining economic growth through FDIs and supporting existing investments.

Some strategic initiatives the centre will pursue include attracting FDIs through missions and events, offering after-care support services, and preparations toward the Ghana Club 100 Awards set to come off in last-quarter of the year, he said.

“Additionally, a regional sensitisation tour (RST) will be organised to raise awareness about investment opportunities in different regions of the country. By fostering a favourable business environment and engaging investors, we strive to maintain economic progress and establish a thriving destination for global investments,” he said.