The Director General of the Social Security and National Insurance Trust (SSNIT), Dr. John Ofori-Tenkorang has revealed that a mere 2 percent out of the 1.9 million SSNIT contributors are self-employed, a situation he described as disturbing.

Currently, only 32,000 self-employed workers contribute to the scheme regularly out of the 1.9 million regular contributors. Nine months ago before the enrolment of an aggressive drive to rope in more self-employed contributors, the figure was only 14,000.

“Unfortunately, only about 1.9 million of the 10 million or so workers in the country are covered under the SSNIT scheme. What is more disturbing is that only about 32,000, representing just about two percent of active contributors are self-employed, despite the fact that the majority of workers in the country are self-employed and/or work in the informal sector. What this means is that most self-employed workers risk working their entire lives even when they are old and frail or having to rely on the state or family and friends for financial support when they retire,” he explained.

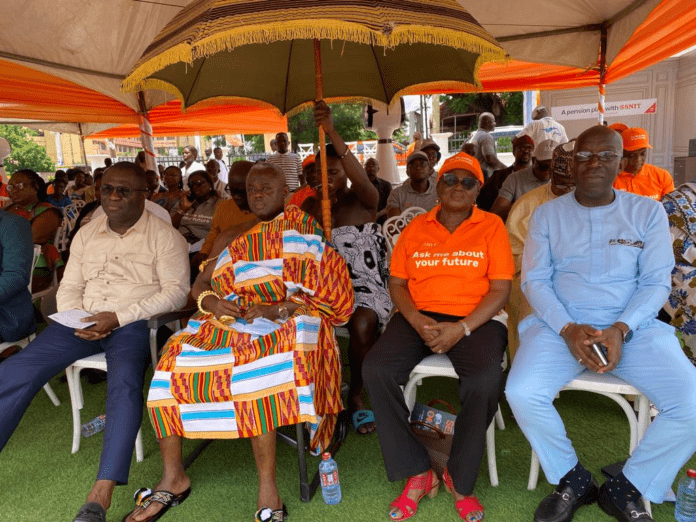

Dr. Ofori-Tenkorang disclosed this at a durbar of artisans and trade unions in Kumasi, Ashanti Region, where he launched the Self-Employed Enrolment Drive (SEED).

The SEED therefore seeks to expand coverage of the Basic National Social Security scheme to self-employed workers so that they can retire comfortably.

This campaign aims to redefine social security in the country and give hope to all self-employed workers that they could retire in dignity and comfort.

Dr. Ofori-Tenkorang elaborated on the benefits that prospective clients would receive once they sign up, stating that: “By signing up and making monthly contributions, you, like your colleagues in the formal sector, are guaranteed monthly pensions when you retire or if you become permanently disabled. You get cover for your survivors as well. I also urge you to take your tier two and tier three contributions seriously. This will ensure that in addition to the monthly pensions you get from SSNIT, the other two tiers will each pay you a one-time lump sum when you retire”.

As part of the SEED campaign, SSNIT staff would be reaching out to prospective contributors at their offices, markets, taxi/trotro stations, on digital media, and other platforms to bring registration to the doorsteps of their clients.

Regarding the mode of paying premiums, Dr. Ofori-Tenkorang noted that SSNIT has put in place several mediums for clients to have convenient transactions such as SSNITpay, mobile money, debit cards and SSNIT’s electronic payment platform.

From right to left: Director General of SSNIT, Dr. John Ofori-Tenkorang; Board Chair, Elizabeth Ohene; Otumfuo Mamensenhene, Nana Osei Kwadwo II\