The financial system in Ghana has grown significantly over the last decade. The landscape can be broadly categorised into Banking Institutions, Non-Bank Financial Institutions (NBFIs), Capital Market, Insurance and Pensions. The Banks are generally Commercial/Universal Banks and Rural Banks. In the case of the NBFIs, this is where we have the likes of Credit Unions, Savings and Loans, Microfinances, Financial Non-Governmental Organisations (NGOs), Susu Collectors and Money Lenders. In this piece, the spotlight is on the Corporative Credit Unions, the general operations, activities and how they have meaningfully contributed to the development of the financial sector and driving financial inclusion in Ghana.

In the simplest form, a co-operative credit union is largely formed by a group of people with a common bond who come together to contribute money in the form of shares and savings into a common pool, and who relend such accumulated funds to themselves in the form of loans for any worthwhile purpose at very a competitive interest rates . The importance of the members coming together cannot be underestimated. What it also means is that the credit union is owned by the individual members who have subscribed to the required minimum share capital.

It is worth noting that the first credit union was founded in 1955 in Jirapa in the Upper West Region, which followed a formation of the Credit Union Association (CUA) in 1968 across the 11 regional offices in Ghana. Today, Credit union can boast of over 500 member unions with shares and savings and with over 850,000 members nationwide. There is a huge opportunity to grow these numbers significantly on the back of the robust structures being put in public post the Financial Sector clean up in Ghana.

There are several types of credit unions in Ghana and key among them are the Community type, Faith/Parish type and Workplace type. Faith based is where church members (e.g Kutunse Community Presby Credit Union) come together to form the credit union. With the Workplace, you have members of the work force coming together to form the credit union. A typical example is the University of Ghana Credit Union. From a Community perspective, the entire members within the community comes together to form the credit union. An example of a Community based credit union is KAMCCU.

Funding Sources

There are several sources of funding a credit union, as already mentioned, the credit union is owned by its members and sources includes avenues such as registration/ membership onboarding fees, members` share capital, members savings and deposits, the interest on loans paid by members, interest on investments, donations made to the union and sometimes other income sources.

To the extent that all these inflows come to the union, products and services provided to members may include Ordinary Shares, Saving Account in the form of Normal, Child, Youth and Fixed Deposits. Specialised loan products are designed to meet their member’s needs at any point in time. On the back of the significant growth in Mobile Money Services, a lot credit unions have added such innovative product and services to their core delivery. Others are actively involved in providing risk management products within the insurance industry.

Legal and Regulatory Framework

Just like any other financial institution, dealing with members funds requires that additional layer to ensure depositor`s funds are highly protected. The financial sector clean-up exercise is history now but some important lessons have been learnt. Some of the regulatory and legal frameworks guiding the credit unions include the Non-Banking Financial Institutions Act, 2008 (Act 774), Co-operative Societies Decree, 1968 (N.L.C.D. 252).Bank of Ghana Act, 2002 (Act 612), a Co-operative Credit Union Regulation, 2015 (L.I. 2225) which was passed in October 28 2015. These Regulation are made to regulate the operational activities of credit unions in Ghana and off course the Societies’ Bye-Laws which is unique to individual credit Unions.

Internal Policy Guidelines.

Among other things, one of the significant documents serving as a guiding principle is its bye laws. This is basically a rule made by the credit union for the regulation of its affairs or management of the area it governs. Bye laws are important because it is formulated to primarily ensure that members are not only safe but also adhere to standards. Before joining any credit union, it is important to thoroughly read the entire bye laws to obtain some level of comfort. Bye laws contain general provisions of the credit union, membership, Corporate Governance Structure various committees among others. To further strengthen the operation of any credit union, there are further internal documents such as the Savings and Shares Policies, Loans Policy, Financial Management Policy and to an extend a robust and comprehensive business plan that must be instituted by the Board of Directors.

Corporate Governance Structure

As corporate governance continues to become an important issue affecting today’s marketplace, many theories, best practices and scorecards have been developed with the goal of creating efficient and effective governance principles. One of the major issues raised by regulators including Bank of Ghana during the financial sector crises was the fact that good corporate governance framework was not practised and that led to the collapse of some of the banks, Microfinance, Savings and loans and Fund Managers.

Although a plethora of good governance information has been developed, the World Council of Credit Unions, Inc. (WOCCU) believes it would be beneficial to credit unions around the world for governance principles to address the particular nuances and unique characteristics of credit unions.

As a result, WOCCU has developed the International Credit Union Governance Principles to create a governance model that more appropriately addresses the structure and mission of credit unions. At their core, credit unions are fundamentally different from other financial institutions. For-profit financial institutions have one primary goal: to maximize the owners gain. As a result of this drive to increase profits, traditional corporate governance principles serve to ensure that profitability is achieved for the shareholders, not the actual users of the bank’s financial services. Like for-profit corporations, credit unions seek to generate profits in order to directly benefit the owners.

However, unlike private commercial banks and other for-profit institutions, the members serve as both the owners of the credit union and the recipients of the credit union services. Therefore, when credit unions maximize their profits, it results in the form of lower interest rates on loans, lower service fees and higher dividends for the members. In addition to this unique aspect, credit unions are democratic institutions, where a single member receives a single vote, regardless of financial stake in the organization. The International Credit Union Governance Principles are ideals to be achieved and are intended to apply to credit unions, not second tier organizations. Credit unions are free to adapt these Principles as necessary to directly address local conditions.

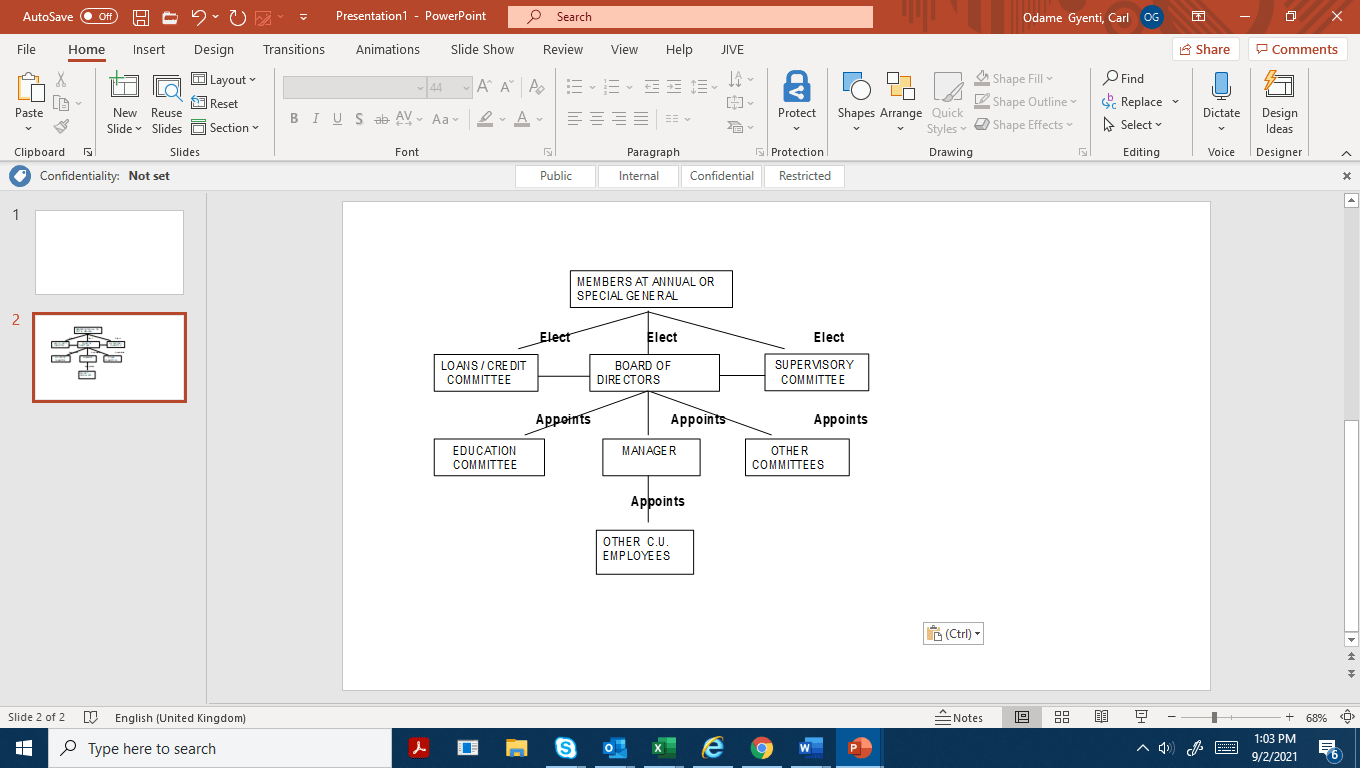

Typical Credit Union Organisation Structure

Key Responsibilities Governing structures

Board of Directors (BOD)

Elected by the members at the Annual General Meeting, The Board of Directors usually consists of a minimum of five and a maximum of seven members and any member of the Board of Directors shall ensure to be a member of the credit union in good standing. Non-citizens and persons below the age of eighteen (18) years are disqualified from being member of the Board of Directors.

The designation of the Board of Directors shall include the Chairperson (President), Vice Chairperson, (Vice-President), Secretary, Treasurer, Assistant Treasurer, other Officers as may be required, and other members; provided that no such person shall be an employee of the credit union or a member of Loans or Supervisory Committee

More importantly, the elected members’ serves four (4) years term of office, and can be eligible for re-election, provided the member have not have served for a maximum of two consecutive terms of four (4) years each. After serving for a total eight (8) years made up of two terms of four (4) years each, a Board member cannot be eligible for election until after a break of four (4) years.

BODs are expected to hold meetings regularly, at least, once each month and other times when necessary. They also work hand in hand with Loan Committee and the Supervisory Committee. Quorum at meetings of the BOD shall be a majority of the Members of the Board. Board Members shall have one vote. The Chairperson have a casting vote in the event of a tie in voting.

Supervisory Committee

Supervision is very important in every business endeavour. The Supervisory Committee usually consist of a minimum of three members who are elected at the General Meeting. The members of the Supervisory Committee cannot be members of the Board of Directors or the Loan Committee, signatories, or persons handling cash or accounts on behalf of the Credit Union. Members have four (4) years term of office but can be re-elected for a maximum of two consecutive terms (8 years), after which such member cannot have a break of four (4) years and shall afterwards be eligible for election.

Among other things, the duty of the Supervisory Committee is to check whether the Board of Directors has fulfilled its functions properly and to check whether the Loans Committee has followed the prescribed procedure in granting loans particularly as regards security. They also see to it that the Treasurer or another authorized person prepares a monthly financial statement.

Loans/Credit Committee

Extending credit to members at a much cheaper and affordable rate forms an integral part of every credit Union. This aspect is handled by this committee. The Loan Committee usually consist of at least three members, elected at the Annual General Meeting. The members of the Committee can never be members of the Board of Directors or the Supervisory Committee. It is also expected that any member of the loan committee serve a four (4) year term of office and can be re-elected for a maximum of two consecutive terms (8 years), after which such member shall have a break of four (4) years and shall afterwards be eligible for election.

Among other things, it is the duty of the committee to inquire carefully into the financial position of borrowing members and their endorsers, so as to ascertain their ability to repay fully and promptly the obligations assumed by them. The authority may be delegated to Loans Officers appointed by the Board. They can have the authority for granting of loans. When there are pending loan applications than can be granted with the funds available, preference are given to applications for smaller loans if the credit factors are nearly equal.

Education Committee

This committee unlike the other three committees is appointed by the BOD, from among the members. Its membership is between 3 and 5. The vice – chairman of the BOD is normally the chairman of the Education Committee. They are charged with the BOD’S responsibility of keeping members informed about the operations of the society. They also promote new products and services as well as new members. They are expected to meet at least once a month and report monthly to the BOD. The principal responsibilities of the committee are:

- Keep members informed about the operations of the credit union,

- Print and distribute education material,

- Membership Promotion;

- Promote New Products and Services;

- Conduct Education and Training Needs

- Survey and Records Keeping and

- Reporting to BOD Monthly.

The Role of Credit Union Association, the Apex Body

Credit unions have one of the extensive worldwide network bodies globally. As indicated below, from the local levels, every credit union is connected to the World Council of Credit Unions.

The importance of Credit Union Association (CUA) cannot be underestimated. Among other things, the promotion of Credit Unions in Ghana and Credit Unions Advocacy ensures that all Credit Unions are monitored and supervised. CUA also provides audit services to Credit Unions, jointly with DOC. All the bye laws and model policies are developed by CUA. CUA further renders comprehensive training and Capacity Building for Credit unions members, leaders &staff. Above all, CUA provides technical support and financial services to Credit unions such as Business plan development, accounting services, Central Finance Facility (CFF), Risk Management Programme (RMG), Deposit Guarantee Scheme (DGS) etc.

Conclusion

Credit Unions continue to play a pivotal role in driving Financial Inclusion. As a member or prospective member, it is important to understand all the laid down policies that govern the union.

The products of credit unions have contributed to an increase in customer base, an increase in capitalization, an increase in asset base and increase in investments. Generally, it shows that given the right strategy, credit unions can become a viable investment alternative to other financial intuitions in the country.

There is the need for the creation of greater awareness of the credit union industry by embarking on vigorous product development and advertisement to enhance patronage since financial institutions thrive on numbers. Lack of awareness has been identified as one of the significant challenges to the operations of credit unions. Credit unions use various advertisement techniques such as the Radio, Flyers, billboards, signage and social media to drive membership growth.

The industry needs to continue strengthen its functional system and show stronger management capability to sustain its operations and contribute to economic growth.

Thank you for reading.

Disclaimer: The views expressed are personal views and doesn’t represent that of the media house or institution the writer works.

Credit: Credit Union Association, Miriam Amoako, Nana Yaw Boakye

About the writer

Carl is a Finance and Investment professional, Country Head (Ag) of Client Coverage with an International Bank in Sierra Leone. Contact: [email protected], Cell: +232 33240467