Nigeria: Higher grain prices seen this week linked to inflation as the world bank spells a more gloomy economic outlook.

Ghana: GDP boosted by mining activities amid increased FX inflows from the World Bank.

South Africa: Inflation woes add extra pressure to the rand.

Egypt: Egypt’s central bank considers enacting a fourth devaluation.

Kenya: Kenyan government faces calls to devalue currency amid increased FX demand pressure.

Uganda: Dovish economic outlook boosted by both oil and non-oil sectors.

Tanzania: Mining activities promise higher GDP in the long term

XOF Region: The securities market regains its dynamism.

XAF Region: Foreign exchange reserves jump by 43%.

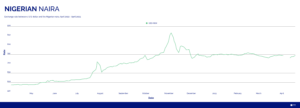

Nigerian Naira (₦)

The naira depreciated steadily over the previous week, falling from $/NGN 731 to $745 in response to increased demand for FX. In response to concerns about the high price of rice in the country, the Rice Processors Association of Nigeria (RIPAN) have cited growing insecurity and inflationary pressures as major reasons for the price increase. The RIPAN also noted that despite the impact of inflationary pressures, there is still some disparity between the market price of local produce and the latest trend of higher priced imports which the agency attributed to higher volumes of imported produce. According to the World Bank, the worsening economic situation in Nigeria could lead to an increase in poverty. It stated that the country’s fiscal deficit was captured at 5 percent which was higher than the 3 percent limit set by the federal government. It also noted that the cash scarcity witnessed earlier had a hampering effect on the country’s economic growth and poverty reduction efforts. We expect continued but gradual depreciation of the naira in the coming weeks as FX demand increases.

Compiled by Ikenga Kalu

Further reading:

The Punch – Rice Processors Blame Insecurity, Inflation for High Cost of Food Commodity

The Punch – Nigeria’s 96% revenue used to service debt in 2022

Ghanaian Cedi (GH¢)

The Ghanaian cedi traded from 11.63 as at close of last week to 11.99 this week, much weaker than the previous week and this came after the market saw a spike in demand on the U.S. dollar, which eroded the gains witnessed two weeks back. Inflation rates fell to 43.7% in the month of March compared to 50.8% in February. Meanwhile GDP for the last quarter of year 2022 rose to 3.7% higher than 2.6% projected supported by the mining activities. The World Bank also committed to offer $250 million as part of a $1.5 billion Ghana stability fund aimed to assist banks and players in the financial sector affected by the domestic exchange program. Going in the forward this would ease pressure on the cedi in the long term.

Compiled by Murega Mungai

Further reading:

Myjoyonline – Producer Price Inflation falls to 43.7% in March 2023

Bloomberg – Mining Propels Ghana to Beat Growth Estimates in Fourth Quarter

Myjoyonline – World Bank commits $250m to Ghana Stability Fund

South African Rand (R)

The South African Rand opened the new week trading at 18.1038, below last week’s open of 18.2072. The USD/ZAR briefly tested the 18.00-18.05 support area on Monday, before rejecting a move to the downside.

Inflation data released on Wednesday showed that year on year (YoY) inflation jumped to 7.1% in March, while month on month (MoM) inflation moved to 1% – what was particularly concerning, is that food prices saw a 14% increase over the past year.

This has in turn led to renewed speculation that the South African Reserve Bank will once again hike rates at next month’s MPC meeting. The markets are now pricing in a 25 basis point hike, with some analysts saying that a 50 bp hike is possible.

From a global perspective, the U.S. dollar index continues to trade between 101-102 levels (same as last week), indicating a somewhat subdued USD for the time being, providing some protection of a break beyond the 18.50 level for the USD/ZAR.

Looking at the week ahead, we can expect the ZAR to continue trading in the 18.00 – 18.40 levels, as local concerns in South Africa means that the rand is unlikely to capitalize on a modest USD.

Further reading:

News24 – Traders raise South Africa rate-hike bets as inflation quickens

Business tech – South Africa forecast: Gloomy with a high chance of recession

Egyptian Pound (EGP)

The Egyptian Pound opened the new week trading at 30.9000 above last week’s opening at 30.8500. The annual urban inflation rate in Egypt rose to 32.7% in March 2023, but below market forecasts of 33.6%. The biggest upward pressure was on food & non-alcoholic beverages, which were the most relevant items in the consumer price indexconsumer price index basket. The core inflation rate eased to 39.50%, while consumer prices advanced 2.7%, easing sharply from a 6.5% gain in February.

The Egyptian pound was trading at record lows due to fears of a fourth devaluation by the country’s central bank. The inflation rate in Egypt reached a five-year high of 31.9% in February and is expected to rise further in the near term. The International Monetary Fund’s loan was conditioned by a shift to a flexible exchange rate regime and a monetary policy aimed at gradually reducing inflation.

In 2023, the currency lost almost 20% against the U.S. DollarU.S. dollar since the start of the year. With the increasing inflation rate we expect the USD/EGP levels to trade between 30.90 and 30.95 in the week ahead.

Compiled by Yashveer Singh

Further reading:

Reuters – Egypt inflation seen hitting all-time high in March

Bloomberg – Egypt Devaluation Calls Grow Louder

Kenyan Shilling (KSh)

The Kenyan shilling traded from 134.60 at close of last week compared to 135.18 this week as demand for the hard currencies outweighed the supply in the market as well as pressure continuing to heighten on debt service obligations. In an earlier note by the IMF to the Kenyan central bank and other Sub-Saharan central banks, encouraged them to let their currencies depreciate so as to support local production and spur growth of exports. Emphasis was placed on taming inflation by tightening monetary policy and encouraging capital inflows and implementing austerity measures to tame the growth of debt. As demand continues to increase on the greenback, we project sustained pressure on the shilling in the near term.

Compiled by Terry Karanja

Further reading:

Business daily – Why IMF wants CBK to let the shilling depreciate

Ugandan Shilling (USh)

This Wednesday, April 19, the Ugandan Shilling traded at 3,737.00 against the U.S. dollar, up 0.32% from the previous trading session. In the previous four weeks, USDUGX gained 0.45%. The Ugandan economy grew 6.8% in the first six months of the fiscal year 2022/23, which runs until the end of June, up from 3.7% in the same period the previous fiscal year, according to the finance ministry on Monday. Services, agriculture, forestry, and fishing were the main drivers of growth. The East African country is on track to achieve 5.3% growth for the entire fiscal year, thanks to lower inflationary pressures, according to the finance ministry. Uganda intends to begin pumping crude oil from fields in the country’s west near the border with the Democratic Republic of the Congo in 2025, with the hope of boosting economic growth to more than 7%.

Looking ahead, firms are confident that output will continue to rise over the next 12 months, bolstered by predictions of continued improvements in customer demand. Looking ahead, we expect the USD/UGX rate to be around 3,763.00 by the end of this quarter and 3,879.00 in a year.

Compiled by Yadhav Panday

Further reading:

Zawya – Uganda’s GDP grows 6.8% in first half of 2022/23 fiscal year

Tanzanian Shilling (TSh)

This past week the Tanzanian shilling weakened to its lowest level against the U.S. dollar since March 2019 with its weakest level at USD/TZS 2,348 which was hit on Monday, April 17, 2023. This is in comparison to the past few weeks where USD/TZS remained around 2,340. Despite this change in level, the currency pair remained relatively stable and controlled, moving between 2,344 and 2,348. The bid and offer rates for USD/TZS are currently at 2,341 and 2,351 respectively.

These weaker Tanzanian shilling levels do not support most FX news coming from Tanzania which have been positive this past week. The Dar es Salaam stock exchange reported its strongest gains of the month this week which is mostly owed to the rise of stock prices at three local companies. Further, on Saturday, April 15, 2023, Tanzania signed contracts worth $667 million U.S. dollars with companies in Australia for the mining of graphite and rare earth minerals. This deal will give a significant bump to the country’s future GDP figures. Speculators are even predicting that in 10 years, Tanzania’s economy will be larger than Kenya’s.

With mostly positive news coming from Tanzania, we expect the Tanzanian shilling to maintain these levels, trading between USD/TZS 2,345 and 2348 in the week ahead, possibly gain some strength and move back towards 2,342.

Compiled by Kristin Van Helsdingen

Further reading:

IPPmedia – DSE indices start the week on high notes

The East African -Tanzania, Australia firms sign $667m deal to mine rare earths

The Citizen – What Sh1.5 trillion pacts herald for Tanzania’s economy

The Citizen – Tanzania to overtake Kenya as East Africa’s largest economy in 10 years

West African CFA Franc Region (XOF)

To deal with the liquidity shortage which prevents states from raising financing on the securities market, the central bank has suspended the standard limiting the holding of securities by banks. This decision had an immediate impact on the securities market. In fact, the operations that took place between April 12, 2023, and April 14, 2023, were a success compared to previous issues. Burkina Faso, Niger and Senegal have raised XOF 110 billion out of a total amount of XOF 177 billion offered by investors, representing a coverage rate of 161%.

Let’s hope that this decision will maintain this dynamism so that the securities market will continue to fulfill its function as a state financing instrument.

Compiled by Jean Cédric Nando KOUA

Further reading:

Sika finance – UMOA-Titres/Week of April 10: The market regains its dynamism thanks to the boost from the BCEAO

Sika finance – UMOA/Liquidity crisis: BCEAO to the rescue of States

Central African CFA Franc Region (XAF)

The central bank has announced in its March 2023 monetary policy report that foreign exchange reserves stood at XAF 6,771.3 billion in January 2023. This level represents an increase of 43% compared to January 2022 and can cover 3.9 months of import of goods and services. This increase is justified by the rise in oil prices and above all by an increase in the retrocession of currencies by mining and oil companies. Indeed, the central bank has reduced the rate of retrocession of foreign currencies from mining and oil companies to 35% against 70% for other economic operators, which allowed the immediate recovery of 500 billion XAF. This rate should gradually change. According to the central bank forecasts, foreign exchange reserves should increase by 11% by the end of 2023.

Compiled by Jean Cédric Nando KOUA

Further reading:

Investir au Cameroun – CEMAC: foreign exchange reserves jump by 43% thanks in particular to the repatriation of extractive companies