Ghana is a party to major international trade agreements involving the EU, the US and the African continent. Ghana’s export statistics showed a general growth until COVID emerged, then it sloped downward briefly but picked up again in 2021. About a quarter of Ghana’s economy is supported by exports. That notwithstanding, several obstacles – such as low capacity, low value-addition and poor infrastructure – seem to be working against Ghana’s export potential. This article analyses these obstacles in light of Ghana’s trade potential and recommends that the country focuses on strengthening domestic capacities and infrastructure to maximise its benefits from the trade agreements.

Ghana is one of the shining examples of political stability and economic growth in sub-Saharan Africa. As of December 30, 2022, the country is a signatory to three (3) major trade agreements. These are the African Growth and Opportunity Act (AGOA-USA), Economic Partnership Agreement (EPA-EU) and the African Continental Free Trade Agreement (AfCFTA-Continental)[i].

The Ghana Export Promotion Authority pegs pre-covid export statistics of 2019 at US$16.25billion, which accounts for about 25% of the country’s GDP[ii]. Even though this constitutes a significant economic contribution to Ghana’s GDP, the figure represents a negligible 0.04% of the international market potential guaranteed by Ghana’s Free Trade Agreements (FTAs)[iii]. This raises the question of whether Ghana is maximising its benefits from its trade pacts. This publication considers the important indicators of Ghana’s trade in line with its trade agreements. The article ends with recommended policy interventions Ghana could implement to improve their economic gains from free trade agreements.

Ghana’s International Trade Trajectory

Ghana has been part of international trade for several decades and was a founding member of the World Trade Organisation in 1995. Most of Ghana’s trade and investment are concentrated in gold, oil and cocoa. Through pragmatic efforts of the Ghana Export Promotion Authority (GEPA) and other analogous institutions and stakeholders, Ghana is progressively developing a formidable non-traditional export sector for fruit, processed agro-outputs and crafts.

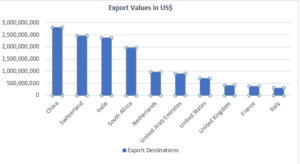

Ghana trades heavily with EU trade partners and the US. In recent years, China has become an increasingly important trading partner as it has topped Ghana’s import and export values. Ghana also trades extensively with its West African neighbours and South Africa. However, Ghana’s bilateral trading costs are higher with most African partners than those outside the continent, making it difficult to connect the continent with traded goods from Ghana.

Some Ghanaian companies have reportedly started trading under the African Continental Free Trade Area (AfCFTA) agreement after a long-delayed implementation of the pact. Still, recent records show a rather ‘baby start’ with almost negligible trade figures under the AfCFTA agreement. The ‘Ghana Beyond Aid’ agenda by government seeks to promote industrialisation and improve the country’s exports. Government has since begun economic reforms aimed at positioning the country as a regional hub for a manufacturing, logistics, finance and digital economy[iv]. That notwithstanding, Ghana’s trade figures lag behind the projected and desired figures.

Ghana’s major Trading Partners

Figure 1: Ghana’s Top Ten Export Destination Countries in 2019

Source: Calculations based on figures from the World Bank and Ghana Export Promotion Authority

Figure 2: Ghana’s Top Ten Countries of Import Origin in 2019

Source: Calculations based on figures from the World Bank and Ghana Export Promotion Authority

From Figures 1 and 2, China, the EU, UK, the US and other countries outside Africa emerged as Ghana’s most important trading partners for both exports and imports. This suggests that Ghana’s trade is incredibly low within the ECOWAS and continental African bloc. Another ironic observation is that Ghana’s current success in international trade might not necessarily depend on free trade agreements – because countries like China, India, Turkey, Vietnam, UAE and several other trade partners do not currently have free-trade pacts with Ghana. These observations raise deep-seated questions regarding the actual causes of trade success or otherwise in Ghana’s cross-border trade trajectory.

Trade obstacles in Ghana

Ghana is a developing country that mainly exports raw materials to its trade partners. Several studies have pointed to the fact that Ghana has a positive international image to boost trade but cannot meet international consumer standards. A recent study into Ghana’s free trade agreements shows that Ghana’s trade obstacles mainly emerge from domestic sources such as production capacity, infrastructure and non-competitive enterprises.

Enterprise funding in Ghana remains painfully high, and uncompetitive. Roads are bad, while rail networks are almost non-existing. Granted that international trade is deeply rooted in uncontrolled free market space and excessive competition, Ghana’s policy interventions should have focused on enhancing the competitiveness of domestic enterprises. This calls for a shift in strategic focus from chasing many trade pacts to ensuring an enabling local business environment.

Ghana’s Comparative Advantage

Ghana’s exports are generally grouped into traditional and non-traditional. Figures 3 and 4 show Ghana’s export dynamics in recent years. Even though traditional exports cover more than 70% of total exports, the non-traditional export sector keeps growing. The 2021 exports were led by Gold (US$5.93B), Crude Petroleum (US$2.71B), Cocoa Beans (US$1.28B), Cocoa Paste (US$414M), and Coconuts, Brazil Nuts and Cashews (US$361M)

Figure 3: Ghana’s Major Export Commodities in 2021

Source: Calculations based on figures from the Ghana Export Promotion Authority 2021 Annual Report

Figure 4: Comparison of Ghana’s Total Exports and Non-Traditional Exports (2017 – 2021)

Source: Calculations based on figures from the Ghana Export Promotion Authority 2021 Annual Report

Figure 4 shows that Ghana’s Non-Traditional Export (NTE) earnings reflect an increase of about 17% over 2020 earnings of US$2.846billion. Since 2017, Ghana’s NTE has grown at an annual average rate of 7.07%. The NTE sector’s remarkable performance in 2021 over 2020 was attributed to several factors: including increasing demand for NTE products, expansion of major companies’ capacities, and adherence to trade protocols.

The export data and related information show that Ghana has great export potential in extractives and agriculture. To turn these potentials into a comparative advantage, Ghana needs to develop these sectors through aggressive reforms which result in value addition, infrastructural development and institutional capacity building. The future of our export market depends on our ability to strategically position our export enterprises to meet the required quality and quantity expectations in the volatile, open market.

Conclusion

The available data indicate that Ghana has a very high export potential globally, irrespective of trade pacts or which continents the markets are in. Ghana could achieve and even exceed its US$25.3billion goal set in the National Export Development Strategy by 2029 – if trade obstacles are removed and domestic enterprises become more competitive. Ghana’s poor performance with the Cotonou Agreement, the AGOA and the EPA has taught us that simply signing onto the AfCFTA is not enough – the countless obstacles inhibiting domestic enterprises must be consciously removed or, at least, reduced to reasonable limits.

Ghana has to back government policies with aggressive and transformative actions which yield results. Suffice it to say that it’s not enough to say you hold a degree. The question is, what can you do with your certificate? In the same way, simply ensure our macro- and micro-economic policies get implemented. We should be hungry to see noteworthy results. Whether the AfCFTA becomes another white-elephant or a new dawn, our actions – not policy documents – will tell.

Policy Recommendations

From the analysis in this article, the following courses of action are recommended:

- Government should immediately improve business and trade infrastructure in Ghana.

- All enterprises within our major and potential export business sectors should be supported to add value to their goods before exporting.

- There should be increased investments in non-traditional exports to diversify the export market and make it more sustainable.

- Enterprises venturing into export or import substitution should be given technical and logistical support to enable them meet the high quantity and quality standards required in international market.

About the Author

Dr. Phanuel Wunu is a lecturer at the School of Business in the University of Cape Coast. His areas of expertise are international trade, sustainable enterprise development and international project management.

References

[i] ITA. (2020). Ghana – Trade Agreements. Retrieved December 28, 2022, from https://www.trade.gov/knowledge-product/ghana-trade-agreements

[ii] Ghana Export Promotion Authority. (2020). 2019 Report on analysis of non-traditional export statistics. Accra. Retrieved from https://www.gepaghana.org/export-statistic/gepa-annual-report-2019-full-version-2/

[iii] Wunu, P. (2022) Free trade agreements and sustainable enterprise development in Ghana. University of Cape Coast.

[iv] Raga, S. (2022) Ghana: macroeconomic and trade profile. Available at: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.giz.de/de/downloads/giz2022-en-afcfta-ghana-macroeconomic-trade-profile.pdf.