Given the cedi’s stellar performance against its major trading partners, particularly the US dollar, the Ghana Union of Traders Associations (GUTA) has hailed efforts of the fiscal and monetary authorities in the development – citing its expected impact on the businesses of its members.

The local currency had endured a turbulent year against the US dollar, losing almost 60 percent of its value by mid-November when it exchanged at a little over GH¢15 for one unit of the American greenback.

However, over the course of the past week – following announcement of the domestic debt exchange programme terms, the staff-level agreement with the International Monetary Fund (IMF) and a sustained campaign by the Bank of Ghana (BoG) to sanitise the foreign exchange (FX) space – the cedi has been on an upward trajectory, closing trading on Wednesday, December 14, 2022 at GH¢9.3 = US$1, according to the BoG; almost halving the peak year-to-date depreciation.

Commenting on the welcome development, GUTA in a communique stated that it “wishes to appreciate the efforts being made by government and the Bank of Ghana to stabilise the cedi”.

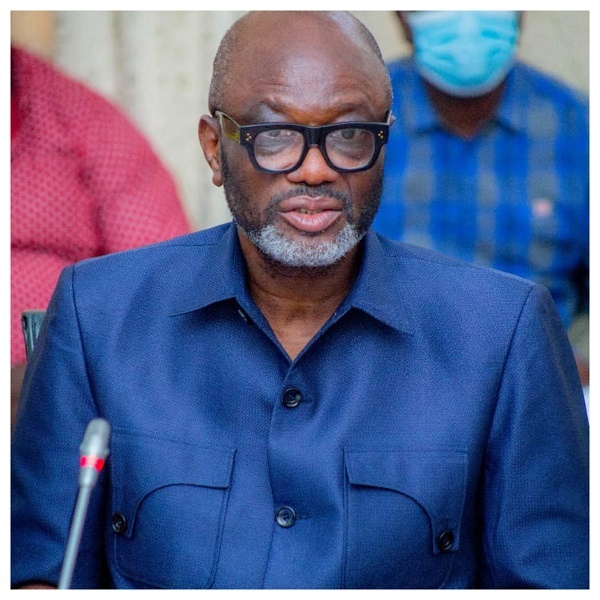

“We urge government to continue with more efforts to sustain the programme and bring relief to the business community. We hope to see further and continuous appreciation of the cedi, and envisage that the economy will turn around in the shortest possible time,” added the statement signed by GUTA president Dr. Joseph Obeng.

Appeal to members

With the cedi’s rally expected to be maintained in the near-term, as US dollars hitherto hoarded by speculators begin to flood the market, the Association appealed for its members to make adjustments to retail prices.

“As the value of the cedi begins to appreciate, GUTA wishes to appeal for members of the business community to also adjust prices of goods and services accordingly so as to make the consuming public feel the impact of this positive trend,” GUTA said.

This comes as inflation for November accelerated to an almost three-decade high at 50.3 percent, beating market expectations.

BoG’s efforts

The central bank, in response to artificial depreciation of the cedi, undertook a number of measures to remedy the situation – some of which have come into effect, with others still being rolled out.

At the conclusion of an emergency meeting of its Monetary Policy Committee in August, the BoG announced that it was “working collaboratively with the mining firms, international oil companies and their bankers to purchase all foreign exchange arising from the voluntary repatriation of export proceeds from mining, and oil and gas companies”.

In October, the apex bank met with directors of banks and the Association of Forex Bureau Operators – cautioning the latter to comply with the Forex Bureau Act and warning them to stop setting forward rates, which had led to rate speculation and unneeded market panic; both of which contributed to the local currency’s rapid fall.

This was followed by the revocation of the licences of two forex bureaus in Accra for breaching provisions in the Forex Bureau Act as well as the arrest of at least 70 illegal black market FX operators.

Following President Nana Addo Dankwa Akufo-Addo’s address to the nation, the Bank, in November, announced that it will no longer provide forex support for the import of some commodities, primarily rice, poultry, vegetable oils, toothpicks, pasta, fruit juice, bottled water, and ceramic tiles.