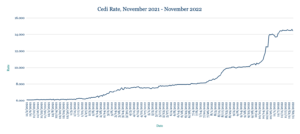

The Cedi pulled back some of its losses, strengthening to 14.38 from 14.52, as the Bank of Ghana increased the monetary policy rate by 2.5 percentage points to 27%. Inflationary also heightened further, with the Bank of Ghana’s measure of core inflation, defined to exclude energy and utility prices, increasing to 39.7% in October from 36.2% a month earlier. Reprieve for the Cedi due to the rate hike is likely to prove temporary. Moody’s this week cut Ghana’s long-term sovereign issuer ratings to Ca, just one level above default and equal to Sri Lanka, which already is in default.

Forty-five African heads of state will travel to Washington DC later this month for the second ever US-African Leaders Summit, reinvigorating a forum created by the Obama administration in 2014. Vice-President Kamala Harris declared the Summit demonstrates America’s “enduring commitment to Africa.” Standing in the way of laudable ambitions toboost trade and investment, however, are some rather more mundane details, namely taxes and tariffs. On the surface, US-Africa trade enjoys tariff-free access via the USA’s African Growth and Opportunity Act (AGOA). But while AGOA has helped to boost trade for some African countries, the program has been terminated for others including Ethiopia, Guinea, Mali and South Sudan. The US plans to remove Burkina Faso from Jan. 1. Progress at the Summit would require a widening of the scope of AGOA to both excluded countries and their exports: services are not covered by AGOA, for example. In the area of taxation, America appears at loggerheads with Africa. Last week, Nigeria, on behalf of 54 member states of the United Nations, submitted a proposal to establish a UN tax convention and global tax body. The US, which stands to forfeit some of the tax base from its corporate giants to the countries they operate in, is resisting such moves. Meantime, US investment and trade is dwindling in Africa. US oil producers such as Exxon and Chevron are retreating from African fields in favour of lower cost projects on the American continent, and official US scepticism over natural gas as a long term “transition” fuel in the move towards renewable energy is discouraging investment. Trade between the US and Africa dropped to $64.3bn last year, less than half the $141.9bn in 2008. By contrast, China-Africa trade soared to a record $254bn last year.

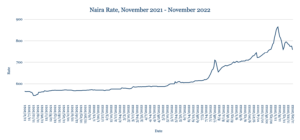

Naira heading for 750 as FX inflows recover

The Naira showed relative stability on the parallel market, appreciating to 759 per dollar from 785 a week ago. Against a backdrop of declining FX income to the Central Bank of Nigeria, Governor Godwin Emefiele this week announced growth in non-oil FX inflows to $4.987bn for 2022 from $3.19bn last year. About NGN 81bn of rebates have been handed to non-oil exporters this year as incentives to help boost the flow of FX into the country. Meanwhile the rising cost of fuel continues to drive up inflation, with the price of diesel increasing by about 215% from a year ago. With Bureau de Change operators still reeling from the CBN’s aggressive intervention into parallel market activities, we expect an upward recovery towards the 750 level.

Risk-on Rand recovery belies worsening domestic data

The Rand climbed to 17.1343 per dollar from 17.2026 a week ago amid improved global appetite for risk assets. On the local front, data released this week showed that South Africa’s trade deficit worsened in October to 4.3bn Rand, countering forecasts for a surplus. Further stage 2 load shedding had little impact on the market as continued outages appear to be priced in. Looking ahead, the Rand will continue moving in line with global risk sentiment, outweighing the effects of weaker data at home.

Egypt faces highest debt interest after Ghana and Sri Lanka

Egypt’s Pound, trading flat at 24.55 against the dollar following a US$3bn IMF agreement, faces pressure to resume depreciation in the short term. The Egyptian government’s bill for interest payments on debt is expected to be around 40% of revenue next year, topped only by Sri Lanka and Ghana. Egypt does have some strong backing from Persian Gulf nations with the ability to increase investment and aid if required. However, with dollars in short supply, manufacturing and production faces potential bottlenecks, driving up inflation. Some progress has been seen with a new exchange created for the import of wheat, which could be expanded to other commodities in the future. The exchange allows Egypt’s General Authority for Supply Commodities (GASC) to purchase wheat directly from global suppliers instead of going through the traditional tender system, enabling improved efficiency for private importers and spurring lower wheat and flour prices and in turn food inflation. We expect the Pound to depreciate further to 24.60 in the week ahead.

Shilling weaker as Kenya deficit widens

Kenya’s Shilling dipped to 122.46 against the dollar from 122.30 a week ago following heightened month-end FX demand from importers and manufacturers. The current account deficit is projected to widen to 5.6% this year as a result of higher costs for oil and other imports surpassing revenue from horticulture and tea exports, according to the Central Bank of Kenya’s latest economic outlook report. Meanwhile, the national treasury is taking steps to ease debt servicing pressures by swapping shorter term debts for longer term maturities, with KES 87.8b ($714.6 million) affected. We expect the Shilling to remain under pressure as traders and importers rush to meet end of year demand.

Inflation slowing in Uganda holds Shilling steady

The Shilling held steady at 3740 per dollar, level with last week’s close, as the annual rate of inflation slowed to 10.6% in November from 10.7% in October. Domestic economic activity is showing signs of recovery, with growth poised to benefit from a gradual increase in investments in the oil sector and the government’s promotion drive for tourism, export diversification and agro-industrialisation. Nevertheless, we expect the Shilling to remain under pressure as tighter global financial conditions risk disrupting the recovery, and as the Ebola outbreak continues, with new cases unable to be traced back to the initial patients and challenges from limited access to medical tools critically needed particularly for the early stages of the disease.

Drought drives Tanzanian Shilling lower

The Tanzanian Shilling weakened marginally to 2,329/ 2,339 against the dollar from 2,327/ 2,337 amid economic pressures from drought in the region: livestock and crops have died, and many have been forced to reduce consumption. With less supply of meat in the country, prices are rising. We expect to see slightly more volatility in the USD/TZS currency pair in the week to come, trading between 2,335 and 2,330 levels.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.