…has public service delivery improved?

Budgeting remains one of the core functions of government. The budget is the most important policy statement of a government. It outlines policy direction, allocates funding to spending programmes that governments have promised to deliver, and provides the foundation for management responsibility and accountability. In a snapshot, budgets provide information of where governments intend to raise revenue and where it intends to spend. It also shows how governments will prioritize and achieve its annual and multi-annual objectives. This makes budgeting a critical function of government as how and where a government spends its revenue is crucial in alleviating poverty and improving lives.

Various approaches to budgeting have been adopted over the years. Governments have experimented with activity-based budgeting, performance-based budget, programme-based budgeting among others. In most cases these approaches to budgeting has been adopted to streamline government spending (deficit reduction) and achieve pre-determined national policy objectives and priorities. One of the widely adopted approaches to budgeting is the Programme-Based Budgeting (PBB) —PBB aims to improve the efficiency and effectiveness of public expenditure by linking the funding of public sector organizations to the results they deliver, making systematic use of performance information. That is, ultimately Programme-Based Budgeting (PBB) aims to improve service delivery in the public sector.

Structure of Programme-Based Budget

At the apex of PBB is the national policy priorities and objectives of the government. The national policy priorities reflect the overall ambition of the political government. In many jurisdictions the national policy priorities are contained in a national development agenda from which all policies of government are adopted. The PBB framework is then broken down into programmes, which must achieve at least one outcome, and this outcome is linked to the national policy objectives. The programmes are further broken down into sub-programmes and activities. All sub-programmes are required to provide specified services (outputs), and each service is measured by service standards (performance indicators) with targets.

Under PBB, costs are assigned to programmes and sub-programmes according to the amount of inputs that are required to achieve the programme goals or output. The PBB will show the costs of the programme, the revenues that the programme generates, as well as showing a way to evaluate the programme’s effectiveness and outputs through performance indicators. Proponents of the PBB argue that, organizing budget information in this manner, provides a clearer picture of how much money is being spent on each programme, the services that the programme delivers as well as means to evaluate how well the programme is performing. It is also argued that Programme-Based Budgeting will allow government agencies to better understand the implications of funding individual programmes. This will allow the agencies to channel state resources into programmes and services that yield “higher returns” to the general public.

Programme-Based Budgeting in Ghana

In 2010, the Ministry of Finance introduced Programme Based Budgeting (PBB) on pilot basis involving two MDAs (Ministries, Departments and Agencies) and continued with seven MDAs. The new budgeting approach was subsequently rolled out to all MDAs with critical mass of staff of MDAs trained in the preparation and management of PBB under the GIFMIS project (2010 – 2014) and had the first Appropriation Act passed in PBB format in 2014. MDAs have since then been preparing and implementing PBB.

The introduction of the PBB was to simplify the budgeting process of MDAs and make them adopt more strategic approach in the management of their budget. Adoption of the PBB approach ensured MDAs budget had direct link between planned expenditure and clearly determined results to achieve improved service delivery for the MDAs. PBB provides the purpose of the budget within the Medium-Term Expenditure Framework (MTEF) to measure budget performance to achieve the purpose for which the budget is been implemented.

Transparency of Budgeting in Ghana

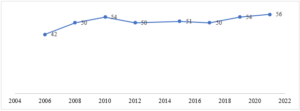

Irrespective of the budgeting approach adopted, it is essential for the state authorities to make the budgeting process transparent by making publicly available certain key documents. Generally, the quality and quantity of budget information has improved with the adoption and implementation of PBB in 2014. The Ministry of Finance has taken steps to publish budget information relating to the MDAs as well as a “Citizens Budget”. Notwithstanding this progress, there is room for improvement. The International Budget Partnership’s Open Budget Index measures budget transparency in Ghana at 56 (out of 100). This indicates that “limited information” on how government raises and spends revenue is made available for public access.

Service Delivery under Programme-Based Budgeting

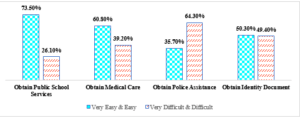

The goal of PBB has been to shift focus from merely allocating resources to line-items to aligning resources to measurable programmes and sub-programmes. Critical services that any government ought to pay attention to include health and education. Using the eight round public opinion survey of Afrobarometer, we gauge what Ghanaians think of public service delivery in the eight-to-ninth year of PBB implementation in the country. The general opinion suggests that seven out of ten Ghanaians finds it easy obtaining education services while six out of ten finds it easy in accessing healthcare. Same conclusions can’t be made for police assistance and obtaining identity documents. Only three out of ten Ghanaians have easy access in obtaining police services while five out of ten finds it difficult in obtaining official identity documents.

There is a mixed public opinion on the delivery of public services in the country. The recent challenges that emanated from the registration and acquisition of the Ghana card is an example. Certainly, the level of quality and access to public services has not reached the desired level even under PBB. Nonetheless, there has been improvement in some areas.

Challenges of PBB Implementation

PBB measures achievements through the setting of measurable performance indicators by the respective implementing MDAs. This places the onus on the Ministry of Finance to not only monitor but devise systematic process to authenticate performance information submitted by MDAs, by comparing targets to actuals. Without this, the system of evaluation and monitoring of budget performance by MDAs will merely rely on trust and remain a perfunctory activity.

Another challenge stemming from the implementation of PBB, is the use of expenditure ceilings as a bassline for further lobbying and negotiations. Attempts by MDAs to use expenditure ceilings provided by Ministry of Finance as a basis to negotiate for higher amounts must be curtailed. This practice has the tendency of creating expenditures that are not aligned to specific programmes and consequently unaccounted expenditures. It also means that, the Ministry of Finance must do a careful and thorough analysis of the spending requirements of MDAs vis-à-vis their programmes and government priority programmes. Doing this will forestall under allocation of resources to MDAs that require more to achieve their targets and vice versa.

Moreso, resources must be strategically allocated among the three broad budget lines items, that is, compensation of employees, goods and services, and capital expenditure. There is often the tendency for the Ministry to allocate more resources to compensation of employees and marginally increase allocations to the other components. This tends to be an easy-out approach in fiscal management, as employee’s compensation is out of control of the spending MDAs. Allocations to the other components mainly goods and services are critical to the operations of MDAs. And if MDAs are to meet their performance targets which will translate into improved service to the public, their goods and service budget needs proper assessment and allocations.

Conclusion

The effectiveness of PBB continues to be predominant in public finance discussions. However, the discourse has often centered on how the on-coming of PBB has impacted management practices and decision making in public organizations. What is often forgotten is that, in most developing countries, government spending has often exceeded revenue leading to burgeoning budget deficits, which throws the entire budget out of gear. As such analyzes of the impact of PBB on the spending behaviors of governments should also be given attention. After all, the PBB’s promise of careful scrutiny for the performance of public programmes should affect how these programmes behave in resource allocation decision-making as well as in curbing wasteful spending.

The author is a researcher with the Leaders of Africa Institute