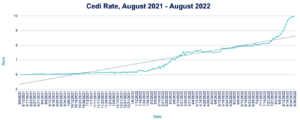

Cedi breaching record low 10 as yields hit 30%

The Cedi appreciated marginally against the dollar this week, trading at 9.99 from a record low 10.08 at last week’s close. Ghana’s local borrowing costs continue to rise, with yields on six-month treasury bills shooting past 30% this week. Proceeds from a $1.3bn syndicated loan for Ghana’s Cocoa Board (COCOBOD) agreed in July is expected to land imminently, which should ease some of the pressure on the Cedi. We expect the currency to drift back to the 10 level in the near term, although the pace of depreciation is likely to be slower.

Elections upheld in Kenya and Angola steady FX

Disputed election outcomes in Kenya and Angola were dismissed by each country’s Supreme Court this week as the results of August’s presidential elections were upheld. William Ruto was officially confirmed as the fifth President of Kenya, and Joao Lourenco was sworn in for a second term in Angola. The Angolan Kwanza appreciated marginally to 428.15 from 428.58 at last week’s close. Kenya’s Shilling initially gained against the dollar, trading at 119.75—strengthening from a record low 120.30 at last week’s close—before later weakening to a fresh record low 120.65. That came as business confidence in Kenya fell to a 16-month low in August, in part fueled by uncertainty surrounding the election. The International Monetary Fund added pressure with a warning on Wednesday that the incoming Ruto administration, which has indicated social spending measures to ease the cost of living, needs to cut spending to reduce borrowing and sustain the economy. We expect the Shilling to remain under pressure in the week ahead.

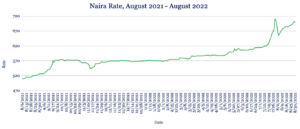

Naira breaks record low 700 as trade growth slows

The Naira weakened against the dollar again this week, sliding beyond the 700 mark at last week’s close to trade at 702. Nigeria’s government this week suspended a plan to impose a 5% excise tax on the country’s telecoms sector following lobbying pressure from telecoms companies, subscribers and other affiliated agencies. Opponents to the levy say that telcos are already heavily taxed by the government. Meantime, year-on-year trade growth slowed to 4.51% in August from 22.49% in the previous 12-month period, stunted by FX strains, global inflationary pressures and supply chain disruptions. We expect the Naira to hold firm around the 700 level against the dollar in the coming days amid potential profit taking.

Rand hits 2-year low as economy contracts

The Rand hit a two-year low against the dollar this week, trading at 17.38 from 17.30 at last week’s close, as data showed the South African economy contracted by 0.7% in the second quarter amid severe flooding and rolling power blackouts. The country’s state-owned energy company Eskom resumed planned load shedding this week after a three-week break. With a stronger dollar is contributing to a broader decline in emerging market currencies, we expect the Rand to remain under pressure in the week ahead.

Egypt hints at flexible exchange rate as Pound slides

The Pound continued its slide against the dollar, trading at 19.28 from 19.23 at last week’s close, as Egypt’s Planning Minister Hala Elsaid this week said a flexible exchange rate regime would be good for the economy. The Pound has lost almost a fifth of its value this year amid speculation that a new IMF agreement will hinge on the country allowing the currency to float more freely. Non-oil private sector activity fell for the 21st month in a row in August as businesses continue to struggle with import bottlenecks and rising inflation on the back of Russia’s ongoing war in Ukraine. We expect the Pound to weaken further against the greenback in the week ahead.

Inflationary pressures to weigh on Ugandan Shilling

The Shilling was little changed against the dollar this week, trading at 3817 from 3816 at last week’s close. Uganda’s Purchasing Managers’ Index climbed to 50.5 in August from 48.2 a month earlier, indicating an expansion in activity. Meantime, the government has scrapped a 5% export levy on refined gold, which led to a fall in overseas sales. By contrast, the country’s corn industry this week called on the government to ban exports after a poor growing season. We expect the Shilling to weaken in the near term due to a stronger dollar and ongoing inflationary pressures.

Tanzanian Shilling steady amid maize export ban

The Shilling was unchanged against the dollar this week, trading at 2331. The Tanzanian government has stopped issuing permits for maize exports amid a weaker harvest, which is expected to drive up maize prices in neighbouring countries such as Kenya while keeping prices lower domestically, providing relief from the rising cost of living. We expect the Shilling to remain stable in the coming week, in part aided by international funding such as Japan’s $500,000 donation to the UN’s World Food Programme to support refugees in Tanzania.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

Gavin Serkin

[email protected]

+44 20 3478 9710