Financial sector stocks remain on course to redeem the stock market from what has turned out to be an especially challenging year, a new report by Databank suggests.

The equities market has seen a reversal of fortunes, following a stellar 2021 campaign, when it ended the period as the second best-performing bourse on the continent, gaining 43.66 percent and reversing a trend of three consecutive years of losses in the process.

But beginning this year, investors have backpedaled from the stock market as soaring inflation, a downward-facing cedi, rising interest rates which have been priced into fixed income yields, and growing economic uncertainties over the sovereign’s debt sustainability and fiscal outlook continue to weigh heavily.

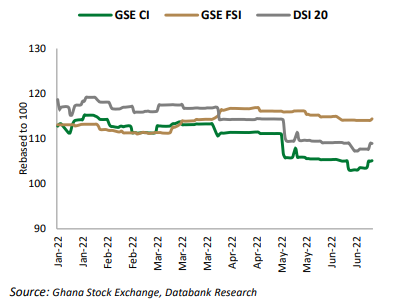

Projections by Databank, in its ‘1H22 Ghana Markets Review & Outlook for 2H22’ report titled: ‘Markets Go Defensive as Inflation Unleash the Bears’, point to financial sector stocks, as measured by the Ghana Stock Exchange Financial Stocks Index (GSE-FSI), to end the year on the current trajectory of outperforming the broader market.

At the end of the first quarter, the GSE-FSI had outperformed the broader Composite Index (GSE-CI) for the first time in five years. At the end of half-one, the GSE’s CI had shrunk by 7.2 percent on a quarter-on-quarter basis at 2,545.48 points and a year-to-date loss of 8.74 percent. Conversely, the financial sector stocks had collectively gained 1.17 percent over the same period.

“Against the backdrop of the challenging economic conditions, equities will likely remain depressed for the rest of this year… We foresee a limited upside for equities, especially for non-financial stocks. We expect the rising interest rates, inflation and strong currency headwinds to continue to squeeze margins of non-financial companies,” the report read in part.

Databank noted that it expects the financial sector to continue to outpace the broader market, especially as banks are expected to see improved profitability on account of the sharp rise in interest rates.

“We expect this to catalyse banking stocks and weigh positively on the broader market performance for 2H22,” it added.

The report, once again, highlighted the significant undervaluation of the entire market as it continues trading at a “nearly 50 percent discount to its historical price-to-earnings ratio.”

Price discovery remains unlikely in the short term, however, as the current concerns about the economy will continue to weigh heavy on equities.

In the penultimate week of July, the GSE-CI dropped to a low of circa 2,440 points. Databank, however, expects that the marginal upturn in investor sentiments, on account of government’s engagement with the International Monetary Fund and easing in inflation, would see the market close the year at around the 2,758 points mark.

“We expect trading activity to be generally muted as investors are likely to apply a wait-see approach and continue to keenly monitor the negotiations between the government and the IMF in the coming months… Although investor sentiment should see a slight improvement with the IMF on the horizon…we expect to close this year at around 2,758 points, which is nearly flat in terms of annual return.”