In an earlier article, I attempted to show you the following points

- Energy and transport are fundamental to any economy and affects us all

- The energy and transport industries are in the beginning throes of a major disruption not transition

- There is a lot of money to be made or lost in ($11.3 trillion annually)

- It can be potentially very dangerous to assume that just because Africa tends to be technology laggards, we will have sufficient time to adjust to this disruption at our leisure. Dangerous to governments, companies, individuals, towns, cities, village, and organizations of all sorts.

The disruption of energy and transportation is an elephantine subject, with various complex and interrelated facets. And to eat an elephant, you do so in bits, not all at once.

Today’s article, is about the potential effects of disruption on incumbent players in an industry. I will borrow two speeches by two different CEOs. Their companies were/are both dominant players in their industries. Today, the first is extinct, and the second is having major challenges. One a phone maker, the other an automobile manufacturer. I am talking about Stephen Elop, former CEO of Nokia and Herbert Dyess, current Group CEO of VW. The question is, will history repeat itself?

Before the speeches thou, some context.

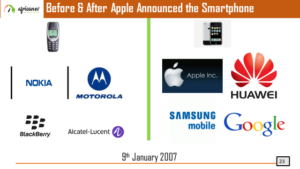

On 9th January 2007, one of the great thespians of the technology world, Steve Jobs unveiled the Apple Iphone. In retrospect, it was an epochal moment for the phone industry.

Before the launch of the Iphone, Apple was known as a computer company that produces both their hardware and software. Their arch-rival at the time, Microsoft however, produces only software (Microsoft Office anyone). So as rivals are wont to do, everyone expected Microsoft to follow Apple with a compelling product to compete with Apple’s Iphone.

There was this famous interview where, the then Microsoft CEO, Steve Ballmer scoffed and laughed at the Iphone after it was launched (search “Steve Ballmer Laughs at Iphone” on youtube). It is clear to anyone who watched that video that at the time, he has not used the Iphone. It will be interesting to know whether Steve Ballmer uses an Iphone today. Irrespective of the answer to that question, it will be safe to say he will be using a smartphone with design features pioneered by the Iphone.

As of 2021, the global smartphone market is worth 273.9 Billion dollars. Today, Microsoft is an insignificant player in the mobile phone market: be it the handset or phone operating systems. It can be fairly said that Steve Ballmer’s laughter cost Microsoft a 273.9 Billion dollars market. That’s an expensive laugh.

The laughter was not the problem thou. It’s the lazy blasé attitude of not finding out realities about potentially disruptive technologies and just dismissing them out of hand that was the problem.

So, are you doing a Steve Ballmer? Maybe you are a politician, regulator, business executive, a consumer etc. The concept applies.

A picture they say is worth a thousand words (maybe billions of dollars in this case) and the above graphic is a succinct summary.

Remember, as established players, Nokia, Blackberry, Motorola and co have capital, and other resources with which to compete. Heck, Microsoft was a bigger and a more dominant player in every dimension compared to Apple, but they still lost.

The next two graphics detail how the market shares of Blackberry (RIM) and Nokia were decimated by the Iphone led Smartphone disruption

In 2010, during its market share collapse, Nokia appointed Stephen Elop as its CEO. After a quick look-see. He fired an internal memo that subsequently leaked to the general public. I present to you, “the man on a burning platform” memo.

Man On A Burning Platform Memo By Nokia CEO Stephen Elop –

Full Transcript

February 2011

“Hello there,

There is a pertinent story about a man who was working on an oil platform in the North Sea. He woke up one night from a loud explosion, which suddenly set his entire oil platform on fire. In mere moments, he was surrounded by flames. Through the smoke and heat, he barely made his way out of the chaos to the platform’s edge. When he looked down over the edge, all he could see were the dark, cold, foreboding Atlantic waters.

As the fire approached him, the man had mere seconds to react. He could stand on the platform, and inevitably be consumed by the burning flames. Or, he could plunge 30 meters in to the freezing waters. The man was standing upon a “burning platform,” and he needed to make a choice.

He decided to jump. It was unexpected. In ordinary circumstances, the man would never consider plunging into icy waters. But these were not ordinary times – his platform was on fire. The man survived the fall and the waters. After he was rescued, he noted that a “burning platform” caused a radical change in his behaviour.

We too, are standing on a “burning platform,” and we must decide how we are going to change our behaviour.

Over the past few months, I’ve shared with you what I’ve heard from our shareholders, operators, developers, suppliers and from you. Today, I’m going to share what I’ve learned and what I have come to believe.

I have learned that we are standing on a burning platform.

And, we have more than one explosion – we have multiple points of scorching heat that are fuelling a blazing fire around us.

For example, there is intense heat coming from our competitors, more rapidly than we ever expected. Apple disrupted the market by redefining the smartphone and attracting developers to a closed, but very powerful ecosystem.

In 2008, Apple’s market share in the $300+ price range was 25 percent; by 2010 it escalated to 61 percent. They are enjoying a tremendous growth trajectory with a 78 percent earnings growth year over year in Q4 2010. Apple demonstrated that if designed well, consumers would buy a high-priced phone with a great experience and developers would build applications. They changed the game, and today, Apple owns the high-end range.

And then, there is Android. In about two years, Android created a platform that attracts application developers, service providers and hardware manufacturers. Android came in at the high-end, they are now winning the mid-range, and quickly they are going downstream to phones under €100. Google has become a gravitational force, drawing much of the industry’s innovation to its core.

Let’s not forget about the low-end price range. In 2008, MediaTek supplied complete reference designs for phone chipsets, which enabled manufacturers in the Shenzhen region of China to produce phones at an unbelievable pace. By some accounts, this ecosystem now produces more than one third of the phones sold globally – taking share from us in emerging markets.

While competitors poured flames on our market share, what happened at Nokia? We fell behind, we missed big trends, and we lost time. At that time, we thought we were making the right decisions; but, with the benefit of hindsight, we now find ourselves years behind.

The first iPhone shipped in 2007, and we still don’t have a product that is close to their experience. Android came on the scene just over 2 years ago, and this week they took our leadership position in smartphone volumes. Unbelievable.

We have some brilliant sources of innovation inside Nokia, but we are not bringing it to market fast enough. We thought MeeGo would be a platform for winning high-end smartphones. However, at this rate, by the end of 2011, we might have only one MeeGo product in the market.

At the midrange, we have Symbian. It has proven to be non-competitive in leading markets like North America. Additionally, Symbian is proving to be an increasingly difficult environment in which to develop to meet the continuously expanding consumer requirements, leading to slowness in product development and also creating a disadvantage when we seek to take advantage of new hardware platforms. As a result, if we continue like before, we will get further and further behind, while our competitors advance further and further ahead.

At the lower-end price range, Chinese OEMs are cranking out a device much faster than, as one Nokia employee said only partially in jest, “the time that it takes us to polish a PowerPoint presentation.” They are fast, they are cheap, and they are challenging us.

And the truly perplexing aspect is that we’re not even fighting with the right weapons. We are still too often trying to approach each price range on a device-to-device basis.

The battle of devices has now become a war of ecosystems, where ecosystems include not only the hardware and software of the device, but developers, applications, ecommerce, advertising, search, social applications, location-based services, unified communications and many other things. Our competitors aren’t taking our market share with devices; they are taking our market share with an entire ecosystem. This means we’re going to have to decide how we either build, catalyse or join an ecosystem.

This is one of the decisions we need to make. In the meantime, we’ve lost market share, we’ve lost mind share and we’ve lost time.

On Tuesday, Standard & Poor’s informed that they will put our A long term and A-1 short term ratings on negative credit watch. This is a similar rating action to the one that Moody’s took last week. Basically it means that during the next few weeks they will make an analysis of Nokia, and decide on a possible credit rating downgrade. Why are these credit agencies contemplating these changes? Because they are concerned about our competitiveness.

Consumer preference for Nokia declined worldwide. In the UK, our brand preference has slipped to 20 percent, which is 8 percent lower than last year. That means only 1 out of 5 people in the UK prefer Nokia to other brands. It’s also down in the other markets, which are traditionally our strongholds: Russia, Germany, Indonesia, UAE, and on and on and on.

How did we get to this point? Why did we fall behind when the world around us evolved?

This is what I have been trying to understand. I believe at least some of it has been due to our attitude inside Nokia. We poured gasoline on our own burning platform. I believe we have lacked accountability and leadership to align and direct the company through these disruptive times. We had a series of misses. We haven’t been delivering innovation fast enough. We’re not collaborating internally.

Nokia, our platform is burning.

We are working on a path forward — a path to rebuild our market leadership. When we share the new strategy on February 11, it will be a huge effort to transform our company. But, I believe that together, we can face the challenges ahead of us. Together, we can choose to define our future.

The burning platform, upon which the man found himself, caused the man to shift his behaviour, and take a bold and brave step into an uncertain future. He was able to tell his story. Now, we have a great opportunity to do the same.

Stephen.

In 2020, Tesla had what I consider to be an epochal event, The Tesla Battery Investor Day. Sure, the Launch of the Tesla Model S, and Model 3 were impactful. However, during their battery investor day, Tesla demonstrated how they plan to achieve massive scale that will bring true disruption. Many people either forget or don’t know that one of the keys behind the Iphone success story was Steve Jobs securing massive manufacturing scale from his supply partners.

Herbert Diess, in January 2020, about eight (8) months before Tesla’s Battery Investor Day gave a speech to some top managers of the Volkswagen group. Dubbed “The Fire Sppech”. Remember, Volkswagen is the biggest manufacturer by numbers of the global automotive industry. Followed closely by Toyota of course.

I find fascinating, the parallels between Stephen Elop’s “Man On A Burning Platform Memo” and Herbert Diess’ “Fire Speech”. Whether VW, unlike Nokia will survive the disruption of its industry remains to be seen. Enjoy

Fire Speech By VW-CEO Diess To His Managers – Full Transcript

Given on – Thursday 16th January 2020

“Ladies and Gentlemen,

the world is on the move. Politically and technologically, we live in an incredibly dynamic time. A turn of an era stands before us – from the dimension of the industrial revolution. And Volkswagen is in the midst of the storm of the two greatest transformation processes:

Climate change and the associated pressure to innovate towards zero-emission driving.

And digitalization, which is fundamentally changing the automobile as a product.

Our Group does not always have the best prerequisites for reacting quickly and consistently enough to these developments. Measured against this, we have not done badly so far. This is also acknowledged by market observers. In 2019 in particular, analysts have gained new confidence in our strategy.

Kepler Cheuvreux attested to us earlier this year: „We think VW is the best positioned player in the industry to master the CO2 challenge.“ Und Goldman Sachs meint: „We expect VW Group to continue to prosper this year as a result of ongoing positive sales developments at VW brand, a pick-up in sales at Audi, and broadly flat margins.“

In the Litigation area, we are making the risks from the diesel crisis more manageable step by step. In terms of corporate culture, we are seeing tangible and measurable progress. I am pleased that we have increased our integrity by three points in the sentiment barometer.

Our modern model range built on the MQB basis in volume and the new Porsches, Audis, Lamborghinis and Bentleys convince the customers. We improve the quality of our business. Revenue and earnings are growing faster than sales. In China, we increased our market share by 1.4 percent in a sharply declining market. This is a great achievement, which hardly anyone would have expected from us. Congratulations to Stephan Wöllenstein and his team on their outstanding performance!

In South America, we are returning to profitability for the first time, and we have also turned our business around in Russia. In North America, we have significantly improved our earnings and aim to break even this year. Volkswagen Financial Services will have a record year in 2019, and the component has made decisive steps in battery development and production.

At Audi, the e-tron has got off to a successful start, development costs have been reduced and a comprehensive cost reduction program has been launched. Porsche has once again delivered excellent figures and cars and has set an example with the Taycan. Seat conquers new and young customers with Cupra. Skoda is running at full speed and will present the new models in India, an important future market for us, at the beginning of February.

VW Commercial Vehicles has put the extremely important Ford cooperation on track, and Traton has completed its IPO. We see positive trends at Bentley, Ducati, Bugatti and Lamborghini, and Bentley in particular is back in the black. The Volkswagen core brand has worked hard to further increase returns. All in all: good developments.

But honesty also means that the storm is just beginning. And today is an opportunity to examine ourselves and each other: Are we well enough prepared for what’s coming? 2020 will show how weatherproof, agile and responsive we have become.

Last week, I was in New York with investors and analysts, where I promoted our strategy. I explained the steps we are taking for 2020 and 2021. In comparison, we are receiving more and more buy recommendations for our shares. 88 percent recommend buying VW shares. We are gaining credibility. That is of enormous importance for us.

But: The development of Tesla’s share price has recently been far more dynamic than the increase in VW’s share price. In terms of market capitalization, Tesla is now almost on a par. Ladies and gentlemen, we are valued like an automobile company, Tesla like a tech company.

In the future, the automobile will be the most complex, valuable Internet device suitable for the masses. We will spend more time in the automobile of the future than today, perhaps two hours instead of one. That’s why it will not be a grey box, but will be much more comfortable, homely and above all more networked and multifunctional than today. In the car, we will be continuously online, delivering far more data than smartphones, but also getting more information, services, security and convenience from the Internet.

The networked car will almost double Internet time. The car will become the most important “mobile device”. When we see this, we understand why Tesla is so valuable from an analyst’s perspective. We at Volkswagen want to get there too. The big question is: Are we fast enough? The honest answer is: maybe, but things are becoming increasingly critical. If we continue at our current pace, things will actually get very tight.

I remember a situation in which I had Nokia employees – I had taken over a few hundred – explain to me how they went down in the fight against Apple. The logic was: “We have 43 different mobile phones, the right one for everyone, nobody wants touch, you have to charge the iPhone at least once a day, while our battery lasts for a week“. And: Nokia had record years, but was practically already dead.

Steve Jobs, on the other hand, had understood that the function of the device was fundamentally different. Access to the Internet became more important than the phone itself. And loading time was no longer so critical for customers. A few years later, Nokia was history.

Ladies and gentlemen, this is precisely the situation that is being repeated in the automotive industry. The car is no longer just a means of transport. And that also means that the era of classic car manufacturers is over. The future of Volkswagen lies in the digital tech group – and only there. And we will need an additional catch-up program to mobilize all the potential in the Group for this.

We have what we need. There is a great deal of technical know-how in our group of companies. We have a top management team, as the Future Executive Development Program has shown us. And we can use the proceeds of today’s technology to finance the transformation from our cash flow.

What we lack is above all speed and the courage to take a radical change of course, if necessary. Ladies and gentlemen, that is what it is all about: a powerful change of direction. Otherwise it could soon be too late. 2020 is now just around the corner. Three points are crucial:

Firstly, meeting the new CO2 limits by making our e-strategy a success and bringing ID.3 on the road. 2020 is the year of truth for CO2 compliance. With a difference of 30 grams to the limit value, which we will have to close in two years and which can only be closed with e-vehicles and plug-ins.

At the beginning of January, the analysts at UBS put it bluntly in a nutshell: „We reiterate our view that the ID3 is VW’s ‚must-get-right‘ vehicle in 2020, as it spearheads VW’s second-to-none EV offensive. Also, the ID3 is key to CO2 compliance for VW in the EU.“ The ID.3 has to get on the roads. To do this, we must meet the challenges at the start. The challenge is the complexity of the software and electronics.

In addition, in order to comply with the limit values, we also have to supply, build and deliver batteries to Seat Mii, VW Up!, e-Golf, e-tron and Taycan. All in all, this is perhaps the most difficult task that Volkswagen has ever had to face.

Second: Implement the e-strategy without losing profitability. Margins in 2020 must at least be sustainable. We have the potential to do so if we really take the seriousness of the situation as an opportunity to fully exploit the potential of this Group and, where necessary, slaughter sacred cows.

We will use the synergies within the Group much more consistently and must reduce complexity even more. To this end, we are forming the synergy families. The idea of using the greatest possible synergies between the brands in model development is not new.

Exploiting the strengths of the Group also means: We need maximum profit pool utilization across all segments. To this end, we have agreed the brand territories.

It is completely understandable that some brands would pursue a different strategy if they were alone. But we operate as a group. Each brand is judged by the fact that it makes full use of its own territory. The corporate goal is above the brand goals. Just as important: with the six percent for research and development and for investments, it must be clear: That is the maximum ceiling. Toyota – not to be compared with us in all consistency – runs at three to four percent in these disciplines – and is considered innovative and environmentally friendly.

We need to make further progress on productivity. Cost-cutting programs are underway in all brands. The German locations in particular offer potential here. And they also have a lot of leverage. Reducing complexity also means that we regularly review our activities and ask ourselves: what can be eliminated, what do we need new?

To name a few examples: …the fuel cell and the Liquid Fuels we’re running at ground level. For a foreseeable time horizon of at least a decade, they are not an alternative to car engines. We need to concentrate fully on the breakthrough of electric mobility.

We will also significantly reduce expenses at Moia. We want to keep our foot in the business. But we have to extend our commitment over time until the conditions for profitability are better. This applies not least to the expensive vehicles.

In addition, the portfolio is being restructured with a clear focus on the core business. The IPO of Traton was an important step. A first step. We are actively engaged in discussions on industrial solutions for Renk and MAN Energie Solutions.

In order to achieve and sustainably increase our target margins, we also need a fundamental rethink. Away from volume orientation, and toward earnings quality.

Take Bentley, for example: 10,000 deliveries – that’s a strong performance by the team, which we did not think possible not so long ago. Congratulations for this and a thank you to the team. But the news would of course be even more impressive if we were to achieve a return greater than zero. If I’m completely honest: I’d rather have 5,000 deliveries and a return above 20%.

Counter example: Mexico. Here, the market share will have fallen slightly in 2019 – caused by the pricing and shutdown of low-yield vehicles. However, corporate earnings improved from a clearly negative contribution to just below break-even. This is expressly an excellent development! We must succeed in the paradigm shift away from volume and towards quality of business. In the future, we will focus even more strongly on sales, return on sales and cash as core reporting figures.

Thirdly: Making the Car.Software.org a success and creating impact. The Car.Software.org is launched. Now it must become operational. This also means that we must not wait until all organizational issues have been resolved down to the last detail, but must get started. We all have a clear demand: The success of the Car.Software.org will decide our future!

These are the building blocks for reaching the 200 billion euros in enterprise value. The program for this is the “Together 2025+” strategy, which we agreed upon last year in Fleesenseev, with the five modules Best Governance, Best Performance, Best Brand Equity, Software Enabled Company and Excellent Leadership. These five modules describe the right direction for the transformation towards a Tech Group.

Turning Volkswagen from an automotive group into a digital tech group – that is a gigantic challenge. It sounds unlikely that it can be mastered. Nevertheless, I believe that we can master it. To do so, we need a radical restructuring of the Group. We need to make use of our strengths, but we also need to leave out and abandon everything superfluous that is not going to get us anywhere.

That is the task of all of us. In these challenging times, it is all about new thinking and joining forces. And, of course, it is still a matter of making Volkswagen a company of sustainable integrity. We have it in our own hands. 2020 is the year of opportunities for faster, more consistent restructuring.

Before Christmas, I congratulated the best trainees from the entire Group in Wolfsburg. I said to them: This company is their company. And if this company is not to become an industrial monument, then they must put aside the monuments of everyday life. I said that to our trainees. And I say the same to you.

We need a shared understanding of the radical nature of change. In the magnitude of our task. And in the short time frame. It gives us exactly one single attempt to secure Volkswagen for the future. Let’s use it.”

Gad is the founder and Executive Director of AfricaNEV

Socials: Facebook & LinkedIN – Gad Senyuiedzorm Ashiagbor;

Twitter -@walencho; email –walencho@gmailcom

AfricaNEV (Africa New Energy and Vehicles) is a continental non profit that aims to accelerate the adoption of e-mobility in Africa by policy advocacy, awareness creation and linking industry players in the value chain.

Socials: Facebook, LinkedIN, Twitter –@walencho; email –africanev@gmailcom