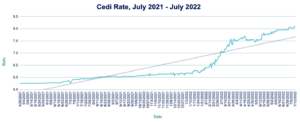

The Cedi slumped to a fresh low against the dollar this week, trading at 8.10 from 8.02 at last week’s close. Ghana’s annual inflation jumped to the highest in almost 19 years in June, with prices increasing 29.8% compared to 27.6% in May. The inflation rate has now exceeded the central bank’s target range of 6% to 10% for 10 months in a row. Economic growth slowed to 3.3% in the first quarter, with the value of the Cedi declining by almost a quarter against the greenback since the start of the year. We expect the currency to continue to struggle against the stronger dollar in the near term.

Rand at 22-month low as output wilts

The Rand sank to its weakest level against the dollar since September 2020, at one point depreciating to 17.15 before retreating to trade at 16.97, from 16.86 at last week’s close. The latest bout of weakness came as South Africa’s manufacturing production contracted by 0.2% in May, well below expectations of a 1.5% expansion. The Rand also came under pressure from global factors, including a broader retreat from riskier assets as investors sought out the safety of the dollar, with US interest rates expected to continue rising. We anticipate further stress for the Rand in the week ahead.

Egypt bucks inflation trend as Pound steadies

The Pound was little changed against the dollar this week, trading at 18.87, in line with last week’s close. The more resilient tone follows a slowing in annual inflation to 13.2% in June from 13.5% in May, ending six straight months of accelerating price rises. Inflationary pressures are likely to persist given Egypt’s reliance on wheat imports that have been severely impacted by Russia’s war in Ukraine. The country’s net foreign reserves fell for a third time this year as import costs for wheat and fuel surged. With inflation easing for now, we expect the Pound to remain relatively stable against the dollar in the week ahead.

Record low Shilling faces Kenya election pressure

The Shilling declined to a fresh record low against the dollar, trading at 118.10/118.30 from 117.95/118.15 at last week’s close amid increased demand for the greenback from the manufacturing and energy sectors. Kenya’s central bank has helped stave off a steeper decline by dipping into its FX reserves, which now stand at $7.9bn, equivalent to 4.61 months of import cover. With August’s presidential election now less than a month away, political uncertainty is likely to pile further pressure on the Shilling in the near term.

Shilling erases Uganda rate hike gains

The Shilling weakened against the dollar this week, trading at 3771 from 3744 at last week’s close, erasing gains seen in the immediate aftermath of last week’s emergency rate hike. Annual inflation increased to 6.8% in June from 6.3% a month earlier—remaining above the bank’s 5% target. Police made at least a dozen arrests this week amid protests over the rising cost of living. Protestors are calling on the government to subsidise basic food items. With economic growth still projected in the range of 4.5% to 5% for 2022, rising to 5% to 5.5% in 2023, supported by public investment, we expect the Shilling to resume its strengthening trend in the medium term.

Tanzanian Shilling holds steady as IFC agrees new loan

The Shilling was unchanged against the dollar this week, trading at 2373. Tanzania’s annual inflation accelerated to 4.4% in June from 4% in May. The rate is now at its highest level in almost five years. Prices rose at a faster pace mostly for transport (8.9% vs 7.2% in May) and food and non-alcoholic beverages (5.9% vs 5.5% in May). The World Bank’s International Finance Corporation this week agreed to lend the country $100m through CRDB Bank Tanzania to boost funding for small and medium-sized companies. Up to a quarter of the loan will be dedicated to women-owned businesses, the IFC said. With the annual inflation rate accelerating to 4.4 percent in June, we expect the Shilling to weaken near term.

Fuel price surge made worse by Africa FX weakness

As surging fuel costs trigger a wave of protests across Africa, leaders are desperately seeking avenues to fix the situation. In Mozambique, bus fares are being subsidized by the World Bank, according to Bloomberg. Ghana is looking to the IMF to bail out its economy following mass protests over the rising cost of living. Governments in Kenya and Nigeria, with elections approaching, are saddled with rising fuel subsidies, weighing on widening budget deficits. Despite these interventions, motorists still face further increases at the pump. Kenya’s Energy and Petroleum Regulatory Authority is likely to increase pump prices by at least 10 Shillings per litre even as the government cushions consumers by about 40 Shillings, according to Kenyan Wallstreet. The pain is being felt only in part due to the high global cost of crude oil. Currency weakness against the dollar is a further cause. Unfortunately, we see no let up on the currency side, as detailed below.

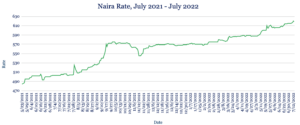

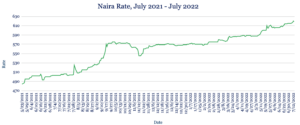

Record low Naira set to lose further ground

The Naira sank to a new record low against the dollar on the unofficial market, trading at 619 from 615 at last week’s close. The Nigerian Union of Petroleum Exploration and Natural Gas workers has threatened a solidarity strike with the Academic Staff Union of Universities following an eight-month shutdown of university activities across the country. This has the potential to worsen difficulties faced by Nigerians due to current fuel scarcity. The Manufacturers Association of Nigeria has appealed to the government to grant it licenses to import diesel from neighbouring Chad and Niger in order to ease electricity-reliability issues and the high cost of diesel fuel. We expect the Naira to lose further ground against the dollar in the near term due to the current strained political atmosphere.

Note to journalists: please feel free to quote from this briefing for news reports and let us know any requests for further comment or interviews via the contact details at the end, or by reply to this email. AZA is Africa’s largest non-bank currency broker by trading volum

e at over $1 billion annually. See https://www.azafinance.com Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

Gavin Serkin

[email protected]

+44 20 3478 9710