I am extremely excited by this year’s Business and Financial Times Banking Survey. My excitement stemmed from the published survey which focused on the theme: “Bouncing Back Stronger: Innovative Banking Solution for National Economic Recovery”. As I reflected on this, I was fascinated by recent developments within the banking sector. Just recently, the Ghana Association of Bankers, in collaboration with the Ghana Payments and Settlement System (GhIPSS), launched the GhanaPay app. This app is a mobile money service, etc., provided by commercial banks to individuals and businesses. It is like any mobile money service, but with additional banking services designed for your financial freedom. These developments, in my view, were made possible through a collaboration with the financial technology (fintech) companies. This, to me, is helping to shape and drive the economy to recovery.

If there is any significant intervention that has changed the financial sector landscape over the last decade in Ghana, it is undoubtedly the emergence of Mobile Money (momo). This has been made possible through the help of fintechs, mobile network operators (MNO) and the banks. It is an undeniable fact that, today, banks that are sitting pretty well on deposits (Liabilities) and those with bigger market share are lenders who have partnered with fintechs and telcos to take the game to the next level.

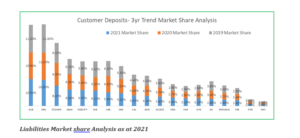

I researched into the 2021 annual report for 20 out of the 23 commercial banks in Ghana. My research revealed that while the Total Assets of these commercial banks grew by 20 percent, Industry Liabilities grew by 17 percent year on year to GH¢121.1bn (2020: GH¢103.8bn). GCB ranked no. 1 with the highest deposit of GH¢13.2bn, maintaining a flat market share of 10.9 percent. UBA and First Atlantic Bank significantly grew their deposit base by 46 percent and 42 percent, respectively. This, in my opinion, is a reflection of their strategy to drive deposits through various products and customer initiatives in collaboration with their fintech partnerships. With the exceptions of CBG, Société Generale and FNB – who dipped on deposit mobilisation by 2 percent, 3 percent and 7 percent, respectively, all other banks increased their liquidity position. In view of the lingering coronavirus (COVID-19) pandemic, banks and fintechs have the leverage to improve innovation, digitise and maximise the opportunities thereof.

Global fintech scene driving e-commerce.

Globally, the fintech sector has been characterised by dynamic growth in its user base, range of products and services, as well as capitalisation and market valuation. This trend is supported by specific demand, supply and technological factors. Majority of fintech solutions are based directly on innovation in retail services; but at the same time, there is an increasing number of innovative digital service development in the corporate segment. In terms of the new and advanced technologies, the application of artificial intelligence may have the strongest impact on the financial sector in the short run. Progress in fintech solutions is also driving regulatory reforms, and regulators are taking key interest in this phenomenon to ensure that all fintechs are licensed globally.

According to the 2021 Global Payments report by Worldloav, online retail sales are expected to rise from US$4trillion in 2021 to US$10trillion by 2027. There has also been significant surge in digital wallets/bank transfers while cash and credit cards are taking a nosedive. Growth in digital wallets accelerated amid the pandemic from 44.5 percent in 2020 of e-commerce transaction volumes. This is expected to grow to 51.7 percent by 2027. The Buy Now, Pay Later payment system is expected to double from 2.1 percent in 2020 to 4.2 percent in 2024. That is not all; the shift from cash to contactless payment methods at point of sales (POS) terminals saw a 32 percent drop in 2020. It is also anticipated that there will be an additional drop of 38 percent from 2020 to about 12.7 percent of global POS volumes by 2024.

Fintech landscape in Ghana

The last time I checked, there were over forty fintech companies and start-up firms in Ghana. The number may even have increased by now. Looking at the increasing numbers, it has been a good step for the Bank of Ghana to establish the Fintech and Innovation Centre to regulate the industry and bring some sanity. This, I believe, has been a step in the right direction. Key players like Express Pay, Slyde Pay, IT Consortium, Emergent (Formerly Interpay), Hubtel, CoreNett, Digi teller, Pay Say, Bloom impact, Inclusive, Accelerex, BTC Ghana and Bit Land – just to mention few – together with the mobile network operators (MNO) and banks have transformed and shaped the financial services in Ghana. Some fintechs have acted as Payment Gateways, Banking Tech, Blockchain, Investment Tech, Mobile Wallet, and lending and payroll management service providers.

Interestingly, though the fintech solutions I have seen are more retail services-led, more innovative corporate products are gradually appearing on the market. This is where solutions such as Person to Person (P2P) or Business to Consumer (B2C) have become so crucial.

Digitisation of the banking system

Until recently, a lot of banks saw Fintechs as competitors; but thankfully, that mindset has changed over time. In the early 2000s, many financial institutions and bank branches were operating on ‘stand – alone’ basis without the necessary connectivity within the bank branch network. For example, there were times customers were referred to their domiciled branches to undertake various amendments such as customer profile update information, cheque book request, etc. This was because most banks were using legacy core banking systems which were not agile, adaptable and scalable. However, with the insurgence of fintechs, this has been made possible through the help of Application Payments Interface (APIs) and other connectivity options. The wake of COVID-19 has even made it worse and has necessitated banks to reimagine and rethink how to reach out to their customers.

Have banks embraced digitalisation?

As some people put it, COVID-19 has provided an opportunity in disguise for companies to reshape business models, work culture and technology. The good thing amid this pandemic is that, most banks have invested heavily in technology and deployed capital to work together with fintechs to reach their clientele base. Some of the new developments and trends in the wake of the pandemic is that most banks begun to place more emphasis on their retail and digital channels to serve their customers. In fact, I would say the digital maturity of the banking system is at a medium level. It is on that basis that digitalisation of internal operations shows a more favourable picture. However, in terms of interactions with external stakeholders, several areas require development. Developments to ease digital access to products and modernise contact with clients need to be considered.

Recently, I saw a new article highlighting that Letshego had disbursed more than a million loans, and such innovations are highly commendable. A lot of banks who continue to be innovative, leveraged on technology and fintechs to drive the digitalisation and financial inclusion agenda. For instance, some banks who hitherto had their automated teller machines (ATM) not accepting cash, have had to upgrade to accept and dispense cash. This has minimised customers visiting the branches, and led to a record of 99 percent uptime on ATMs since they are now being tracked remotely.

The need for the digitisation of customer interaction has increasingly become necessary, and this should be seen in the light of medium to long-term recovery plans.

Fintechs are undoubtedly part of the solution to the problem, and banks should continue their commitment to strengthening ties with the financial technology ecosystem, from which new opportunities for the financial sector will keep emerging.

Technological innovation, faster than ever

The truth of the matter is that, many activities could have come to a halt due to the crises. However, at the same time various levels of innovations have sprung up and been happening at a much faster rate so that fintechs can find a quick and probably inexpensive solution for banks. This acceleration is happening much faster because Fintechs are more agile and collaborating with banks to deploy ideas and solutions to the table.

To sum it up, the impact of fintechs and banks in driving economic recovery cannot be underestimated, and the synergies between them must continue. As the future remains uncertain, there will be a move toward a new paradigm in which customers are going to be more digital and volatile. Definitely, fintechs are going to be the big winners, and the banking sector must collaborate with them to remain relevant in defining the future.

Credit:https://www.pwc.com/sg/en/publications/banking-industry-responding-to-the-impact-of-the-covid-19.html, ResearchAndMarkets.com, https://www.bbva.com/banks,

Disclaimer: The views expressed are personal views and don’t represent that of the media house or institution with which the writer works.

About the writer

Carl is a Banking, Finance, and Investment Professional with an International Bank in Ghana. Contact: [email protected], Cell: +233 200301110