Citizens must be ready to tighten their belts for a long-haul battle against rising cost of living, as both global and local conditions are pointing to continuous rise in the prices of goods and services for the greater part of this year.

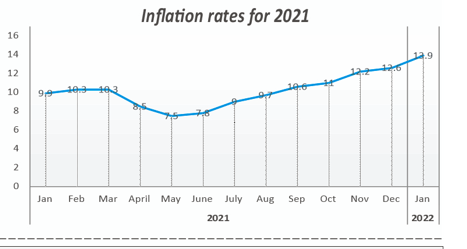

Recent data from the Ghana Statistical Service (GSS) show inflation has plunged into a free-fall mode, as January saw general price levels of goods and services increase by 13.9 percent from 12.6 percent recorded in December 2022 – way above the upper band target of 10 percent.

What’s more worrying are the drivers of inflation, which signal no liberation soon. In the past few months, housing and water, power and fuel have been the main factors contributing to high inflation in the country. The three recorded inflation rates of 28.7 percent, 20.8 percent, and 17.4 percent in January. Fuel prices, for example, continue to climb unabated mainly due to rising crude oil prices – which are reflected at the pumps – and depreciation of the cedi against the dollar.

Fuel prices at the pumps are now selling more than GH¢7 per litre, and are even predicted by market watchers to hit GH¢8 by mid-year. Transport operators have also warned of an impending increment of transport fares by about 30 percent. All these will further feed into inflation – thereby resulting in the hiking of prices for goods and services, with the final consumer being on the receiving end.

To further understand the difficult economic environment, especially for local producers, it is important to look at the inflation trend between locally produced and imported goods. Locally produced goods saw inflation rise to 15 percent in January, the highest it has ever recorded since rebasing of the inflation basket in August 2019.

Meanwhile, that of imported products recorded an 11 percent change in price for the period; indicating that domestic manufacturers are experiencing high cost of production, a phenomenon that will be around for quite a long time this year. Historically, locally produced goods have persistently seen higher inflation than imported goods over the last few years.

Furthermore, given projections made by the Bank of Ghana and other market-watchers, prices of goods and services will remain high in the coming months – a situation that may well affect lending rates, as the central bank’s ‘body language’ indicates it will not cut the policy rate anytime soon. Therefore, access to cheap capital will continue to remain a wishful dream for businesses.

“All the core inflation measures and inflation expectations have increased, which points to heightened underlying inflation pressures. The latest forecast shows that inflation will likely remain above target in the near-term, driven by both external and domestic factors, and only return to target about four-quarters ahead.

“The inflation outlook’s key risks include: rising crude oil prices and their transmission to ex-pump petroleum prices and transportation costs; rising global inflation; food price uncertainties; and the fiscal outlook. The Monetary Policy Committee envisaged this scenario when it raised the policy rate in November 2021 to contain the inherent aggregate demand pressures likely to drive prices in the outlook,” the January report of the Monetary Policy Committee of the Bank of Ghana stated.

And even though government was forced by circumstances to cut expenditure by 20 percent for the year, in a move to moderate risks to the inflation outlook, it will not be enough to tame the situation as many months will be needed to yield the expected results.

So, looking at the trend of inflation and the factors driving it upward, consumers should be ready to lose more of their disposable income, as cost of living will remain high for the months to come.