- beats pre-pandemic level

A recently published Investment Trends Monitor report by the United Nations Conference on Trade and Development (UNCTAD) has shown that global Foreign Direct Investment (FDI) flows shot up 77 percent to an estimated US$1.65trillion from US$929billion in 2021 – in the process surpassing pre-pandemic levels.

The report indicated that the hike was largely fuelled by strong investor confidence in infrastructure sectors, supported by favourable long-term financing conditions, recovery stimulus packages and overseas investment programmes, particularly in the more advanced economies.

“Project finance in infrastructure now exceeds pre-pandemic levels across most sectors. Project numbers are up, mostly in renewable energy and industrial real estate,” the report stated.

Despite adding that international project finance in infrastructure sectors will continue to provide growth momentum, concerns were raised about the uneven trend of inflows.

“Recovery of investment flows to developing countries is encouraging, but the stagnation of new investment in the least developed countries in industries important for productive capacities, and key Sustainable Development Goals (SDG) sectors – such as electricity, food or health – is a major cause for concern,” it read in part.

Trend

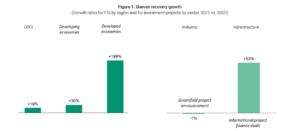

Data contained in the report showed that developed economies saw the biggest rise by a distance, with FDI reaching an estimated US$777billion in 2021 – almost triple the exceptionally low COVID-19-induced level of 2020. “Of the total increase in global FDI flows in 2021 (US$718billion), more than US$500 billion, or almost three quarters, was recorded in developed economies.”

A breakdown revealed that in Europe more than 80 percent of the increase in flows was due to large swings in conduit economies. Inflows in the United States – the largest host economy -more than doubled, with the increase solely dependent on a surge in cross-border mergers and acquisitions (M&As).

In developing economies, FDI flows increased by 30 percent to nearly US$870billion, with a growth acceleration in East and South-East Asia of 20 percent; and with Latin America and the Caribbean witnessing a recovery to near pre-pandemic levels.

Africa recorded inflows worth US$97billion, as most recipients across the continent saw a moderate rise in FDI. This resulted in the total for the region more than doubling, but it was inflated by a single intra-firm financial transaction in South Africa during the second half of 2021.

Despite describing the outlook for FDIs for 2022 as positive, the report noted that the 2021 rebound growth rate is unlikely to be repeated. “The 2021 rebound growth rate is unlikely to be repeated. The underlying trend – net of conduit flows, one-off transactions, and intra-firm financial flows – will remain relatively muted, as in 2021,” the report further indicated.

On the local front

Commenting on the subject, the Dean of the University of Cape Coast (UCC) Business School, Professor John Gatsi, said the development is not surprising – owing to the changing dynamics of investor demands and appetite, and concerns over stability.

“Investors remain concerned over issues such as the ease payment of taxes and permits, the cost and concentration of digitalisation, among others. Developing countries including Ghana must be guided by these things to attract investors,” he said.

He added that the country is in a favourable position for leveraging the Public-Private Partnership Act, 2020 to allay concerns over the security of investment, especially in the infrastructure sectors. “There has been hesitancy to move into countries and areas where there is an inherent risk of unrest or loss of ownership. Now that we have the 2020 Public-Private Partnership Act it has provided some answers to the requests by investors, and we should promote it to investors.”

The half-year report issued by the country’s primary investment promotion vehicle, Ghana Investment Promotion Centre (GIPC), indicated that the nation had received FDI amounting to US$829.29million for the period under consideration. The was a year-on-year increase of 32.15 percent on the inbound FDI value of US$627.52million recorded in the same period of 2020.