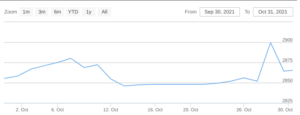

Indigenous oil palm producer Benso Oil (BOPP) has continued its fairytale run on the local bourse, leading the gainer’s table as its shares price grew by 74.83% from GH¢2.86 to GH¢5 in the month of October.

The rally, which began in June with the share price at GH¢2, has since gained 203% on that price valuation – bested only by FanMilk on the GSE for year-to-date performance. This has been sustained largely due to investor confidence in the firm’s performance beginning 2020 and an appreciation of the global price of palm oil, which has grown from an average US$471 in 2018 to US$1,061 in Q2 of 2021.

A perusal of BOPP’s financials shows that its revenue grew from GH¢79.09million in 2018 to GH¢95.6million in 2019. FY2020 saw revenue reach GH¢123.8million, representing a 29% growth, and GH¢104.4million at the end of June this year – with the oil palm producer on course to meet its projected revenue target of GH¢194.5million by year-end. At the end of the third quarter, it had attained GH¢150.9million in revenue.

Commenting on the company’s performance when it met investors during a ‘Facts Behind the Figures’ session organised by the GSE, its Director and General Manager, Samuel Avaala said: “2H2021 topline growth of 63% is attributable to the bullish world market crude palm oil prices, coupled with higher crop productivity from both the nucleus plantations, smallholders and out-growers. Operational efficiencies have also seen sustained high levels and continue to improve while cost discipline practices have ensured that unit production cost remained controlled in line with plans.

“This performance comes on the back of sustained operational efficiencies, strong production volumes, and the recovery of world market crude palm oil prices which began in early 2020. Benso Oil Palm Plantation PLC is set to maintain the strong profit trend to end of the year by leveraging on its core competencies for production and taking advantage of the bullish world market price trend.

“The company is committed to conducting its business in a socially responsible and ecologically sustainable manner, through using internationally accepted best practices which deliver sustainable stakeholder and shareholder value.”

The share price of BOPP had soared to GH¢6.05 as at beginning of the second trading week in November, as investors appear to have pitched their camp with BOPP – also based on its extensive community-wide social responsibility programmes, including its clinic.

Rest of the pack

The market is guaranteed its highest return in half a decade with the Composite Index (GSE-CI) returning a favourable 47.52% year-to-date (YTD). The equities market was also driven by the appreciation in share price of Fan Milk Limited (FML), Republic Bank Ghana (RBGH), Enterprise Group (EGL) as well as Total Ghana, which realised about 39.75%, 39.53%, 9.13% and 7.96% rise in share prices respectively.

Per the October 2021 data released by the Exchange, the main market’s cumulative performance from January to October 2021, in relation to the comparable period in 2020, shows there was a marginal dip in the volume of shares traded by 3.53% from 439.39 million last year to 423.91 million in 2021. Yet, in value terms, there was an increase of 39.26% from about GH¢341.71million to GH¢445.26million – indicating a continuous rise in the value of shares on the local equities market.

Accordingly, the year on year, market capitalisation and primary index, the GSE Composite Index (GSE-CI), shot up 21% and 55.90% respectively, with analysts anticipating further bullishness on the local bourse.