Did you know banking and financial services began with merchants who gave grain loans to farmers and traders who carried goods between cities? This was around 2000 BC in Assyria, India and Sumeria (south Mesopotamia). Later, lenders based in temples in ancient Greece and the Roman Empire lent money, accepted deposits and changed money. All these were done quite manually. Even at the genesis of modern banking systems in Florence, Italy with banks like the Medici Bank, and others like Banca Monte dei Paschi di Siena and Banco di Napoli, manual systems were the norm.

It is on the back of this that fintech emerges. The term ‘Fintech’ is coined from ‘finance’/’financial’ and ‘technology’. It refers to any business that uses technology to enhance or automate financial services and processes. These businesses comprise a rapidly growing industry that serves the interests of both consumers and the businesses in a myriad of ways. Fintech has a seemingly endless array of applications and has found use in internet and mobile banking and insurance, cryptocurrencies and investments.

Fintech has been with us for quite a while. The earliest development can be linked with the invention of the telephone back in the mid to late nineteenth century, when Alexander Graham Bell was granted a United States patent for a device that produced clearly intelligible replication of the human voice at a second device.

Much later, with the advent of digital technology from the late sixties to the first decade of the new millennium, there was a proliferation of technologies, systems and tools to facilitate financial services. In recent times, however, the explosion of social media and e-commerce have often driven financial service businesses either up or down. Tech-savvy has become a must for many businesses offering financial services, be they banking, insurance, investments or payment platforms.

The Use of Technology

Fintech uses technology to improve activities in finance. The use of smartphones for mobile banking, investing, borrowing services, and blockchain are examples of technologies aiming to make financial services more accessible to the general public. Indeed, in many economies, the penetration financial services have achieved has been mainly because solutions powered by technology have been deployed.

Fintech companies of today use a variety of technologies, including artificial intelligence (AI), big data, robotic process automation (RPA), and blockchain.

AI is concerned with building smart machines that can emulate tasks that typically require human intelligence to make decisions and apply solutions. AI algorithms can, therefore, provide insight on customer spending and savings/investment habits, allowing businesses to better understand their clients. Banks usually employ chatbots to assist with customer service without the limits of time or schedule. Credit lenders are making smart underwriting decisions by utilizing a variety of factors that more accurately assess traditionally underserved borrowers.

Big data is a field that examines how to extract huge volumes of complex data, analyse the data for machine learning (systems learning from certain trends and patterns in the data), predictive modeling and other advanced analytical processes. These would usually be too much for traditional analyses tools and techniques to deal with.

Robotic process automation is a systems technology that makes it easy to build, deploy and manage software robots that can mimic human actions interacting with digital systems and software. They would tend to do so more consistently and faster than people.

A Blockchain

A blockchain is a type of database, that is, a collection of data that is arranged and stored electronically on a computer system. A blockchain collects information together in groups, also known as blocks, that hold sets of information. When a block is filled it is set in stone and becomes a part of this timeline. Each block in the chain is given an exact timestamp when it is added to the chain.

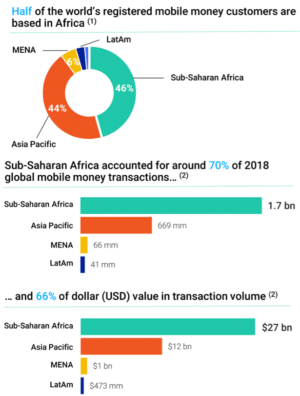

The impact of fintech on Africa has been huge. Financial inclusion for the millions who are unbanked, uninsured and have no access to credit is now becoming possible through fintech. As the continent’s mobile phone and internet penetration increases, the world’s second-fastest growing payments and banking market will soon sideline traditional systems for the execution of financial service transactions. The continent is already the largest adopter of mobile money transfer systems (Figure 1), comprising nearly half of the globe’s registered mobile money customers, approximately 70 percent of global mobile money transactions, and two-thirds of the transaction volume by value.

The proliferation of mobile financial services, indicates a potential for fintech to revolutionize financial inclusion in sub-Saharan Africa. Demographic trends in the region, such as a sizable fast-growing population, the expanding middle class, and the significantly underdeveloped financial services industry, signal the region’s burgeoning demand for digital financial technologies. For African consumers, fintech innovations provide access to vital financial services. Improving the penetration of telecommunications infrastructure will continue to enable equitable access to finance for all Africans.

Fintech firms specializing in digital payments dominate sub-Saharan Africa’s fintech investment landscape by both financing and transactional metrics. Digital banking and lending services trail closely behind digital payments. However, financing for digital payment services is much more than that for digital banking and lending services which receives 40% less financing.

Fintech in Ghana

In Ghana, the fintech industry has seen tremendous growth, powered by developments in mobile technology infrastructure, as well as emerging trends in the financial and non-financial services sectors. As in other African countries, mobile payments transactions form the bulk of all fintech-aided transactions, the telecommunications giant, MTN Ghana playing a lead role. Partnerships with MasterCard and Western Union would allow MTN subscribers to make digital payments to merchants around the global and receive money transfer amounts directly onto their digital wallet accounts.

Many other applications are made use of to enhance businesses. Fintech businesses partner businesses in other sectors to provide commerce or payment solutions. For instance, leading textiles business, Premium African Textiles and KudiGo, a fintech company, partnered to exhibit and market bespoke made-in-Ghana textile prints on the global market. Others, like FIDO, provide online loans to subscribers to its service. E-commerce sites such as Jumia have been in business to provide a safe marketplace for buyers and sellers to meet, deal, pay and receive payment by digital platforms like MoMo. Glovo makes deliveries to customers who order food from restaurants and grocery stores with digital payment options.

Laws and Regulations

Regulation and security have been critical to fintech roll-out. The Payment Systems and Services Act, 2019 was enacted to regulate the issuance of electronic money, payment instruments, payment service providers and electronic money issuers. The law regulates fintech companies that undertake payment services and outlines laws on licensing, capital requirements, compliance requirements, consumer protection, and the responsibilities of electronic money issuers as well as payment service providers. Additionally, in December 2020, the Cybersecurity Act, Act 1038 was given assent by the president.

The Act regulates cybersecurity in Ghana. It also regulates owners of the critical information infrastructure in the country, in respect of cybersecurity activities, service providers and practitioners. The Act also establishes Ghana’s first Cybersecurity Authority “to regulate cybersecurity activities in the country; to promote the development of cybersecurity in the country and to provide for related matters.”

The functions of the Act include the promotion of the security of computers and computer systems, monitoring cybersecurity threats within and outside Ghana, establishing the standards for certifying cyber products and services, and providing technical support for law enforcement and security agencies to prosecute cyber offences, among others.

Other relevant laws include: The Anti-Money Laundering Law, revised to consolidate all laws on anti-money laundering and to establish the Financial Intelligence Centre; the Data Protection Act and the Electronic Transactions Act.

The Bank of Ghana (BoG) acts as the key regulator. A number of other regulatory bodies play different roles. The Securities and Exchange Commission (SEC) regulates fintech firms and activities that involve the trading of securities. Data Protection Commission (DPC) ensures that data is dealt with in accordance to the country’s data protection best practices. The National Insurance Commission (NIC) regulates the activities of fintech companies in the insurance industry.

That the country has not had a major security issue in the fintech business shows that regulation is adequately policing the fast-developing fintech industry. There still is space for development beyond digital payment platforms, and digital banking and lending. Innovation and investments in the development of mobile telephony infrastructure in rural Ghana will lead the way to further development in areas that have, hitherto, been unattended to, but which have a huge potential for growth. Health delivery, education and agriculture could be ‘it’.

ABOUT THE AUTHOR

Through his writings Kwadwo has discovered his love and knack to simplify complex theories spicing them with everyday life experiences for the benefit of all. The Head of OctaneDC Research, Kwadwo Acheampong, has over a decade experience in fund management and administration, portfolio management, management consulting, operations management and process improvement. Feel free to send him your feedback on his article. Email: [email protected]

Cell: +233244563530