Proceeds from ESLA in the first quarter of 2021 fell by 14.03 percent to GH¢533.31million, the central bank’s first-quarter statistical bulletin the has shown.

The data reveal that the drop from GH¢620.3million in first-quarter 2020 is largely driven by the Public Lighting Levy (PLL), National Electrification Scheme Levy (NESL) components contributing to the ESLA proceeds, which recorded no revenues – despite an increase in the Price Stabilisation and Recovery Levy and the Energy Debt Recovery Levy.

The report further shows that at the end of 2020, GH¢15.7 million was collected for PLL; while NESL recorded an amount of GH¢10.4million as actual collection. Proceeds for both PLL and NESL were above their respective targets by 5.7 percent, according to the 2020 annual report on management of the energy sector levies and accounts project.

The decline in revenue of the PLL and NESL could be attributed to levies collected which have not been lodged into the respective accounts but will reflect later in future reports. Despite the fall in revenue, there is optimism for the ESLA to perform better this year – given that the 2021 budget introduced new taxes.

In April this year, the Energy Sector Levies Act, 2015 (Act 899) was amended to increase the Energy Sector Levies by GHp20 per litre of petrol and diesel and GHp8 per kg for Liquefied Petroleum Gas (LPG).

Proceeds from the Energy Sector Recovery Levy is planned for use in meeting the funding gap resulting from inability of the Electricity Company of Ghana (ECG) to redeem its obligations under the terms of power purchase agreements (PPAs) with independent power producers.

ESLA Projection

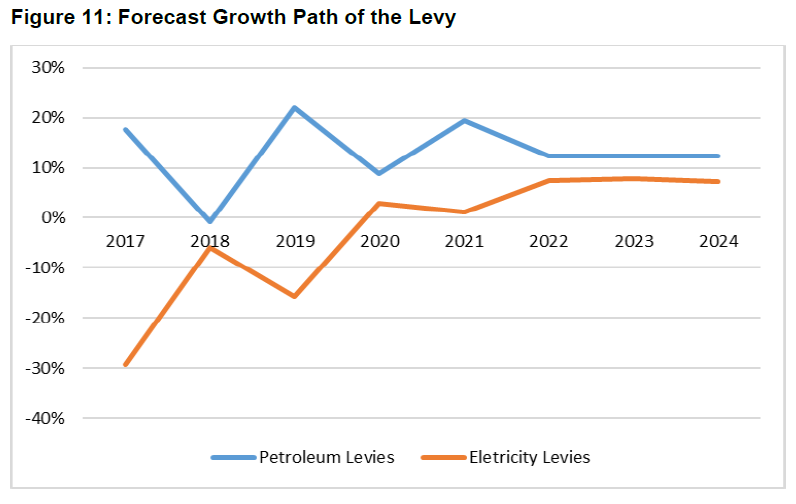

The 2020 annual report projects that ESLA proceeds in the next four years will increase averagely by 12 percent per annum, from 2021 to 2024. The growth in levies is largely expected to contribute in the reduction of financing challenges facing the energy sector, as well as support the Road Fund and Energy Commission in delivering on their mandate.

According to the report, the 2021 levy is estimated to increase to GH¢634.7million at 12 percent, compared with 2020. The indicative projections for the other years – 2022, 2023 and 2024 – show an average growth of 12 percent compared with the respective previous years’ forecast.

Notwithstanding challenges posed by the COVID-19 pandemic in 2020, levy collections increased over the period ending December 2020 with GH¢1.71 billion collected – of which ESLA Plc has subsequently received GH¢52.53million relating to 2020 transfers.

The report indicates that for the 2020 fiscal year, levy receipts amounted to GH¢4.57billion; thus exceeding the target by GH¢128.09million, equivalent to 2.9 percent. The improvement in performance was largely attributed to an increase in the Energy Debt Recovery Levy (EDRL) and Road Fund levies in August 2019, which impacted positively on collections in 2020.

Since 2016, total collections amounted to GH¢17.7billion – lower than the programmed amount by GH¢834.58million and representing underperformance of 4.7 percent. Lodgment of funds into the ESLA accounts, on the other hand, amounted to GH¢16.2billion.

The underperformance in collections was principally due to the withdrawal and/or reduction in the price stabilisation and recovery levy to cushion consumers against paying higher prices for petroleum products at the pumps, and lower recovery of electricity bills by the EDCs.