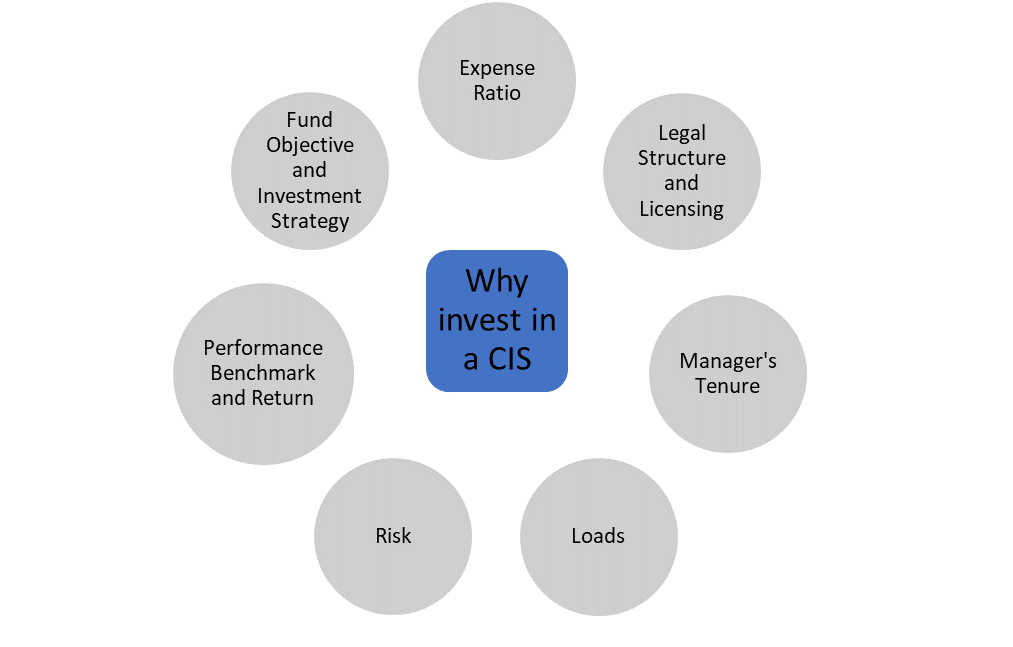

Collective Investment Schemes (CSIs): mutual funds and unit trusts are a lure over many investors because of low barriers to entry, easy exit, diversification and efficiency considerations. An investor stands to gain many benefits and the risks are comparatively lower.

Every investor should play an active role in overseeing his or her investments but how do they do so? There are a few checks that investors can conduct quite easily without having to be savvy. It may not be enough to just ‘cast your bread upon the waters’. It may be helpful or crucial to be mindful, tactful and responsive and it could save any investor some regrets.

Courtesy: OctaneDC Research

Legal structure and licensing

A fund must be duly registered to conduct its business as a mutual fund or a unit trust. It would be good to ask what kind of CIS the fund is. If it is a mutual fund, find out whether it is a registered corporate body and whether the regulator, the Securities and Exchange Commission (SEC), has approved of it and has given it a license to operate as a mutual fund. If it is a unit trust, it must have a trust deed, a trustee (or board of trustees) and a license to operate as a unit trust given by SEC. These documents are ordinarily to be displayed in an open area, easily accessible to the general public.

Fund Objective

Every investor must be sure the fund’s objective aligns well with their own investment objective. An investor that seeks an investment for income purposes should usually not invest in an equity fund with little or no emphasis on income. Similarly, an investor who seeks high returns should usually not invest in a money market fund.

Fund Investment Strategy

A fund’s strategy should also be appropriate for the investor. For an investor with solely equity investments, a fixed income or balance strategy may help diversify the investor’s investment portfolio and reduce exposure. Also, within equity investments, a large-cap fund may be a good addition to a small-cap and mid-cap investment portfolio. A look at the fund’s strategy should let the investor know how the fund’s inclusion will affect their entire investment portfolio strategy.

Risk

Akin to fund strategy is the level of risk the fund is exposed to. The strategy informs asset allocation and selection for the fund’s portfolio. An investor should weigh carefully what risks the fund is exposed to and how well diversified the fund assets are. The market or different markets of the fund’s assets should also be considered. Some markets, irrespective of the assets, are inherently riskier than others. An asset which is viewed as low risk in one market may be high risk compared to similar assets in other markets.

Performance Benchmark and Return

Each fund must have an appropriate benchmark. This will be used to judge whether the fund return for the period is adequate or not. The fund will show this in their periodic reports (quarterly, annual) and performance should be compared with the benchmark. The consistency of the return performance is key. There may be a few periods that the benchmark return may not be achieved. However, if over a reasonable length of time, the average return is above the benchmark’s, that should be satisfactory. Therefore, a fund may do well in three continuous quarters but slump in the next quarter. On an annual basis, the return may exceed the target. If, on the other hand, returns fall short consistently over a long period, the manager’s skill or the appropriateness of the benchmark may be questioned.

It is not just about the appropriateness of the benchmark or how well the fund is doing vis-à-vis its benchmark. A fund must fare well compared to similar funds. In the same market, if a balanced fund returns 15%, say, then the average return of balanced funds in the same economy should be close to 15%.

Performance (Returns) of CISs as at December 31, 2020

| Name of Fund/Trust | Return | Name of Fund/Trust | Return | |||

| (%) | (%) | |||||

| Balanced funds | Christian Community Mutual Fund | 17.01 | Equity funds | Republic Equity Trust | 3.12 | |

| UMB Balanced Fund | 15.67 | SAS Fortune Fund | 0.68 | |||

| CM Fund | 14.97 | Anidaso Mutual Fund | -4.13 | |||

| Plus Balanced Fund | 14.68 | Databank EPACK Investment Fund | -8.67 | |||

| Elite Mutual Fund | 14.06 | Fixed Income funds | Fixed Income Alpha Plus Fund | 21.78 | ||

| Fidelity Balanced Trust | 11.57 | Fidelity Fixed Income Trust | 18.74 | |||

| Dalex Vision Fund | 11.56 | Stanlib Income Fund Trust | 18.11 | |||

| Databank EdIFund (Tier 2) | 11.07 | Databank MFund | 18.06 | |||

| Kiddifund Mutual Fund | 7.39 | Financial Independence Mutual Fund | 17.13 | |||

| Databank Ark Fund | 6.78 | Plus Income Fund | 17.11 | |||

| Databank Balanced Fund | 6.10 | EDC Fixed Income Fund Unit Trust | 16.58 | |||

| Republic Future Plan Trust | 5.99 | SEM Income Fund | 16.13 | |||

| *Galaxy Balanced Fund | 5.93 | Databank EdIFund (Tier 1) | 14.28 | |||

| EDC Ghana Balanced Fund | 1.80 | NIMED Fixed Income Fund (Tier 1) | 8.73 | |||

| Money Market funds | Stanlib Cash Trust | 16.85 | NIMED Fixed Income Fund (Tier 2) | 4.56 | ||

| NGIS Money Market Fund | 14.85 | REITs | Republic REIT | 7.41 | ||

| EDC Ghana Money Market Unit Trust | 14.83 | |||||

| SEM Money Plus Fund | 14.25 | |||||

| Republic Unit Trust | 10.50 | |||||

| **ODC Money Market Fund | 2.65 |

Courtesy: Databank Group/ Annual Report Ghana

Expense ratio

The expense ratio (ER) or management expense ratio (MER) of a fund is calculated as the total operating expenses of the fund divided by the fund’s assets under management. Operating expenses reduce the fund’s assets, thereby reducing the return to investors. The higher the operating expenses and the expense ratio, the lower the return to investors will be. A fund with a lower ER is most likely operating more efficiently than a fund with a higher one. Investors, therefore, check this ratio to assess how well it compares with similar funds and whether it is increasing or decreasing. Costs included are fund administration fees, management fees, custodial services fees, taxes, legal expenses, and accounting and auditing fees. Trading costs, loads and redemption fees, which, if applicable, are paid directly by fund investors, are not included in operating expenses.

Loads

It is also important to find out if there are sales charges, referred to as loads. Some funds front-load and deduct from every deposit before it is invested. Some others back-load, which are charges to the investor when a withdrawal is made. It would be good to know what type of load there is and how much the load is, since these are direct expenses to the investor and are not shared or spread over other fund assets.

Is a ‘no-loads’ fund better than one that charges loads? Loads may end up being significant deductions from return for the investor so they are important considerations. However, funds that advertise as ‘no-load funds may have other charges which may make up for not charging loads. There may also be restrictions on redemptions. A careful examination of the fund’s prospectus before investing should reveal these and help the investor come to an informed decision.

Manager’s tenure

The fund manager’s tenure is another important consideration which should attract the investor’s attention. An investment adviser and portfolio management team make investment decisions based on a fund’s investment objectives. Manager tenure is most important to know when investing in actively managed mutual funds. When analyzing a fund’s performance, it’s necessary to confirm the manager or management team has been managing the fund for the time frame you are reviewing and has had success.

Annual General Meetings (AGMs)

Each fund holds Annual General Meetings (AGMs) to report to investors and receive feedback from them. It is an important platform to engage with the fund manager during such meetings, though fruitful interactions with the fund manager is not limited to this time only. Every subscriber/unitholder should go with a quest to have a concern addressed and receive more information for decision making. Issues could range from governance of the scheme, administration, investment, strategy and market research. Such interactions should lead to information for better decision making, on the part of the investor.

About the Writer

Kwadwo is a Senior Investment Analyst at OctaneDC Limited and heads OctaneDC Research. Prior to joining OctaneDC team, Kwadwo was a Fund Manager at Dalex Capital and has over a decade experience in fund management and administration, portfolio management, management consulting, operations management and process improvement. You may contact him at [email protected] or +233244563530