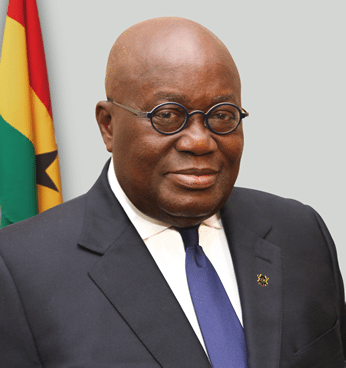

The Social Security and National Insurance Trust (SSNIT) has automated its system, and with the submission of the right documents and satisfying all procedures pensioners can now receive their pension claims within 10 days of applying after retirement from active service, President Nana Addo Dankwa Akufo-Addo, has said.

According to him, the move is part of government’s aggressive digitalisation agenda to accelerate government business and bring convenience to persons seeking some state services.

At his first State of the Nation Address for his second term in office, President Akufo-Addo said: “We have also digitised the operations of many government institutions; including the ports, NHIS, DVLA, GRA, and the Passport Office. One of the most dramatic examples of this development has been the ability of SSNIT to pay pensions within 10 days of application, as opposed to the endless delays of the past.

“To make it easy to obtain government services, a portal – Ghana.Gov – has been established where all MMDAs are being onboarded. It is a one-stop shop where anyone can apply for and pay for government service. We expect to complete the onboarding of all MMDAs this year; and in so doing, significantly enhance efficiency and reduce the cost of delivery for government services to our people.”

The president further indicated that from the second quarter of this year, all National ID numbers will become SSNIT numbers. This move will increase the number of people on the SSNIT database from 4 million to 15.5 million.

He further revealed that the National ID numbers will also become National Health Insurance Scheme (NHIS) numbers. “Very soon, we will link the National ID to all SIM cards, bank accounts, Births and Deaths Registry, DVLA, and passports.”

The president said for the first time, through implementation of the Digital Property Addressing System, every location in Ghana has a digital address – adding that the process of affixing unique property address plates for some 7.5 million properties in all 16 regions has also started.

He noted that government’s digitalisation agenda gave keen attention to the financial sector as a means to attract funds that have been depositing in homes into the financial space. Due to the efforts geared at achieving this effect: “For the first time in Ghana, more than 70 percent of the population has access to financial services either through a bank account or a mobile money account.

“We have been able to do so through the implementation of mobile money interoperability (between bank accounts and mobile wallets), with Ghana as the first and only country in Africa to have done so. It is therefore not surprising that Ghana is the fastest-growing mobile money market in Africa.

“Furthermore, our successful introduction of the Universal QR (Quick Response) CODE for payments across banks, telcos, fintechs and merchants will propel Ghana to be among the first countries in Africa (if not the first) to move toward a largely cashless economy, when fully rolled out across the country with the support of the Bank of Ghana,” President Akufo-Addo intimated.