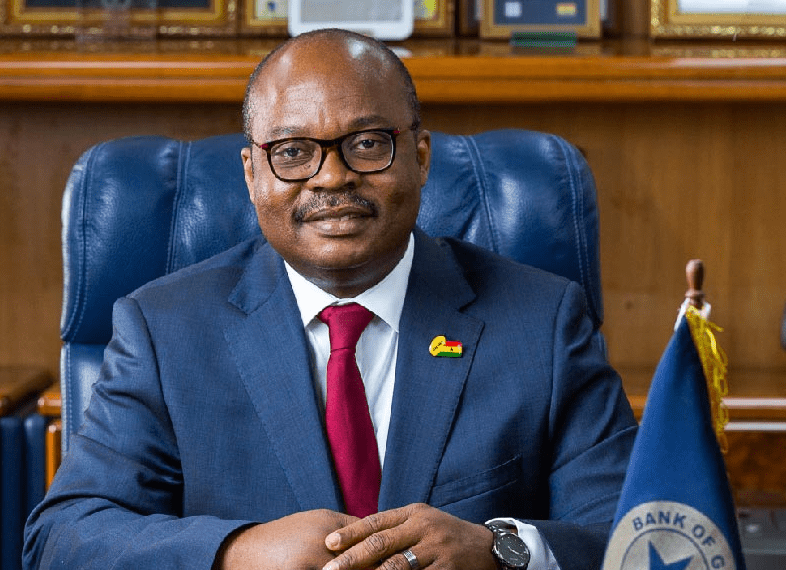

Congratulations to Dr. Ernest Addison on his reappointment by President Nana Addo Dankwa Akufo-Addo as Governor of the Bank of Ghana (BoG). By my overall evaluation, the BoG Governor deserves to be reappointed. Whew … He was bold and courageous enough to take responsibility for the Financial sector cleanup and the resultant turmoil.

Successive BoG governors had buried their heads in the sand despite ample evidence that the financial system was rotten. The implementation of the cleanup may be subject to debate but Dr. Addison’s courage is not in doubt. On the other side of the Governor’s balance sheet, I wish he had done a lot more to recover the huge outlay of public funds from the perpetuators of the financial sector mess. The recovery has been abysmal.

Under his watch, the Cedi has been fairly stable. Between 2017 and 2020 we had a compound annual depreciation of 8.42% versus 22.24% compound annual depreciation between 2013 and 2016.

The biggest blot in the BoG Governor’s playbook has been helping the government to close fiscal gaps starting with the GH¢10billion bailout in May 2020. This was deemed to be part of COVID-19 relief efforts, but it encouraged the government to continue election year consumption spending that made the fiscal deficit even larger.

Dr. Addison is facing unparalleled challenges for his next four-year term:

- Public Borrowing

Ghana’s debt situation has become precarious, not only with respect to the debt to GDP ratio but more importantly, to our debt service ratio which is projected to be over 70% for 2020. The threat of a public debt default is as real as happened in Greece, Lebanon and Tanzania. This could cause savage cuts to government expenditure, massive lay-offs /unemployment, currency crash and reduced standards of living.

- Recession

The Ghanaian economy is officially in a ‘Recession” after two consecutive quarters of negative GDP growth rates due to COVID-19. On 16 December 2020, the Government Statistician, Samuel Kobina Annim, announced that Ghana’s GDP contracted by 1.1% in the third quarter of 2020 after a contraction of 3.2% in the second quarter. A ‘Recession’ brings the specter of higher unemployment, reduced revenue collection combined with increased demand for stimulus packages. Businesses would likely face reduced demand, revenues, and profits.

How does the Governor foster growth in an economy which was already ‘broke’ by any definition and then sent into a tailspin by global pandemic induced shutdown? The only real tools the Governor has in promoting economic growth is interest rates and money supply. A government with an insatiable appetite for debt makes these tools worthless.

Dr. Ernest Addison we wish you the wisdom of ‘Solomon’ and the political skills of ‘Machiavelli’ to navigate these uncharted waters.