The latest National Insurance Commission’s report has revealed that IBAG members earned a total brokerage income of GH¢134million in 2019 – up from GH¢113million in 2018. This represents a year on year growth of 19%.

According to the report, the top-10 companies contributed a total of GH¢78.9million in 2019 compared to GH¢68million in 2018; this represents a market share of 59%.

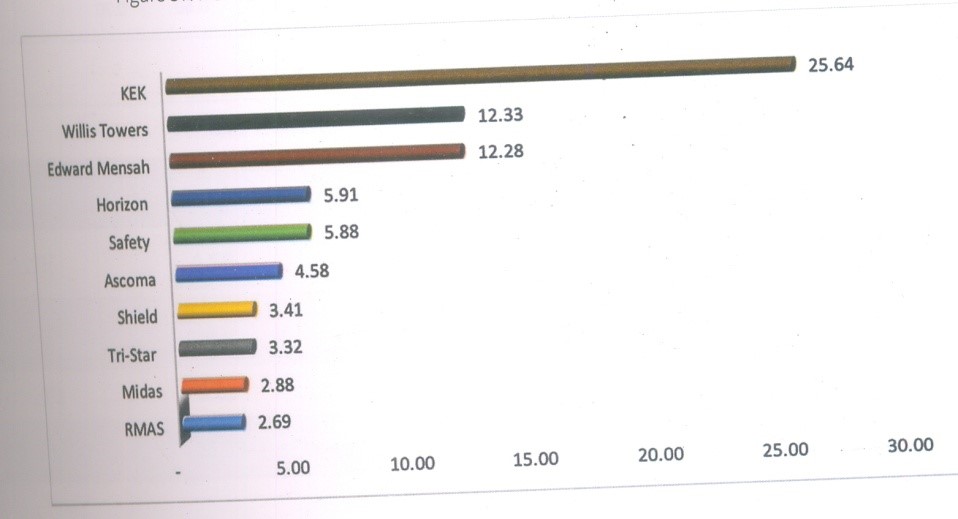

The companies are: KEK Insurance Brokers – GH¢25.64m; Willis Towers – GH¢12.33m; Edward Mensah Wood – GH¢12.28m; Horizon – GH¢5.91m; Safety – GH¢5.88m; Ascoma – GH¢4.58m; Shield –GH¢3.41m; Tri-star – GG¢3.32m; Midas – GH¢2.88m; and Rmas – GH¢2.69m.

The report further noted that 94 Insurance Broking firms were licenced to do business in the year under review, and applauded KEK Insurance Brokers on retaining its position as the largest insurance broker in terms of brokerage income.

The report also noted that Edward Mensah Wood and Associates and Safety Insurance Brokers were over taken by Willis Towers Watson, which is now the second-largest insurance broker. It also indicated that Midas Insurance Brokers in 2019 became part of the top ten brokers in terms of brokerage income, while Allstar dropped out of the top ten brokers.

Total Assets of the brokers stood at GH¢160.7million at year-end 2019, representing 86%. Top ten assets include: KEK – GH¢22.8m; Edward Mensah – GH¢15.6m; Willis Towers – GH¢10.9m; Safety – GH¢7.3m; Ascoma – GH¢7.0m; Horizon – GH¢4.9m; Rmas – GH¢4.8m; First Anchor – GH¢4.5m; Safeguard – GH¢3.3m; and Shield – GH¢3.3m.