In 2016, Ghana, the second largest gold producer in Africa, and the eighth largest globally, legally produced 96 Metric Tons (“MT”) of gold. On average, Ghana produces approximately 100 MT annually. At April 1, 2017, the Bank of Ghana (“BoG”) Gold Reserve amounted to 8.70 MT, (it has not been added to since 2000) equivalent to 7.7% of its Foreign Reserves.

A Gold Reserve is the gold held by the Central Bank of any country as a store of value, and as a guarantee for any form of payment. It is accounted for as part of a country’s Foreign Reserves (paper currencies and other assets). Asked about the importance of a Gold Reserve, Mario Draghi,

President, European Central Bank responded: “A Gold Reserve is a reserve of safety” — “It gives you a fairly good protection against fluctuations against the Dollar.”

The United States, Germany, Italy and France have the largest Gold Reserves in absolute Metric Tons, but more importantly, as a percentage of Foreign Reserves. This is primarily due to the historical legacy of the Gold Standard — terminated in 1971, and the fact that the US Dollar replaced gold as the primary “Reserve Currency” globally.

Following the 2008 global financial crisis, and the U.S. Federal Reserve’s quantitative easing policies, gold prices have risen consistently as many of the major Central Banks are actively adding to their Gold Reserves. In 2015, the Central Banks of France, China, and Russia added 483 MT, the second largest amount since the end of the Gold Standard in 1971. Undoubtedly, due to Brexit, and a more isolationist US under President Trump, 2016 trading results from the Central Banks of many of the world’s major economies will show a similar trend.

| COUNTRY / CENTRAL BANK | GOLD RESERVE

(MT) April 1, 2017 |

As a % of Foreign Reserves |

| United States | 8,133.5 | 75.4 |

| Germany | 3,377.9 | 69.6 |

| IMF | 2,814 | |

| Italy | 2,451.8 | 68.5 |

| France | 2,435.8 | 64.0 |

| China | 1,842.6 | 2.4 |

| Russia | 1,655.4 | 16.8 |

| Switzerland | 1,040 | 6.0 |

| Japan | 765.2 | 2.5 |

| The Netherlands | 612.5 | 64.9 |

| India | 557.8 | 6.1 |

| European Central Bank | 504.8 | 27.2 |

| United Kingdom | 310.3 | 8.9 |

| Euro Area (Including ECB) | 10,786.1 | 55.8 |

| West Africa Economic Monetary Union | 36.5 | 13.9 |

| South Africa | 125.3 | 10.8 |

| Nigeria | 21.4 | 2.7 |

| Mauritius | 12.4 | 10.1 |

| Ghana | 8.7 | 7.7 |

| Ghana (Proposed) | 30.0 |

With the ascension of the Renminbi to become an IMF Reserve Currency in September 2016, China has been on a major gold purchasing spree to increase its Gold Reserve, and diversify its Foreign Reserves away from the US Dollar. In July 2015, disclosing its official Gold Reserve for the first time in six years, China announced that it increased its Gold Reserve by almost 57% from 1,054 MT to 1,658 MT. Presently, China’s Gold Reserve as a % of Foreign Reserves is still very low at 2.4% compared to its major competitors — U.S., Euro, U.K. Going forward, China is likely to continue its purchasing over the medium/long term until it reaches a significant minority percentage threshold.

All IMF Reserve Currencies (US Dollar, Pound Sterling, Euro, Yen, Renminbi) either have significant Gold Reserves, or are actively purchasing and building a substantial safety net — China. Conversely, most developing countries maintain a high percentage of paper currency (primarily US Dollars) and low Gold Reserves, as a percentage of Foreign Reserves.

Typically, gold prices run counter-cyclical to the monetary policies of major economies, and geopolitical events — its value rising in times of uncertainty. Definitively, over the long-term, gold has held and appreciated as a store of value.

Ghana needs to grow its Gold Reserve for currency stability and to act as a pillar to sustained macroeconomic growth. This proposal recommends:

- Ghana grows and maintains its Gold Reserve as a percentage of Foreign Reserves from 7.7% presently to 30% over the medium/long term.

- Adding to Ghana’s Gold Reserve by 5% of Ghana’s annual gold production until the 30% Gold/Foreign Reserve ratio is reached.

- Gold Reserve Storage Architecture: (i) 80% stored with the BoG at all times; (ii) the remainder 20% split proportionally among United States, United Kingdom, China, Switzerland and Mauritius — Ghana’s major trading partners.

GHANA’s ECONOMY

Ghana enjoyed significant macroeconomic growth from 2008–2012 with the commercialization of oil — however, this translated into “irrational exuberance” at its most extreme. From 2013 onwards, Ghana, a lower-middle income country suffered: (i) a depreciating Cedi; (ii) power cuts; (iii) continued volatility in commodity prices; (iv) corruption; (v) high interest rates, and fairly high inflation; and (vi) constraining indebtedness.

In 2014, the aggregate of these pernicious economic factors pivoted Ghana to sign a US$918 million loan and technical assistance program with the IMF which aimed to bring: (i) macroeconomic and currency stability; (ii) improve debt sustainability; (iii) safeguard social protections; and (iv) stimulate macroeconomic growth. However, the incumbent government was unable to meet most of the IMF targets from 2014–2016. In 2016, Ghana generated GDP growth of 3.6%, versus population growth of 2.2% — the economy was essentially stagnant — and Ghana’s Debt to GDP ratio breached 70% — the highly indebted threshold.

As a result, the opposition New Patriotic Party won the election on a campaign based on ensuring currency stability, implementing growth policies, and enhancing social protections: (i) moving the economy “from taxation to production”; (ii) “one district, one factory”; and (iii) Free SHS (Senior High School).

CURRENT GOVERNMENT STATED CURRENCY STABILITY POLICIES

On stabilizing the local currency firmly against the US Dollar, the new administration proposes an increase in domestic production, coupled with matching the amount of Cedis in circulation, to the US Dollars in the system, to firmly address the challenges facing the local currency. These two initiatives will definitely help stabilize the Cedi, but are also subject to volatility:

(i) An increase in domestic production — an economy that produces more for both domestic and international markets would rely less on imports, stronger currency, and more foreign reserves. Given the state of Ghana’s economy — the foundation pillars to sustainable growth are still developing, it will take a time to grow and strengthen the economy. In the meantime, macroeconomic volatility and currency depreciation will continue; and

(ii)Matching the amount of Cedis in circulation to the US Dollars in the system. Likewise, this policy assists currency stability, but is not sufficient to bring long-term stability to the Cedi.

Both policy initiatives either individually, or in tandem will not be sufficient to bring long-term / lasting stability to the Cedi. Ghana’s currency and foreign reserves will still be prone to shocks, particularly strong headwinds, or crosswinds such as a sharp and lasting decline in commodity prices, unsustainable fiscal and/or current account deficits, or systemic unchecked corruption.

Further, as we move towards high growth in 2017 -2020, and for Ghana’s longer term development needs, a substantial Gold Reserve is necessary to achieve sustainable currency stability.

BENEFITS OF A 30% GOLD RESERVE/FOREIGN RESERVE RATIO:

- Optimal diversification of Ghana’s Foreign Reserves away from the US Dollar — brings further currency and macroeconomic stability. ;

- Act as a source of savings, and as a natural hedge against the volatility of high GDP growth.

- Serve as a Demonstration Effect “instrument,” signaling to the market that Ghana is implementing the right measures to achieve both high GDP growth, and currency stability.

- Create a foundation pillar to Ghana becoming an offshore financial center.

In a generation, even if economic hardship visits, Ghana will be better able to withstand the shock, and will probably not need the IMF again.

WHO BUYS THE GOLD?

Most of Ghana’s annual legal output of 100 MT is exported to the United Kingdom, Switzerland and China. Illegal mining, “galamsey”, is estimated at up to 50 MT annually, and is said to be exported primarily to China and India.

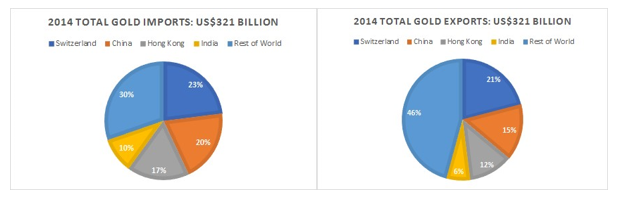

Switzerland, although not a gold producer, is the world’s biggest gold trader, followed by China, Hong Kong and India. In 2016, Switzerland exported 2000 MT, roughly equivalent to 2.1x Ghana’s entire GDP for 2016. For the Swiss authorities, “the movement of precious metals is more closely related to payment transfers as a substitute for paper money, than it is to the movement of commodities to be processed or used.”

Switzerland developed its competitive advantage as the world’s largest gold trader based on: (i) four of the world’s largest gold refineries are based in Switzerland — together, these facilities refine almost two-thirds of the world’s gold; (ii) historically, the Zurich gold market has always played an important role in the global gold trade; (iii) acting as one of the pillars supporting the Swiss financial/banking services industry; and (iv) security and logistical efficiencies.

A PROPOSAL FOR GHANA’S GOLD RESERVE STORAGE ARCHITECTURE

In late 2016, Ghana inaugurated its first gold refinery — Gold Coast Refinery Ghana Limited (“Gold Coast Refinery”). The US$110 million facility is the largest in West Africa, and the second largest in Africa, and has an annual capacity of 180 MT, and can refine raw dust, scrap gold and other precious metals, to international standards.

Over the medium/long term, a viable junior gold refinery capable of up to 100 MT should be established, to provide competition, substitution and redundancy to Gold Coast Refinery. Perhaps, the unfinished Tarkwa Gold Refinery could be re-invested in and made operational. If so, it will also increase West Africa’s global standard gold refinery capacity, and transform Ghana’s comparative advantage as a gold producer, into a competitive advantage as a gold trader.

The Ghanaian authorities should consider the following policy: (i) At least 80% of all legally (majors and artisanal) mined gold should be refined at Gold Coast Refinery; (ii) environmental and extractive auditors should be strategically positioned in gold producing areas and at our ports; (iii) once illegal small scale mining “galamsey” has been institutionalized with the appropriate environmental and auditing safeguards — all small-scale gold purchased by the BoG, will be at 95% of the World Market Price; and (iv) accept payment of taxes by gold producers in cash and in kind.

An optimal Gold Reserve storage architecture proposal could be 80% is stored in Ghana at all times, with the remainder 20% split proportionally among United States, United Kingdom, China, Switzerland and Mauritius. This stores Ghana’s gold close to foreign currency markets in New York, London, HK, Zurich, where gold is traded for foreign currency swaps. Mauritius is considered because: (i) with the recent signing of a double taxation treaty with Ghana, greater investment inflows are expected through Mauritius; (ii) traditionally, Mauritius has played a role as the offshore financial center for Africa; and (iii) security and logistical advantages.

At year-end 2016, Ghana’s Foreign Reserves stood at US$6.162 Billion. If Foreign Reserves are to remain constant, and Ghana adopts a 5% of annual production formula to grow its Gold Reserve, it will take approximately 8 years to reach a 30:70 equilibrium with its Foreign Reserves. If the authorities are able to curtail “galamsey”, and institutionalize the practice with the appropriate environmental safeguards, Ghana will likely achieve this target sooner.

It is important to maintain discipline, consistency, transparency and accountability as the founding principles to transforming Ghana’s economy through growing its Gold Reserve.

Ghanaians understand our idiosyncratic economic issues, and it can be done. If the Ghanaian authorities were to implement and enforce the following initiatives: (i) Grow Ghana’s Gold Reserve to a 30:70 equilibrium to Foreign Reserves; (ii) issue a 2nd Refinery License; (iii) invest the equivalent amount in Agriculture, and the Digital Economy; (iv) pursue pro-private sector / clean industrialized growth policies; and (v) strengthen social services — Ghana could reach middle income in 15 years, with a material decrease in inequality.

In the future, perhaps Ghana could act as one of the founding members to the establishment of an

“African Monetary Fund” — a “Lender of Last Resort” to African countries, and more importantly, a provider of “Best Practice” technical assistance from indigenous lessons learned.

Sources: Bank of Ghana, Government of Ghana, World Bank, IMF, World Gold Council, SwissInfo.ch

KOFI ARKAAH

Financial strategist with 25 years of global finance experience. Previously worked with Ark Partners, IFC/World Bank and Norwest Bank.