What does it take to invest on the stock market? Money, patience and high-risk appetite. Having money is not enough a good reason to own a piece of a company. For you to become a shareholder in a company, in this case a listed company, you must have a long-term investment approach to this investment decision. The recommendation is a minimum of 10 years for the stock market but the longer, the better. One may ask, why is this the case?

Timing

Timing is very crucial in buying stock. Warren Buffet, one of the most acclaimed investors in the world, and one who is believed to have made his billions through investing in the stock market; once said, we should be ready to invest in the stock market when the market is down and get out when the market begins to soar. How do you know the time is right to buy and the time is right to sell? Its takes information and patience.

With a long-term projection on stock performances, investors are able to manage the shocks that comes with holding stocks. The recommendation is to begin your investment journey by owning some few stocks and learning to appreciate the tractions along the way. When you are under the age of 30 years, you have years ahead before pension to take some calculated risk on the stock market. The point here is that, you have enough time to realize gains in some stocks to cancel out losses on some others if the concept of diversification was applied from the outset.

Risk Level

Knowing and appreciating your risk levels is also an important decision reference in buying or investing in stocks. One needs to appreciate the cyclical nature of stock markets and remain patient in periods of losses. It is true, one could lose all their investments on the stock market and it is also true, that one could gain in multiples on their investment on the stock market. The recommended strategy by Warren Buffet is to buy when the price is low and sell when the price is high. In addition, it is also recommended to buy more shares when prices have drop further down. This is referred to as ‘averaging down’ or decreasing the cumulative average at which you bought your initial sets of shares. This implies that, if you bought your initial 100 shares at Ghs10 per share, your total cost is GHS1,000. Where the price drops to GHs7 per share and you bought additional 100 shares for GHs700, your average cost per share is now GHs8.5 and no longer GHs10. Comparing the average cost of GHs8.5 to the current market price of say GHs9 per share, provides you with an enhanced insight into the actual gains/losses on your investment.

Seed Money

The final point is having money to invest on the stock market. The advice is to invest monies that you can afford to put away for a long time. These are the types of monies you must allow to work for you. The recommendation is for us not to invest any money we cannot afford to lose in investment. The point I made earlier about the possibility of losing significant portions and sometimes everything you have invested. The approach to manage losses on the stock market is to apply the rules of diversification. This approach in itself requires that you deploy a bit more at a time and a bit more at other times to take advantage of ‘averaging down’ as explained above. It is, therefore, good to invest more at various points in the performance of the market.

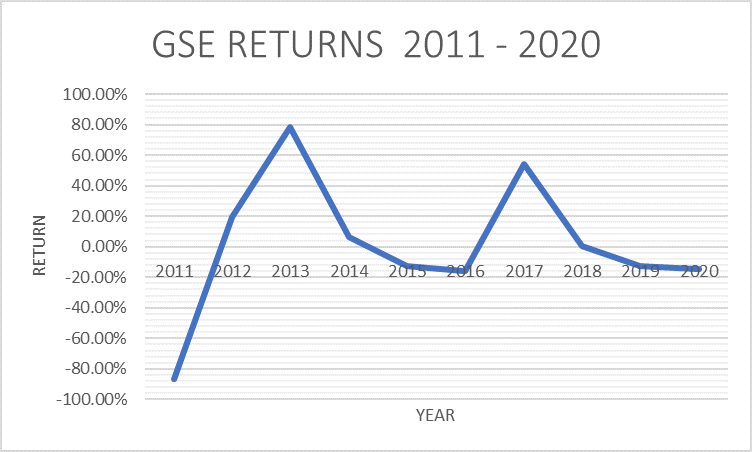

It is a good time to consider investing in the stock market as valuations for most companies are at their lowest on the Ghana Stock Market. A conversation with your broker and fund manager will be a good way to begin the year with investment opportunities on the stock market.

ABOUT THE WRITER

Dr. Suzy Aku Puplampu is CEO of OctaneDC Limited. As a finance and investment professional, Suzy has an in-depth knowledge and experience working in the finance industry in Ghana spanning two decades. Suzy is a Toastmaster who loves to write on finance and other social issues.. She blogs at https://suzydotblog.wordpress.com