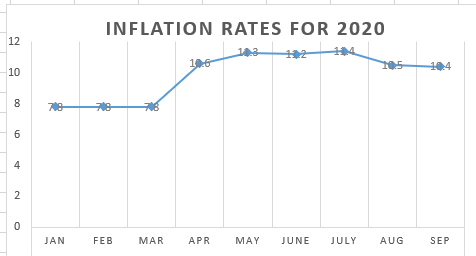

The general price level of goods and services, measured by consumer price index, has once again seen a marginal decline in September – following a record jump in April 2020 occasioned by high spending on food in preparation for the coronavirus pandemic-induced lockdown.

Data released by the Ghana Statistical Service (GSS) have shown that inflation for September 2020 has declined marginally to 10.4 percent from 10.5 percent recorded the previous month, making it the lowest rate since April when prices rose by 10.6 percent from a three-month flat rate – beginning January – of 7.8 percent.

Both food and non-food baskets saw a decline in their rates. The food and non-alcoholic beverages group recorded inflation of 11.2 percent against 11.4 percent recorded in August; while that of the non-food group recorded 9.8 percent inflation in September, just 0.1 percentage point lower than the previous month.

Despite the food group recording inflation higher than the non-food group, its contribution to overall inflation is reducing close to the pre-pandemic rates.

The inflation of imported goods was 5.1 percent while that for local goods was 12.3 percent on average during the month. At the regional level, overall year-on-year inflation ranged from 1.3 percent in the Upper West Region to 14.2 percent in Greater Accra.

The September decline still casts doubt over how it will impact the monetary policy rate of the Bank of Ghana as it kept the rate at 14.5 percent last month – even though inflation had declined to 10.5 percent from 11.4 percent in July.

The central bank said fiscal threats exacerbated by the pandemic remain; hence its decision to maintain the rate for the third time in a row.

“Fiscal policy has been a source of considerable stimulus, driven by exceptional expenditures directed toward goods & services, capital expenditures, COVID-related spending and in the energy sector.

As at July 2020, the budget deficit was higher than programmed. Indications from banking data point to a faster budgetary execution in August relative to the annual target of 11.4 percent of GDP, supported by exceptional domestic and foreign financing sources.

“The drivers of economic growth are returning to normal with prospects for a good recovery. Monetary and fiscal policies have been supportive, providing the necessary underpinnings for the economy to withstand negative output shocks arising from the pandemic. However, this has come at the cost of moving away from the consolidation path, and could pose a risk to long-term macroeconomic stability if decisive measures are not taken to define a feasible fiscal adjustment to stabilise debt.

“Under the circumstances, the Committee’s view is that risks to the immediate outlook for inflation and growth are broadly balanced, and it decided to keep the policy rate unchanged at 14.5 percent,” the MPC statement said.

However justifiable or thoughtful that decision was, it still remains a big blow to the private sector as lending rates remain high – in the region of 20-23 percent.