The Ghana Stock Exchange (GSE) has gone through a lot of barren periods in recent years. Between 2015 to 2019, the only year it returned a positive was in 2017 when the market gained 52.73%.

The rest of the years has been negative. -11.77% in 2015, -15.33 in 2016, -0.29 in 2018 and -12.25 in 2019.

If 2020 ends in a negative (July figure is -16.81) it would be the second election year in a row the market has returned a negative; the last time was in 1992 when it returned -3.63.

Beyond 2015, the biggest gain till date happened in 2013 when the market chalked more than 70% by year end.

People have questioned the potential of the GSE to return good to investors. In the article; Accra Bourse: the highs and lows of 2018 the Young Investors Network showed readers how some investors earned more than 60% within a short period in 2018 on individual stocks, though the market as a whole returned -0.29%.

The rational behind the writeup was to portray that short-term investors can also patronize the stock market.

After a strong performance in 2017, investors took positions in expectation that the trend would continue in the following year, 2018.

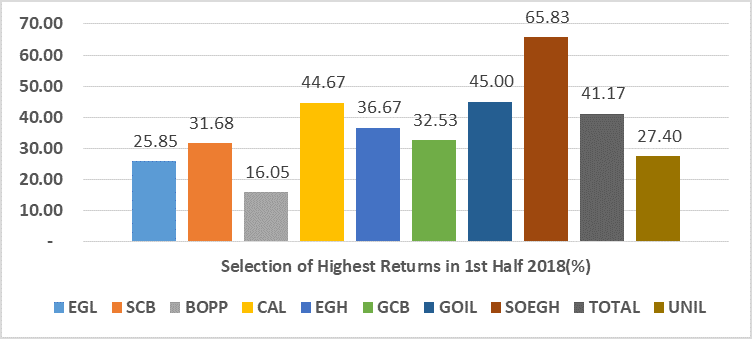

The first half of 2018 was generally good for investors as it recorded a year high of 35.62%.

Within the period, some individual stocks such as Societe General, GOIL, CAL Bank and TOTAL also recorded year highs of 65.83%, 45%, 44.67% and 41.17% respectively.

What this means is that when you purchase stocks and pay attention to it, you are likely to make some income within a short period then you can sell off.

The troubles of the market coincided with the announcement by the Bank of Ghana in August 2018 of the consolidation of Unibank Ghana Ltd, The Royal Bank Ltd, Beige Bank Ltd, Sovereign Bank Ltd, and Construction Bank Ltd to form a new bank called Consolidated Bank Ltd. Around the same period, Menzgold too had been clamped down. Liquidity in the financial system became an issue.

The GSE thrives on liquidity. Basically, because the GSE is a risky area and investors normally use dispensable funds to enter.

Though the consolidated banks were not listed entities, pension fund managers, who are mainly the drivers of the Ghana Stock Exchange where hugely hit because of their exposure to the collapsed institutions.

Most investors had to fall on the stock market to cater for short term obligations. Between August 2018 and present, pension fund managers have sold more equities than they have purchased.

Individual investors have found no reason to commit funds into the market.

This shows that the main reason why the stock market remained down in the last few years was because the financial sector crises remained unresolved.

The financial sector cleanup was in fact very necessary. The five-year bond that was proposed for settlement however was going to compound matters. The decision therefore to pay cash has the potential to shore up public confidence in the financial system.

Pension Fund Managers will have to revert to their statutory requirement of purchasing equities as part of their portfolios under management.

Our article, The GSE: How the Banks Have Performed in the Last Five Years, showed how the banks have performed between 2015 and 2019.

Shareholders are being rewarded with dividends for the sterling performance in 2019. The strong performance has continued in 2020. Strong financials have been produced. The share prices are very low.

It is essential for investors to speak to their stock brokers and investment advisors to enable them take positions within the market especially within the banks as soon as possible. This is not the time to wait and see.

Young Investors Network (YIN) is a financial education organization with a commitment to educating the youth in financial literacy, business skills and dedicated to preparing the next generation of investors. Its mission is to inspire youth to be outstanding investors – investors in companies, investors in their communities, and investors in themselves. Please visit www.younginvestorsghana.org for more