By Dela AGBO

Investment decisions revolve around two primary asset classes: Equity and Debt. These two instruments provide capital to businesses and governments while offering unique advantages to investors and issuers.

Understanding their characteristics, benefits, and cost implications is essential for making informed financial decisions.

Equity Investments

Equity represents ownership in a company. When investors buy shares or stocks, they become part-owners of the business and share in its profits and losses.

Companies issue equity to raise capital without the obligation of repayment, making it an attractive financing option for growth and expansion.

Benefits of Equity for Investors

- Potential for High Returns – Equity investments offer capital appreciation, and in some cases, dividends, making them one of the most rewarding investment options.

- Ownership Rights – Shareholders may have voting rights, allowing them to influence major company decisions.

- Dividend Income – Many companies pay periodic dividends, providing investors with a stream of passive income.

- Liquidity – Publicly traded equities can be easily bought or sold in the stock market.

Benefits of Equity for Issuers

- No Fixed Repayment Obligation – Unlike debt, equity does not require periodic interest or principal repayments, reducing financial burden.

- Improved Financial Flexibility – Since there are no repayment deadlines, businesses can reinvest profits into growth initiatives.

- Enhanced Market Credibility – A well-performing stock increases the company’s visibility and credibility in the market.

However, issuing equity comes with downsides, particularly dilution of ownership and control, as new shareholders gain decision-making power to influence management decision of the firm.

Debt Investments

Debt refers to borrowing capital, typically through bonds or loans, where the issuer agrees to repay the principal along with interest over a specified period. Unlike equity, debt does not confer ownership rights to investors.

Benefits of Debt for Investors

- Predictable Income – Debt instruments provide fixed interest payments, offering stability even in volatile markets.

- Priority in Payments – In the event of company liquidation, debt holders are paid before equity shareholders.

- Lower Risk Compared to Equity – Since interest payments are contractual obligations, debt investors face lower risk than equity investors.

Benefits of Debt for Issuers

- Cheaper Source of Financing – Debt financing is often more cost-effective than equity because interest payments are tax-deductible, reducing overall tax liabilities.

- Retention of Ownership – Unlike equity, issuing debt does not dilute ownership or decision-making power.

- Fixed Obligation – Companies know exactly how much they owe and for how long, allowing better financial planning.

However, excessive debt can lead to financial strain, particularly if revenue generation is inconsistent.

Which is Cheaper for the Issuer?

Debt is generally cheaper than equity for issuers. The primary reasons are:

- Tax Benefits – Interest payments on debt are tax-deductible, reducing the company’s taxable income.

- Lower Cost of Capital – Debt investors take on less risk than equity investors, allowing companies to secure loans at lower interest rates compared to the required return on equity.

- No Dilution of Ownership – Debt allows companies to raise funds without losing control, making it a more strategic option for businesses that prioritize decision-making power.

However, the cost of debt can rise if a company is highly leveraged or faces difficulties in repaying obligations.

Conclusion

Both equity and debt play vital roles in financial markets, each serving different purposes for issuers and investors.

For investors, equity offers higher return potential but comes with greater risk, while debt provides stable income with lower risk.

For issuers, debt is a cheaper financing option due to tax advantages and ownership retention, but equity provides long-term flexibility without repayment obligations.

Ultimately, the right mix of equity and debt depends on the financial goals, risk appetite, and market conditions for both investors and companies. For additional information, contact EcoCapital Investment Management Limited for detail explanation.

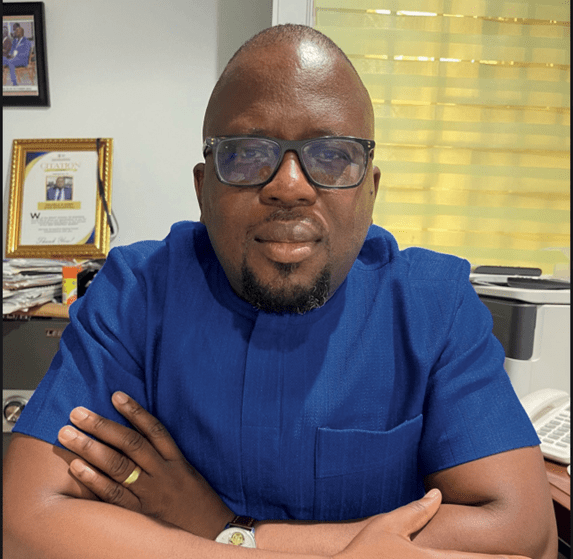

Dela is the CEO of EcoCapital Investment.