Gold prices surged past the US$3,050-per-ounce mark last Wednesday, setting a new all-time record and underscoring the potential impact a locally backed gold Exchange Traded

Fund (ETF) could have had on Ghana’s investment landscape.

The Minerals Income and Investment Fund (MIIF) has since 2023 been working on

launching a physical gold-backed ETF, which was expected to be listed by the fourth quarter of 2024.

However, regulatory delays-particularly from the Securities and Exchange Commission

(SEC), seem to have slowed the process, leaving investors unable to capitalize on one of

the best-performing assets in recent years.

A market gap in Ghana’s investment options

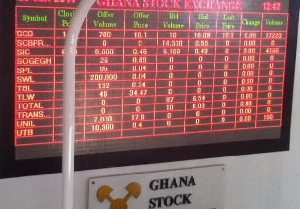

Currently, the only gold-backed ETF available on the Ghana Stock Exchange (GSE) is South Africa’s NewGold ETF (GLD), which has appreciated by over 160% in the past three years.

However, demand often outstrips supply for the units, leaving Ghanaian investors with

limited access to gold-linked assets.

Had the MIIF ETF been operational, it would have provided a liquid and transparent vehicle

for investors to gain exposure to gold prices, especially as global markets continue to favor

gold as a hedge against inflation and economic uncertainty.

Why a Gold-backed ETF matters

A gold-based ETF would offer several key benefits:

A Hedge Against lnflation and Currency Depreciation – With the cedi facing periodic

depreciation, a gold-backed ETF would provide a safe-haven investment for local investors.

Portfolio Diversification – Gold is historically a stable asset during market downturns, making it an attractive alternative for investors looking to balance their portfolios.

Enhanced Market Liquidity – Unlike the limited availability of the NewGold ETF (GLD), a Ghana- based gold ETF would ensure local investors can consistently access gold-linked investment options.

Support for Ghana’s Gold Sector – MIIF plans to source gold for the ETF from its Small-Scale Gold Mining Incubation Programme and Gold Trade Program, ensuring the ETF directly benefits Ghana’s mining industry.

Challenges and future prospects

While MIIF under the previous CE0, Edward Nana Yaw Koranteng, had earlier announced

plans to list the ETF on the GSE by the end of 2024, several regulatory and logistical challenges-compounded by the change in government-could impact the timeline. MIIF, according to earlier new reports in 2024, has appointed transaction advisors to oversee the

process, but approvals from the SEC remain a key hurdle.

A case of delayed gains

Had the MIIF gold-backed ETF been launched earlier, investors could have already capitalized on gold’s historic rally. Since January 2024, gold prices have seen a remarkable upward trend, making the delay in ETF approval a missed opportunity for local investors.

This regulatory setback has prevented Ghanaian investors from fully leveraging the

benefits of gold’s price appreciation, further emphasizing the need for faster

implementation of innovative financial instruments in the country’s capital markets.

With gold prices still showing strength, anticipation for the MIIF ETF’s launch remains

high. If successfully listed, it could become a game-changer for Ghana’s financial markets,

providing an accessible and profitable investment avenue for both institutional and retail investors.