Juaben Rural Bank PLC, a paragon of excellence in customer satisfaction, has been at the forefront of delivering exceptional service with high integrity, perseverance and trust for four decades.

With a strong customer-centric approach, the bank has consistently delivered financial solutions through innovative products and timely support, earning the loyalty and admiration of numerous individuals, businesses and institutions.

Through their dedication and commitment, Juaben Rural Bank plc. has fostered a culture of transparency and service excellence, cementing their status as one of Ghana’s best rural banks.

This outstanding achievement has been formally recognised by the Ghana National Chamber of Commerce and Industries (GNCCI), which honoured the bank as the Best Rural Bank for the year 2023.

This prestigious award is a demonstration of the bank’s continued efforts to deliver quality service to delight our customers and maintain the highest standards of transparency, solidifying our strong position in the Ghana’s rural banking sector.

Juaben Rural Bank PLC’s commitment to customer satisfaction has been the mainspring behind our success; and for 40 years, we recognise excellence as enshrined in our core values: ‘People focused, passion for excellence, integrity, responsiveness and can-do-attitude’.

Beyond its conventional savings and current accounts, Juaben Rural Bank PLC has pioneered a range of innovative products designed to cater for the diverse needs of our customers. These cutting-edge offerings have a direct and positive impact on customers’ financial lives.

Through creative genius, the bank has introduced ground breaking products – such as: Daakye Nti Investment: A tailored investment solution for kids’ education and Cash Collection Services: harmoniously integrated cash collection at event venues – while modifying existing products to make them more attractive to potential and existing customers at large.

The table shows the bank’s performance

As shown in the table, the bank’s total assets have experienced a remarkable surge over the past six years, skyrocketing from GH₵112,956,693 in 2019 to GH₵388,681,795 as of September 2024, marking a 244 percent increase. Similarly, total investments have witnessed an unprecedented growth, soaring from GH₵47,483,163 in 2019 to GH₵231,962,066, representing a staggering 389 percent rise.

Deposit growth has also seen a dramatic uptick, climbing from GH₵92,964,912 in 2019 to GH₵339,532,239 as of September 2024, representing a 265 percent increase. Furthermore, loans and advances have demonstrated a significant escalation, rising from GH₵41,719,476 in 2019 to GH₵70,874,736 as of September 2024, representing a 70 percent increase.

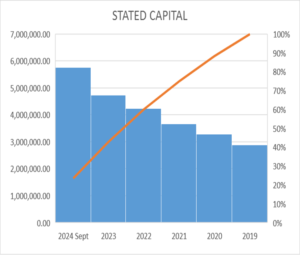

Investors have also shown significant interest in Juaben Rural Bank PLC. by investing in the shares of the bank as depicted in the graph that follows:

Juaben Rural Bank PLC. has a longstanding policy of consistency when it comes to dividend payments. With the exception of the COVID-19 pandemic years (2019 and 2020), where the bank strategically withheld dividend payments, the bank has consistently distributed dividends to shareholders.

In the years 2018, 2021 and 2022, the bank paid out dividends of GH₵715,374.72, GH₵932,929.02 and GH₵1,125,053 respectively, demonstrating its commitment to rewarding shareholders.

The consistent payment of dividends has played a significant role in driving the growth of share capital over the years as seen in the graph earlier. As the bank has distributed dividends to shareholders, it has attracted more investors, leading to an increase in share capital.

This, in turn, has enabled the bank to expand its operations, invest in new opportunities and further enhance shareholder-value.

Juaben Rural Bank PLC is very much conscious of our corporate social responsibilities (CSR). Several initiatives that seek to promote the welfare of the people within the communities we serve have been embarked upon, including the construction of a multi-purpose x-ray department for the Juaben Government Hospital, which has significantly improved healthcare services in the area.

Additionally, the bank has provided state-of-the-art boreholes for many deprived rural communities, ensuring access to clean water for the residents. Juaben Rural Bank PLC. has also demonstrated its generosity through numerous donations, both in-kind and cash, to various schools, organisations, development partners and the Ghana Education Service (GES).

In tune with our commitment to support needy but brilliant students, the bank has granted scholarships to a total of 162 students who have a family member invested in the bank’s shares. These initiatives underscore our commitment to CSR and determination of making a meaningful difference in the lives of others.

Juaben Rural Bank PLC’s continuous pursuit of excellence has been recognised both nationally and internationally as evidenced by the numerous awards we have received.

The bank is proud to have been a prominent member of Ghana’s Prestigious Club 100 and to have received the Ashanti Financial Service Excellence Awards under the auspices of Manhyia.

Furthermore, our commitment to quality, technology and innovation has been recognised globally as we have been honoured with International Star (Gold) Award for Quality in Geneva, Switzerland and the World Quality Commitment Platinum Award in Paris, France. And now, the bank has been awarded by the Ghana National Chamber of Commerce and Industries as the Best Rural Bank of the year 2023.

Juaben Rural Bank boasts an extensive network of 11 strategically located branches throughout the Ashanti Region. The bank’s head office is situated in Juaben, approximately 30 kilometres from Kumasi.

Additional branches are conveniently located in Ejisu, Bonwire, Fumesua, Kejetia, Roman Hill, Suame New Road, Pankrono, Aboaso, Onwe, Sepe and Juaben. This widespread presence enables the bank to serve a diverse range of customers and provide accessible banking services to communities across the region.