By Alberta QUARCOOPOME

“Rather fail with honor than succeed by fraud”….Sophocles

Last week, I started my annual ritual of running a series of fraud discussions, following the BOG latest fraud report. We first looked at the different financial institutions that are always covered in this report, that is, banks, specialized deposit-taking institutions and payment service providers.

The annual reports classify the various types of frauds, the trends over the past four years. The report has also highlighted some directives by BOG to banks, SDIs and PSPs which, if implemented, will help reduce the incidence of fraud in the sector.

The report quotes: “Analysis of the 2023 data showed that fraud heightened in fraudulent withdrawals from victims’ accounts, cyber/email fraud, and cash theft (cash suppression). Another area of concern is SIM swap related fraud, where SIM numbers linked to banking accounts are fraudulently taken over and monies subsequently withdrawn from the accounts.

This form of fraud targets individuals who have banking applications on their mobile phones and have linked their bank accounts to mobile money wallets.”

Last week, my article examined the issue of internal fraud perpetuated by staff of these institutions and I looked at the fundamentals of hiring the right people who have both the skills as well as the right attitude since the currency of banking is trust.

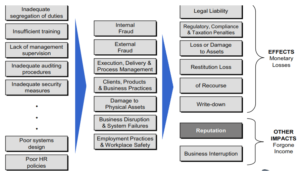

In operational risk management, there are four main sources of risk which ends up in losses when they are not mitigated. These are process risk, people risk, system risk and external factors.

OPERATIONAL RISKS – CAUSES, EVENTS AND CONSEQUENCES

I have covered all these in previous articles but my main concern has always been the people factor because whether traditional banking or digital banking, the operators are the people. A well skilled banker without ethics is not a trusted person.

The People Risk Factor

This is a risk associated with an employee’s intentional or unintentional action. Some people risk may include: high staff turnover, internal fraud, Inadequate staff training, over reliance on key staff, health and safety issues. Let us look at identifying some red flags of people risk:

- Staff not taking their bulk leave

- Staff who prevent others from interfering with their work

- Lack of segregation of duties

- Excessive overtime

- Excessive socialising and entertaining

- Changes in behaviour and dress code

- Life style changes

- Staff engaged in gambling

- Excessive closeness to a customer

The Role of Supervisors in Fraud Mitigation

Cash suppression:

The report stated that “Although cash suppression fraud has largely been associated with the rural banking sub-sector, but the few cases recorded in 2023 by universal banks involved huge amounts. For instance, a cash theft of USD466,000.00 was recorded at a universal bank, which when converted to Cedis led to a significant increase in loss value within the banking sector”.

Dear supervisors, the harsh economic conditions in the country continues to reduce the value of salaries every month. Temptation to indulge in unprofessional conduct at these times is very high and needs to be avoided and prevented as much as possible.

Cash suppression by staff can be prevented by following the relevant procedures in cash handling. The A to Z cash management procedures are very basic and must never be compromised, especially the dual control, segregation of duties, regular checks and balances in place. Although staff privacy is important, the above- mentioned red flags should never be under-estimated. That is why it is important to use case studies and scenarios during training sessions.

The KYC or Know your Customer policy of banks.

This continues to be a global policy strictly sanctioned by all regulators of financial institutions. Since account opening is the door or opening to fraud, its importance should be drummed down to all employees, not to let down their guards. Acceptance of forged documents result in the infiltration of banks by fraudsters who indulge in stolen or cloned cheques, impersonation, and other fraudulent activities. Several years ago, I learnt about the fraudsters also having their own slogan.

As bankers perform KYC, fraudsters also perform their own investigations called KYT or Know Your Target! When they have too-easy opening of accounts not involving KYC, it becomes risky. With digital banking, the remote account opening processes have incorporated the use of trusted profiles and validated identity cards to facilitate the on-boarding system.

It is important that new customers are properly identified and educated well on the pros and cons of digitalization, especially with regards to cyber security. Supervisors, please avoid your institution being labelled as an easy target by fraudsters. Hold on to your role and guard your position.

Know Your Staff

I have also developed my own policy for supervisors everywhere, called KNOW YOUR STAFF, or KYS! This has worked for me over the past decades. Supervisors don’t know everything, see everything or become everything. Monitoring of staff by supervisors is a key part of leadership. However, through teamwork and effective delegation, you can have a good vision of all that goes on in your department.

There are so many stories of working colleagues who looked and seemed very genuine in their actions and demeanors until they are caught up in unprofessional acts. Don’t be deceived by outward appearances. One common bank policy is Trust, but Verify.

Monitoring of Staff

One if the compliance procedures in banking is to ensure that the HR performs a regular process of monitoring the staff accounts. There have been several cases of staff using their accounts like a business accounts.

Salary accounts should be operated as such and any one-off huge deposit into them must be sanctioned, to avoid conflict of interest. There are always cases of staff who suddenly flaunt wealth and exhibit sudden lifestyle changes. Everyone aspires to move up the ladder financially and acquire genuine wealth through family inheritance, relationships, etc, or even some small side gigs, but Supervisors should occasionally put their ears on the ground to indirectly test the truth about some apprehensions. Be close to all the staff without being too nosy.

An open-door policy with coaching and mentoring will encourage subordinates to come close and sometimes share their thoughts and suspicions with you, so you can nib some potential fraud in the bud.

Let me share a personal story. My company conducted a bank-wide training for a financial institution seven years ago. Getting to the end of the year, my Relationship Officer asked me to assist him in meeting his year-end target, so I purchased a fixed deposit with the institution. Despite the smooth and friendly service offered me, I later got to realize after five months that the investment was not done.

To cut a long story short, this guy duped several customers of their investments and travelled to the United States. This left me very disappointed since it was part of my retirement funds. He called me later to apologize and promised refunding it! I have let the matter in the hands of our Maker. Apparently, I got to know that he was living above his means, with a lavish lifestyle, claiming his mum was rich. He was dressed in expensive suits, owned his own car without a bank loan, had several girlfriends, etc.

If the Supervisors had put their ears on the ground, they could have spotted some of the red flags. If only supervisors had used the KYC principle and asked questions, and monitored his activities, it would have been detected early. Not all that glitters is gold!

The Process Risk

As a highly regulated sector of the economy, banking has always not been easy for its employees. It is highly regulated by banking laws as well as Directives from Bank of Ghana. Since the banker- customer relationship is a legal contract under which each party can be sued or sue, every banking transaction is conducted under processes and procedures. They are not done by using logic.

Therefore, bank staff are strictly monitored to ensure transactions are accurate, transparent and speedily done. The sanction regime of financial institutions is expected to be robust and strict. Under the perpetual scrutiny of BoG, customers have easier access to report directly to the central bank when their complaints are not solved within a required period of time. Banking policies and processes are also expected to be reviewed periodically to meet the dynamics of the sector.

Let me pause here. Next week, we shall look at some preventive measures to ensure process and system risks in banking transactions are enforced to minimize the fraud menace.

TO BE CONTINUED

ABOUT THE AUTHOR

Alberta Quarcoopome is a Fellow of the Institute of Bankers, and CEO of ALKAN Business Consult Ltd. She is the Author of Three books: “The 21st Century Bank Teller: A Strategic Partner” and “My Front Desk Experience: A Young Banker’s Story” and “The Modern Branch Manager’s Companion”. She uses her experience and practical case studies, training young bankers in operational risk management, sales, customer service, banking operations and fraud.

CONTACT

Website www.alkanbiz.com

Email:alberta@alkanbiz.com or [email protected]

Tel: +233-0244333051/+233-0244611343