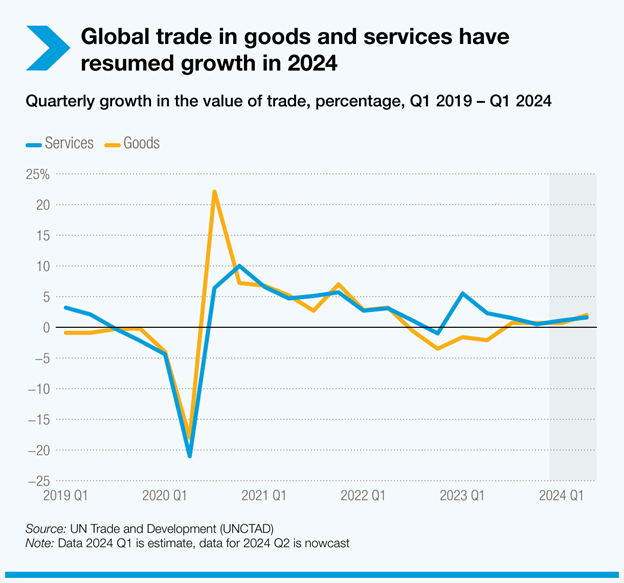

Global trade trends turned positive in the first quarter of 2024, with the value of trade in goods increasing by around 1% quarter-over-quarter and services by about 1.5%.

This surge, fueled by positive trade dynamics for the United States and developing countries, particularly large Asian developing economies, is expected to add approximately $250 billion to goods trade and $100 billion to services trade in the first half of 2024 compared to the second half of 2023.

Global forecasts for GDP growth remain at around 3% for 2024, with the short-term trade outlook being cautiously optimistic. If positive trends persist, global trade in 2024 could reach almost $32 trillion, yet it is unlikely to surpass its record level seen in 2022.

China, India and the US drive global trade

Global trade growth in the first quarter of 2024 was primarily driven by increased exports from China (9%), India (7%) and the US (3%). Conversely, Europe’s exports showed no growth and Africa’s exports decreased by 5%.

South-South trade sets the pace

Trade in developing countries and South-South trade increased by about 2% in both imports and exports during the first quarter. In comparison, developed countries saw flat imports and a modest 1% rise in exports.

On an annual basis, however, South-South trade fell by 5% when comparing the first quarter of 2023 to the first quarter of 2024.

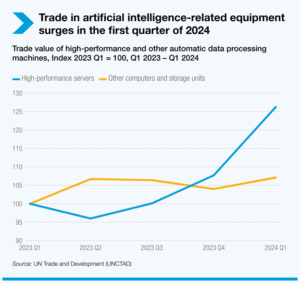

Green energy and AI sectors see strong surge

Trade growth varied significantly across sectors, with green energy and AI-related products experiencing stronger increases.

The trade value of high-performance servers rose by 25% compared to the first quarter of 2023, while other computers and storage units saw an 8% increase. The trade value of electric vehicles also grew significantly, increasing by about 25%.

Positive outlook tempered by geopolitical and policy challenges

Despite these positive trends, the outlook for 2024 is tempered by potential geopolitical issues and industrial policy impacts. Geopolitical tensions, rising shipping costs, and emerging industrial policies could reshape global trade patterns.

The report warns that an increasing focus on domestic industries and trade restrictions could hinder international trade growth.