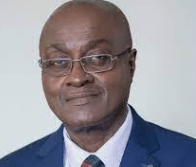

As one of the highlights of the 8th CEO Summit and Awards held in Accra, Kofi Adomakoh, the Managing Director of GCB Bank, was honored with the prestigious title of Banking CEO of the Year.

This accolade, the awarding body said, underscores Mr. Adomakoh’s exceptional leadership and strategic vision has propelled GCB Bank to new heights since he assumed office.

Commenting on receiving the Banking CEO of the Year award, Mr. Adomakoh expressed gratitude for the recognition and credited the success to the collective efforts of the entire GCB Bank team. He reiterated the bank’s commitment to driving sustainable growth, fostering financial inclusion, and continuing to innovate to meet the evolving needs of customers and the economy.

“Receiving the Banking CEO of the Year award is a testament to the dedication and innovation of the entire GCB Bank team. We are committed to driving sustainable growth, fostering financial inclusion, and continuing to innovate to meet the evolving needs of our customers and the economy,” he said.

Mr. Adomakoh’s journey to this recognition has been marked by a relentless commitment to innovation, customer-centric approaches, and driving sustainable growth in the banking sector.

Under his stewardship, GCB Bank has witnessed remarkable achievements and solidified its position as a leader in Ghana’s financial landscape.

Since assuming the role of Managing Director, Mr. Adomakoh has spearheaded transformative initiatives that have significantly enhanced GCB Bank’s performance. The bank’s financial results have showcased consistent growth and resilience, reflecting Mr. Adomakoh’s strategic acumen and ability to navigate through dynamic market conditions.

One of the pivotal strategies implemented under Mr. Adomakoh’s leadership is the focus on digital transformation. GCB Bank has been at the forefront of digital innovation, launching groundbreaking services such as G-Money, Ghana’s first bank-led mobile money service. This initiative has not only enhanced financial inclusion but also positioned GCB Bank as a trailblazer in leveraging technology to deliver seamless banking experiences.

“Our focus on digitalization is not just about keeping pace with the industry; it’s about transforming banking experiences, enhancing accessibility, and empowering our customers in the digital age,” he noted.

In March 2023, GCB Bank executed Ghana’s first successful Pan-African Payment and Settlement System (PAPSS) client transaction.

Furthermore, Mr. Adomakoh’s emphasis on customer experience has resulted in enhanced service delivery, personalized offerings, and an unwavering commitment to meeting the diverse needs of customers across segments. This customer-centric approach has translated into increased customer satisfaction and loyalty, further strengthening GCB Bank’s market position.

Unsurprisingly, the bank was the second-largest bank in credit extension – holding a 10.7 percent share of gross loans as of December 2023.

Under Mr. Adomakoh’s leadership, GCB Bank has also demonstrated robust financial performance. The bank’s financial intermediation has expanded significantly, with notable contributions to credit extension and facilitating Ghana’s international trade through innovative financial instruments.