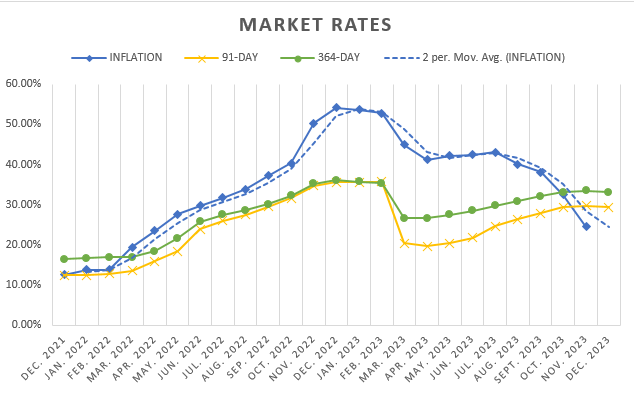

The recent decline in consumer inflation has triggered a notable shift in the Treasury market, significantly influencing rates and reshaping investor sentiments.

The unexpected plummet in headline inflation from 35.2 percent in October to 26.4 percent in November 2023 has led to a ripple-effect across the markets, particularly impacting T-bill yields and market dynamics.

This abrupt decline prompted a downturn in T-bill yields, with the 91-day and 182-day yields retreating by 53bps and 83bps respectively, settling at 29.05 percent and 31.14 percent. The 364-day yield also saw a considerable decrease, settling at 32.49 percent (-97bps) in response to the unexpected drop in inflation rates.

Investor interest in T-bills remained robust, evident from bids hitting GH¢4.73bn against an auction target of GH¢3.98bn. The government accepted GH¢4.72bn, surpassing the target by approximately 19 percent and maturities due by around 27 percent.

Economists and analysts anticipate sustained disinflation to continue exerting downward pressure on T-bill yields. The decline in headline inflation was primarily attributed to favourable base effects and higher Consumer Price Index (CPI) levels in the corresponding period last year.

This marked downturn aligns with market forecasts, offering a much-needed relief amid persistently high inflation rates. This is a favourable outcome, considering the government’s year-end inflation target of 31.3 percent, as outlined in the 2024 Budget.

The disinflation process began earlier in the year, when inflation started scaling down from 43.1 percent in July 2023 to 40.1 percent in August. Despite occasional fluctuations, the trend has been predominantly downward, marking a cumulative decline of 27.7 percent since its peak in December 2022 at 54.1 percent.

The government’s heavy reliance on money market funding might initially support an increase in T-bill yields. However, experts anticipate that sustained disinflation will likely limit any significant upticks in yields.

Looking ahead, the Treasury plans to raise GH¢2.59bn through Treasury Bill offers spanning 91 to 364-day bills, covering estimated maturing bills of GH¢2.42bn. This development hints at market sentiments suggesting that nominal yields may have peaked, hovering between 29.97 percent and 33.70 percent across the T-bill curve.

The positive shift in the market is expected to benefit the treasury, especially considering its plan to domestically finance around GH¢61.4billion, constituting 99.3 percent of the total deficit financing for 2024.

Furthermore, in the secondary bond market for government papers, trading activity remained upbeat with a 47.42 percent increase in total weekly volume traded, reaching GH¢2.07bn. Notably, trading was concentrated on the 2031-2034 papers, representing 61.40 percent of the total market turnover.

Bond yields experienced a mixed performance, with some papers seeing a decrease while others recorded an increase. Despite this, investor confidence seems to be gradually rebounding on Ghana’s disinflation process.

In conclusion, the substantial decline in consumer inflation has not only impacted T-bill yields, but has also influenced market sentiments. The ongoing disinflationary trend is anticipated to continue shaping Ghana’s financial landscape, possibly paving the way for more stable and favourable market conditions in the near future.