- as ‘funding winter’ bites harder

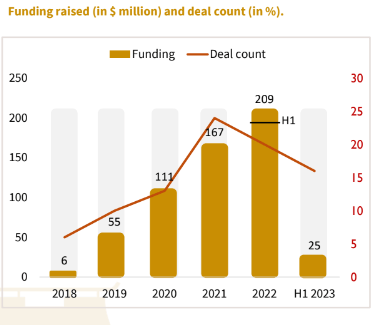

In first-half 2023, the domestic start-up funding landscape witnessed a significant decline with only US$25million raised in equity and debt deals – marking an 86 percent decrease compared to the same period of the previous year, according to the Ghana Innovation Ecosystem half-year (H) 2023 Report.

This stark drop, the lowest since 2019, has raised concerns among the entrepreneurial community and investors alike… indicating a potential shift in the country’s start-up ecosystem.

The decline in funding comes after a robust 2022, which saw several substantial deals at beginning of the financial year, resulting in a total of US$187million raised. However, the trend seems to have taken a different turn this year.

“2022 saw an exhilarating investment boom; cheap money and outlandish valuations drove investments in Ghana start-ups to a new high. With the increase in the US Fed’s interest rate and inflation, there has been a decline in cheap money globally. Ghana’s startup funding is already feeling the impact. 2023 funding is likely to hit its lowest since 2019,” said Isaac Newton Acquah, Co-Founder of The Innovation Spark, which published the report.

The situation is not unique to Ghana. A global trend known as a ‘funding winter’ – wherein start-up companies receive less funding – started in 2022 and continued for Africa during 2023.

Before that, during the opposite trend – called a ‘funding heatwave’ – the African Big Four countries (Nigeria, South Africa, Kenya and Egypt) collectively raised US$4.6billion between July 2021 and June 2022, according to the aggregator Big Deal Africa. Nigeria led with over US$2billion, followed by Kenya, South Africa and Egypt with just under US$1billion. Four other countries (Senegal, Ghana, Tunisia and Tanzania) crossed the US$100million mark, and seven more claimed over US$10million.

Now, a year later, the situation has changed significantly. Most countries, including the Big Four, experienced a substantial drop in funding. Nigeria saw the most significant decrease, with funding contracting by 77 percent year-on-year. As a result, Egypt took top-spot with the most moderate decline among the Big Four by going down only 25 percent YoY. Egypt remains the only ecosystem with over half a billion dollars in funding. South Africa’s funding was cut in half – down 53 percent, and Kenya’s funding decreased by 69 percent.

In addition to the Big Four, in the four markets where over US$100million had been raised during the funding heatwave, funding decreased dramatically during the funding winter. Tanzania saw a 68 percent YoY decrease, Ghana experienced an 86 percent YoY decrease, while funding in Tunisia and Senegal dropped significantly (from US$222million to US$6million). Four out of seven markets where US$10million to US $100million was raised during the heatwave also suffered significant losses (DRC, Namibia, Zambia and Uganda). Morocco’s funding remained relatively stable year-on-year.

Commenting on the development, Richard Nunekpeku – Vice President, Legal and Strategy at the Ghana Fintech and Payments Association, stated that innovations in the financial technology (fintech) space, particularly, had accounted for new investments prior to 2023.

However, due to the slow pace of new innovations within that sector – coupled with emerging corporate governance issues with some fintech companies that had previously raised a lot of money, investors are beginning to be critical and slow in putting up additional funds.

“Nonetheless, we cannot discount effects of the global economic challenges resulting in many re-alignments on investment needs and industries,” he stated.

He believes the trend of low investor capital/funding is going to continue into the near-future. This, he noted, means that local startups must be innovative with their product or service offerings to capture the eye of investors.

“Also, regulatory compliance and good corporate governance practices must be enhanced to ensure positive due diligence outcomes. Ultimately, where securing investor funding is becoming increasingly impossible to achieve, local startups must pursue collaboration and partnerships with other local startups through mergers in order to consolidate their operational capabilities and maximise their own small personal funding sources,” Mr. Nunekpeku remarked.

Industries’ break-down

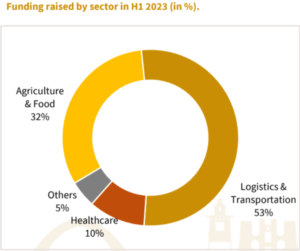

The funding landscape in first-half 2023 saw a major shift in terms of industries that attracted investments. The transport and logistics sector emerged as the leader, securing US$13.2million, mainly fuelled by Jetstream’s US$13million Pre-series A round. On the other hand, the Agriculture and Food sector received a boost from Degas’ US$8million Series A raise.

Comparatively, fintech – which was a major player in 2022, experienced a staggering 99 percent decline in funding. While some fintech deals are in the due diligence phase, funding is unlikely to reach the 2022 volume of US$96million. Additionally, the health-tech sector also faced a 17.5 percent decrease in funding.

Start-up funding by industry

Start-up funding in Ghana during the period under consideration was predominantly allocated to various industries. The logistics and transportation sector led the way, securing the lion’s-share with 53 percent of the total funding. Agriculture and food followed closely behind, accounting for 32 percent of the investments. Healthcare also received significant attention, with 10 percent of the funds directed toward this sector. The remaining five percent was distributed across other industries. These figures reflect the distribution of funding across diverse sectors within Ghana’s start-up ecosystem.

Gender diversity in funding

In a notable development, female-led startups and gender-diverse teams raised 52 percent of the total capital, although this figure was significantly influenced by Jetstream’s US$13million round. However, in terms of deal count, male-led CEOs still constituted the majority at 90 percent.

“Despite the bleakness of investments flowing in, there are still several reasons to celebrate this half-year. Female-led teams raised more investment for the first time when the total investment value was considered. However, when it comes to the deal count, male-led start-ups outnumber the number of female-led startups that received funding,” the report added.

Funding by stage and business model

All deals in H1 2023 were early-stage deals, ranging from pressed to pre-Series A rounds. Late-stage deals were notably absent during this period. Venture capital remained the primary source of capital for founders.

In terms of business models, there was a strong preference for B2B startups which raised 90 percent of the funding – representing a 26 percent increase compared to first-half 2022.