Treasury Secretary Janet Yellen begins her tour of Senegal, Zambia and South Africa this week, with hopes high on the continent of adding substance to President Joe Biden’s comments last month that the US is “all in on Africa’s future.” Yellen follows Chinese Foreign Minister Qin Gang’s tour this month taking in Ethiopia, Gabon, Angola, Benin and Egypt. China-Africa bilateral trade at $254bn for 2021 is four times higher than US-Africa trade. Chinese foreign direct investment in Africa rose to $43bn in 2020. During his visit, Qin faced criticism for opaque terms and onerous collateral demands on Chinese loans, exposing countries to potential ‘debt traps.’ Qin countered that Chinese money has helped improve the lives of African people and called for international cooperation rather than competition. Yellen is expected to discuss infrastructure investment, debt, and energy and food security, expanding on Biden’s pledge of more than $15 billion in trade and investment deals, and his proposal to include the African Union in the G20 group of major economies. Biden is scheduled to travel to Africa later this year, along with Vice President Kamala Harris. The visits could mark 2023 as the year US engagement in Africa moves beyond assistance to a more equal partnership for trade and investment.

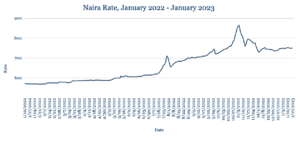

Stabilised Naira trending lower ahead of election

The Naira held relatively stable against the dollar, trading at 751 from 749 at last week’s close. Nigeria regained its position as Africa’s top oil producer after pumping just over 1.2 million barrels per day in December. The increase in production follows efforts by Nigeria to beef up security surveillance for its oil infrastructure to reduce theft. Following the introduction of new Naira notes last year, the volume of currency in circulation fell to NGN3.16tr in November from NGN3.29tr in October. That is limiting the amount of cash available for potential vote buying as February’s presidential election approaches. As demand continues to build going into the year, we expect further but gradual depreciation of the naira.

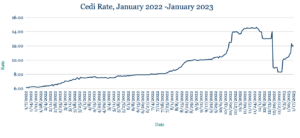

Ghana’s gold for oil helps steady Cedi

The Cedi halted its recent sharp slide against the dollar, trading at 12.01 from 12.28 at last week’s close – still significantly weaker than its year-end level of 8.35 following Ghana’s debt default in December. The government is hoping its barter trade of gold for oil will ease FX demand by allowing Ghana to use gold to buy oil products instead of its dollar reserves, which in turn should support the Cedi over the medium term. The Cedi remains under sustained pressure given flight from Ghana’s bond market as the country seeks to restructure its debt as part of an IMF emergency loan programme.

Energy crisis piles pressure on Rand

The Rand weakened against the dollar, trading at 17.11 from 16.81 at last week’s close as South Africa’s energy crisis deepens. President Cyril Ramaphosa cancelled a scheduled trip to the World Economic Forum in Davos as rolling blackouts worsen and state utility company Eskom—responsible for 90% of South Africa’s power—struggles to find a solution. The government this week said it is planning a new law to accelerate the development of private power plants to increase generating capacity. The country has suffered blackouts every day this year after a record 205 days of load shedding in 2022. South Africans have been without power for up to 12 hours a day over the past week as Eskom scrambles to save the country’s electricity grid from collapse. Against this backdrop, we expect the Rand to continue weakening over the near term.

Devalued Egypt Pound finds 30 level ground amid FX inflows

The Pound weakened against the dollar, trading at 29.69 from 28.56 at last week’s close –though the currency has shown signs of stabilising at the current level, which is above the record low of 31.40. Egypt’s central bank said that allowing the Pound to float more freely combined with its latest devaluation has supported greater FX inflows, which have totalled more than $925m since last week. Daily FX trading activity has surged to more than 20 times the daily average seen in recent weeks. Fitch Ratings said Egyptian banks’ capital ratios can withstand further depreciation of the Pound, with private sector banks better positioned than their state-owned counterparts due to their greater capital generating capabilities. In the absence of further macro shocks, we expect the Pound to continue trading around the 30 level in the short term.

Kenyans hoard dollars as Shilling hits new low

The Shilling hit a fresh record low against the dollar, sliding to 124.00/124.20 from 123.75/123.95 at last week’s close. The weakening trend, which is making Kenya’s external debt payments more expensive, continues amid rising import costs. Wealthy Kenyans have been buying dollars as a hedge against the depreciating Shilling and are now sitting on a record KES922bn-worth, putting further pressure on the local currency. The country’s FX reserves remain adequate at $7.4bn, enough for 4.15 months of import cover. We expect the Shilling to continue depreciating as rising inflation pushes up the cost of living in a country that is dependent on imports, including fuel, machinery, medicine, food and clothing.

Lower tourism prospects weigh on Ugandan Shilling

The Shilling weakened marginally against the dollar, trading at 3670 from 3662 at last week’s close. The IMF this week said its executive board has approved the release of about $240m in funding for Uganda as part of its 36-month extended credit facility that has been in place since June 2021. The country’s finance ministry is projecting growth of 6% in the 2023/24 financial year, supported by increased oil sector activity, regional trade growth and a rebound in agricultural output. The government said it expects to borrow around $2.6bn for the coming fiscal year. Uganda cancelled a $2.3bn railway project with a Chinese contractor after failing to attract Chinese funding. It is now seeking investment from Turkey for the project, Bloomberg reported. We expect the Shilling to depreciate over the long term after the government slashed the country’s tourism budget, potentially reducing the amount of FX coming into the country.

Tanzanian Shilling weakens to near four-year dollar low

The Shilling slipped to its weakest level against the dollar in almost four years, trading at 2338 from 2336 at last week’s close. While the decline is marginal, the currency is starting to form a slight weakening trend against the greenback. Tanzania’s central bank sold off a total of $124m from its FX reserves during the first half of the financial year in a bid to cushion the economy against inflation and other costs related to goods imports. In total, FX reserves had fallen to $4.5bn in November compared to $6.6bn a year earlier. Reserves were supported by Tanzania increasing coal exports to almost $142m from $13m over the same period as Europe sought alternative energy sources amid Russia’s war in Ukraine. While that boost is likely to be short-lived, the country is seeking to attract further investment and trade with the European Union in the year ahead. With that in mind, we expect the Shilling to withstand any significant losses against the dollar in the near term.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.