Any hopes for East African nations, Ethiopia, Kenya and Somalia—experiencing their worst droughts in 40 years—to receive meaningful and timely reparations from the industrialised world for climate change appear dashed. In the closing days of the UN’s climate conference COP27, the European Union and African Union announced an initiative on Wednesday to “bring together existing and new” programs amounting to over $1 billion to fund climate adaptation and resilience in Africa, with more than $60 million earmarked for “loss and damage” reparations for countries impacted by global warming. However, reluctance from industrial nations including the US and China is blocking agreement on broader loss and damage funding. The best we can expect is the requirement for a commitment to a loss and damage fund by late 2024. The alternative being discussed is two years of technical work on a “mosaic” of funding arrangements, according to a draft text released on Monday. The African Group of Negotiators’ legal adviser, Seth Osafo, said at a press conference on Tuesday that said his group wants to see a funding facility to help countries adversely affected by climate change, but specifically avoided a call for reparations, according to Bloomberg. Countries are meanwhile pursuing more immediate avenues. Ethiopia has requested IMF financing to help provide food for more than 20 million people impacted by drought and civil war. Kenya is set to receive $433m from the IMF as part of a $2.34bn loan facility agreed last year, as the record-weak Shilling increases the cost of servicing foreign-currency debt.

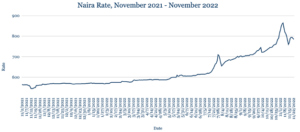

Naira slides amid arrests to ‘sanitise’ FX market

The Naira weakened against the dollar, sliding to 790 from 780 at last week’s close, as inflation accelerated to a 17-year high of 21.09% for October, led by rising fuel costs, an FX scarcity and disruptions to the global food supply chain. Severe flooding across many parts of Nigeria, resulting in significant loss of farmland, has squeezed domestic food supplies and pushed prices higher. The country’s Economic and Financial Crimes Commission said it has arrested some bureau de change operators and currency speculators in an attempt to ‘sanitise’ the FX market, which it says helped the Naira recover from its record low 865 hit in early November. We expect to see further weakness in the days ahead as businesses take advantage of the relative dip to meet dollar needs.

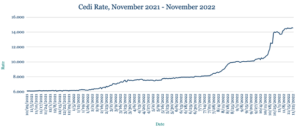

Cedi touching fresh low seems set for 15 levels

The Cedi hit a fresh record low 14.54 before recovering slightly to 14.50, compared to 14.43 at last week’s close. Ghana’s President Nana Akufo-Addo this week fired his Finance Minister Charles Adu Boahen over unspecified allegations related to the country’s mining industry. Negative sentiment continues to plague the Cedi, with a potential $3bn IMF bailout remaining elusive and uncertainty around Ghana’s 2023 budget and surging inflation—currently at 40.4%—adding to the currency’s malaise. The Bank of Ghana sold $60m into the market in its forward forex auction, but that did little to stem the Cedi’s losses. With demand for FX elevated ahead of the festive season, we expect the local currency to weaken beyond the 15 level.

Rand steady before credit rating reviews

The Rand was little changed, weakening slightly to 17.25 from 17.24 at last week’s close, as power cuts continue to impact the economy. Planned outages exceeded last year’s record number twice in the first nine months of the year, with loadshedding hitting 5,761 gigawatt hours by the end of September, up from 2,521 gigawatt hours in the whole of 2021, according to the Council for Scientific and Industrial Research. Attention will turn to Standard & Poor’s and Moody’s Investors Service, which are expected to complete reviews of South Africa’s credit rating imminently. While stopping short of ratings changes, we expect the agencies to strike a positive tone following the improved fiscal outlook in last month’s mid-term budget. Overall, we expect the Rand to continue trading flat in coming days.

Egypt Pound struggles to find floor in free float transition

The Pound sank to a fresh record low, trading at 24.47 from 24.39 at last week’s close, as currency traders seek a new floor amid Egypt’s move towards a freer floating exchange rate as part of an IMF accord. While precise details of the IMF’s $3bn loan agreement are unknown, the funds will likely be used to help the government adjust its fiscal policy, reduce government debt and overhaul the country’s tax system. The IMF said the deal will help safeguard Egypt’s macroeconomic stability, improve debt sustainability and strengthen its resilience against external shocks. We expect further depreciation in the short term due to the decline in FX reserves and deep FX liquidity squeeze in country, exits by portfolio investors, and direct exposure to the shock waves from the Ukraine conflict in terms of higher wheat and fuel costs.

IMF funds to support record low Kenyan Shilling

The Shilling fell to a new dollar low, trading at 121.90/122.10 from 121.70/121.90 at last week’s close as FX demand from the manufacturing and energy sectors shows little sign of abating. Rising inflation led by higher food and fuel prices is denting economic activity, especially for small businesses which are forced to absorb the high input costs at the same time as declining consumer spending. Kenya’s Energy and Petroleum Regulatory Authority reduced fuel prices by KES1 this week following a drop in the cost of imported fuel products. The government is expected to receive $433m from the IMF as part of the $2.34bn loan facility agreed last year. The funds will help to cover external financing needs, which have been strained by drought and challenging global financing conditions. We expect the IMF funding and adequate FX reserves to support the Shilling in the week ahead.

Inflation pressure for Uganda Shilling amid Ebola outbreak

The Shilling was little changed against the dollar, trading at 3750 from 3770 at last week’s close, as annual inflation climbed to a record high 10.7%. The country’s Ebola outbreak continues, with confirmed cases hitting 136 at the end of last week, including 18 healthcare workers of whom seven have died. In total, deaths stand at 56, equal to a case fatality rate of 39%. While the government has been increasing efforts to boost local production and diversify the country’s export base in a bid to boost foreign earnings and reduce exchange rate volatility, the ongoing Ebola outbreak and the rising costs of fuel, electricity and water is likely to keep pressure on the Shilling in the near term.

Tanzanian Shilling steady amid relatively low inflation

The Shilling remained relatively steady, trading at 2332 from 2331 at Friday’s close. Following President Samia Suluhu Hassan’s recent visit to China, Tanzania is seeking to tap into the Chinese $150m-a-year avocado import market, which is expected to grow to $174m by 2024, offering a potential opportunity for Tanzanian avocado farmers to ramp up exports. Agri-commodity sales including cashew nuts and NGO inflows have helped keep the Shilling stable in recent weeks, and with the country managing to keep annual inflation relatively low at 4.9% in October, we expect the Shilling to continue holding firm against the dollar in the week ahead.

Issued by AZA. This Newsletter is produced as a service to our clients. It is prepared by our dealing professionals and is based on their understanding and interpretation of market events. AZA cannot be held responsible for any losses of whatever nature sustained as a result of action taken based on comments contained in this publication.

For more information, high-resolution charts or interviews, please contact:

Gavin Serkin

[email protected]

+44 20 3478 9710