Desperate times indeed call for desperate measures. This universal yet thought-provoking statement befits the current measures being taken by economies in the world whose downturn have mainly been triggered by the COVID-19 pandemic and further exacerbated by the Russia-Ukraine war. The question, however, is whether it is appropriate to conveniently attribute this economic trough to these recent events. Could there have been wobbly economic fundamentals which perhaps have been exposed by the COVID-19 pandemic and Russia-Ukraine war? Probably yes, especially in the case of Ghana. A study conducted by J. P. Morgan and Fitch, distinctively, classified Ghana as part of countries in the danger zone.

Foreign Investors’ Reaction on Ghana’s Bond Market

For a continuous five-month duration, investments of cedi-denominated bonds by foreign investors have continually reduced – from GH¢34billion in August 2021 to GH¢28billion at the end of March 2022. This represents a 17.65% reduction of foreign investments on Ghana’s bond market, resulting from a national revenue deficit and heightened inflation signals which portray a hawkish monetary policy stance by the central bank of Ghana. Market movements in cedi-denominated bond yields experienced an upward slope as market players re-priced their assets to reveal the inherent risks in the Ghanaian economy. This reflects loss of confidence in the Ghanaian bond market, and generally in the Ghanaian economy. Amid these disinvestments by foreign investors, 53% of our revenues are used in financing interest payments on our debt – which happens to be the second-largest allocation of revenue toward debt servicing in the world after Sri Lanka, according to a study by Fitch.

One of the fastest-plummeting currencies in the world

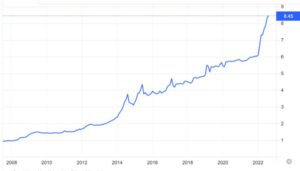

The Ghana cedi has experienced its fastest decline in seven years. The re-denomination of the Ghana cedi which had the cedi pegged to one dollar in 2007 has depreciated rapidly. From 2007 till the ending of July 2022, the cedi has experienced the fastest decline. Per the graph below, in 2007 the cedi to the dollar rate was 1:1 which thereafter sloped upward gently till 2014. From 2014 to 2021, there were many upward yet undulating movements in the US$/GH¢ rate. In 2022, there was a steep movement in the rate as compared to previous years. As at December 2021, the Ghana cedi was selling at US$1 = GH¢6.15 and was trading at US$1 = GH¢8.45 as at July 2022.

Movement of US$/GH¢ from 2007 to 2022

Destruction of value

Considering the turnout of events, ranging from increasing inflation rate to increasing policy rate and increasing the Ghana Reference Rate, one wonders whether the Ghanaian economy has become unattractive for doing business. The impact of this on many businesses in Ghana is that there is destruction of value for many companies. Ghana’s reliance on imported goods and the current debt position has incessantly led to depreciation of the cedi. The increase in inflation rate and policy rate has led to an increase in the base rate at which companies borrow from banks (Ghana Reference Rate). Businesses tend to pass on that additional cost from its borrowings and depreciation of the Ghana cedi to the ordinary Ghanaian, affecting the people’s standard of living and hence our economic development.

Should foreign companies continue to operate in Ghana?

We also cannot ignore the strong presence of foreign companies in the Ghanaian market. Will these companies also be considering exiting our market like the foreign investors in our cedi-denominated bonds? What is the opportunity-cost of these companies operating in their own countries as against operating in Ghana? Firstly, these foreign companies have established many branches – hence huge capital investments – in Ghana. Secondly, there is huge competition in their own countries. Thirdly, the current economic situation in their country will inform them of which scenario presents the better alternative.

In considering the opportunity cost, we would have to find out the current state of that country’s economy. For an economy whose inflation rate is also high and followed by depreciating currency – in the wake of supply disruptions caused by the pandemic and war in Ukraine, they may also be facing escalating import bills. Such an economy would have to do a cost-benefit analysis of the two economies as well as some qualitative analysis in making a good decision.

Yes, others too; but not this magnitude

The current economic situation portrays a global economic crisis that’s not faced by just one or a few economies. The Russia-Ukraine war has adversely affected the standard of living for people everywhere. The main contention, however, is the extent of economic downturn in Ghana as compared to other countries. This calls for redress in the economic strategy of Ghana’s economy. Firstly, we will have to strengthen our agricultural sector to export more. Secondly, we would have to invest in factories to convert our raw materials to semi-finished and finished products.

Furthermore, engineers and tech-savvy Ghanaians must be motivated and supported to innovate and manufacture machines and technologies that can assist our primary sector. Also, government will have to support existing and start-up businesses to operate at a large scale so as to reduce capital flight which springs from foreign direct investments. Very importantly, Ghana should have a strategic plan for the long-term. In addition to this, government should embark on projects which produce positive cashflows to defray existing debt and to sustain the economy.

The writer is a banking Treasury associate focused on working with corporates in Ghana on their Treasury management needs.