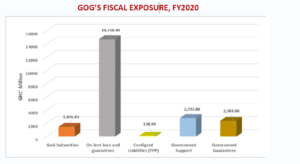

Government’s exposure in total sums commitments to State-owned Enterprises (SOEs) amounted to about GH¢21.53billion as at the end of 2020, according to the 2020 State Ownership Report.

This, the State Interests and Governance Authority (SIGA) says, reveals the continued reliance on government for support by Specified Entities (SEs).

Per the report, the exposure includes government subvention of GH¢1.48billion, on-lent loans of GH¢14.74billion, and outstanding stock of government-backed guarantees of GH¢2.38billion. This is in addition to contingent liabilities of GH¢138.99million from ongoing Public-Private Partnership (PPP) projects.

The remaining component of GH¢2.79billion was in government support and bail-outs to some SEs to mitigate the adverse impact of COVID-19 at the height of the pandemic.

Addressing the issue, Chief Executive Officer (CEO) for the SIGA, Ambassador Edward Boateng said: “The above trend needs to be reversed. SIGA’s mandate is to facilitate this reversal and ensure that, ultimately, the Specified Entities contribute at least 30 percent of GDP to the economy”.

Speaking further, he said: “Specified Entities, in particular SOEs, are in equal measure a potential source of fiscal risk to the national budget and major contributors to the national budget in support of the economic development process. It is therefore appropriate to highlight pertinent issues related to fiscal relations between the state and Specified Entities, as discussed in this section”.

Government Bailout

In the 2020 fiscal year, central government received requests from eight SEs for financial support to cover payroll expenditure and help mitigate adverse effects of the COVID-19 pandemic on their operations, the report indicated.

Five SEs, comprising three SOEs and two Joint Venture Corporations (JVCs), were given direct government support amounting to GH¢72.6million. Two other Entities – both Other State Enterprises (OSEs) – were granted no-objection to borrowing on their own balance sheets to the tune of GH¢54.90million, the report indicated.

The entities which received explicit and implicit support include Ghana Airport Company Limited (GACL), GH¢43.4million; PSC Tema Shipyard & Dry-Dock (PSC), GH¢1million; Intercity STC Coaches Limited (ISTC), GH¢3.7million; Metro Mass Transit Limited (MMT), GH¢14million; and Ghana Post Company Limited (Ghana Post), GH¢10.5million.

The rest are Ghana Communication Technology University (GCTU), GH¢24million; and Ghana Institute of Management and Public Administration (GIMPA), GH¢30.90million. “As at the end of FY2020, one entity – Ghana Civil Aviation Authority (GCAA) – had not completed the process to receive government support,” the report noted.

On-lent loans and guarantees

According to the 2020 Annual Public Debt Report (APDR) issued by the Finance Ministry, the stock of recoverable loans as at end-December 2020 stood at GH¢14.7billion. This was made up of Export Credit Guarantee Department (ECGD) facilities and on-lent facilities to SOEs.

Of the figure, GH¢206.7million was repayment arrears primarily from on-lent loans to SOEs. The APDR also indicates that a recovery of GH¢43.3million was made on the on-lent portfolio in 2020.

“As at the end of 2020, the outstanding stock of government-backed guarantees was GH¢2.38billion, which is equivalent to US$415.4million. These guarantees are typically granted by government to enable Specified Entities raise credit at lower costs,” the report added.