The 2022 Budget Statement and Economic Policy is expected to be delivered by the Finance Minister on 17th November, 2022 in accordance with the Articles 179 and 180 of the 1992 Constitution. As the Minister prepares to present the 2022 Budget, it is important to reflect on the 2021 Budget which was themed ‘Economic Revitalisation through Completion, Consolidation & Continuity’ and subsequently the 2021 Mid-Year Budget.

The following macroeconomic targets were set for the 2021 fiscal year;

- Overall Real GDP growth of 5.0 percent;

- Non-Oil Real GDP growth of 6.7 percent;

- End-period inflation of 8.0 percent;

- Fiscal deficit of 9.5 percent of GDP;

- Primary deficit of 1.3 percent of GDP; and

- Gross International Reserves to cover not less than 4.0 months of imports.

It is important to assess the fiscal performance of 2021 which will be the yardstick for setting target for 2022 and the medium term. The government of Ghana in the 2021 budget introduced COVID-19 Health Levy of a one percentage point increase in the National Health Insurance Levy and a one percentage point increase in the VAT Flat Rate; Sanitation and Pollution Levy (SPL) of 10 pesewas on the price per litre of petrol/diesel under the Energy Sector Levies Act (ESLA); Energy Sector Recovery Levy of 20 pesewas per litre on petrol/diesel under the ESLA.

To defray the cost incurred by cleaning up the financial sector, a levy of 5 percent on profit-before-tax of banks was introduced. More so, government proposed to amend the Fees and Charges (Miscellaneous Provisions) Act, 2018 (Act 983) to enable road tolls reflect an automatic annual adjustment that will be pegged to the previous year’s average annual inflation. With the current inflation rate, road tolls may increase in 2022.

With the introduction of these new taxes, provisional fiscal performance for the 2021 half year is indicated below.

Provisional Fiscal Performance (Jan-Jun, 2021)

| Indicators | 2021 Budget

GH¢ |

Prog

GH¢ |

Prov. Outturn

GH¢ |

Deviation

GH¢ |

| Total Revenue & Grants | 72,452 | 32,362 | 28,304 | -4,058 |

| % of GDP | 16.7 | 7.5 | 6.5 | |

| Total Exp. (incl. Arrears clearance) | 113,750 | 55,088 | 50,619 | -4,469 |

| % of GDP | 26.2 | 12.7 | 11.7 | |

| Budget Balance | -41,298 | -22,726 | -22,315 | |

| % of GDP | -9.5 | -5.2 | -5.1 | |

| Primary Balance | -5,434 | -4,797 | -7,290 | -2,493 |

Source: MoF

The 2022 budget will give an update on the above figures but it is clear that revenue target will be missed. On the other hand, if expenditures are not contained, fiscal deficit target will be missed in the period under review. For the first time in many years, the 2021 budget allocation for interest payment which was GH¢ 35,863,814,494 exceeded all expenditure allocations including compensation of employees which had an estimate of GH¢ 30,313,597,722. Capital expenditure for the 2021 fiscal year is GH¢ 11,422,711,135. This trend is worrying as public debt balloons. Government has indicated to issue Eurobond in the 2022 fiscal year which will further increases Ghana’s debt.

Public Debt

| No | Item | 2016

GH¢ |

2017

GH¢ |

2018

GH¢ |

2019

GH¢ |

2020

GH¢ |

2021 End-June

GH¢ |

| 1. | External | 68.8 | 75.8 | 86.2 | 112.7 | 141.8 | 161.8 |

| % of GDP | 32.0 | 29.5 | 28.7 | 32.3 | 37.0 | 37.3 | |

| 2. | Domestic | 53.4 | 66.8 | 86.9 | 105.5 | 149.8 | 172.7 |

| % of GDP | 24.8 | 26.0 | 28.9 | 30.2 | 39.1 | 39.8 | |

| 3. | Total Public Debt | 122.2 | 142.5 | 173.1 | 218.2 | 291.6 | 334.6 |

| % of GDP | 56.8 | 55.5 | 57.6 | 62.4 | 76.1 | 77.1 |

Source: MoF

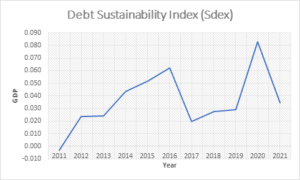

Linked to the public debt is debt sustainability indicators. In a recent report by the Economic Governance Platform titled, ‘The Evolution of Debt Sustainability Indicators’, Ghana’s best performance in debt sustainability was in 2011 when the country achieved an annual surplus of growth of 0.3% in that year. In 2021 alone, Ghana requires an additional growth of 3.5% to achieve debt sustainability.

Debt Sustainability Index

The African Development Bank launched the West Africa Regional Economic Outlook 2021 report titled ‘From Debt Resolution to Growth: The Road Ahead for Africa’ on 11th November, 2021. Ghana is classified as high risk of debt distress. Admitting that Covid-19 is a factor for this increased debt level, Ghana should not sacrifice the medium term prospects on the altar of high public debt and its accompanying interest rate.

Policy Proposals for 2022

- Scrap some taxes and levies on petroleum prices. Inflation rate for the month of October 2021 was 11% -the highest in 15 months. This is largely caused by increase in petroleum prices which also affects transport fares. A key indicator the Bank of Ghana considers in setting the Monetary Policy Rate (MPR) is inflation. Should inflation rate keep rising, BoG might adjust upwards the MPR which currently stands at 13.5%.

- With potential tax payers of 15.7 million, government should implement policies to widen the tax net to generate more revenue.

- Pass the tax exemption bill. Ghana loses 5% of GDP through tax exemptions. This will help increase revenue.

- Job creation (public and private) is critical. Government should operationalize the ‘Youth Banc’ to provide cheap credit to youth entrepreneurs as trading progresses steadily under the African Continental Free Trade Area (AfCFTA) agreement. Also, bottlenecks to doing business in Ghana should be addressed.

- Regulatory framework is crucial in robing in the private sector as a catalyst for poverty reduction and economic development. In December, 2020, Ghana’s parliament passed the Public-Private Partnership Act to actively engage the private sector in delivery of public goods. Government through the Ghana Infrastructure and Investment Fund (GIIF) should seek private sector participation through financing, construction and management of infrastructure.

- Key sectors (agribusiness, ICT and industry) that have potential to reduce poverty and propel economic growth should be explored. These sectors have great potential to foster economic inclusion, create jobs and deepen integration and connectivity. Agribusiness accounts for 25% of Ghana’s GDP and employs nearly half the labor force.

- Government in 2022 should explore innovative approach to domestic revenue mobilsation and close fiscal leakages to expand fiscal space. With high rate of debt, government should use Special Drawing Rights (SDR) allocation prudently and also liquidate outstanding costly debt.

- Securitisation deals are expected in the medium term but government should thread cautiously in order not to enter into deals that will not be in the best interest of the country.

- Operationalise the Development Bank Ghana. The establishment of DBG will help provide long-term affordable capital for the agriculture and manufacturing sectors which has the potential to lift millions of Ghana’s from poverty. Also, the financing gap of US$6.1 billion (13% of GDP) in the MSMEs sector will be bridged with the establishment of DBG. In Ghana, 74% of MSMEs are estimated to be partially or fully credit-constrained according to the World Bank.

- A comprehensive review of the Free Senior High School program is needed to ensure efficiency and improve human capital development. Also, financing of the National Health Insurance Scheme should be reviewed to increase access. At present, about 14 million Ghanaians are on NHIS while according to the 2021 Provisional Population and Housing Census, the population of Ghana stands at 30.8 million. In conclusion, the 2022 budget should consolidate macroeconomic gains made so far while addressing the risks to economic growth and development.

The writer is an Economist/ Partner @ C-KADD Global