Despite looming threats on the country’s currency ahead of the December polls emanating from possible foreign capital outflows and repatriation of profits – a usual occurrence during this period, Databank Research says the cedi will continue to remain stable for the remaining part of the year.

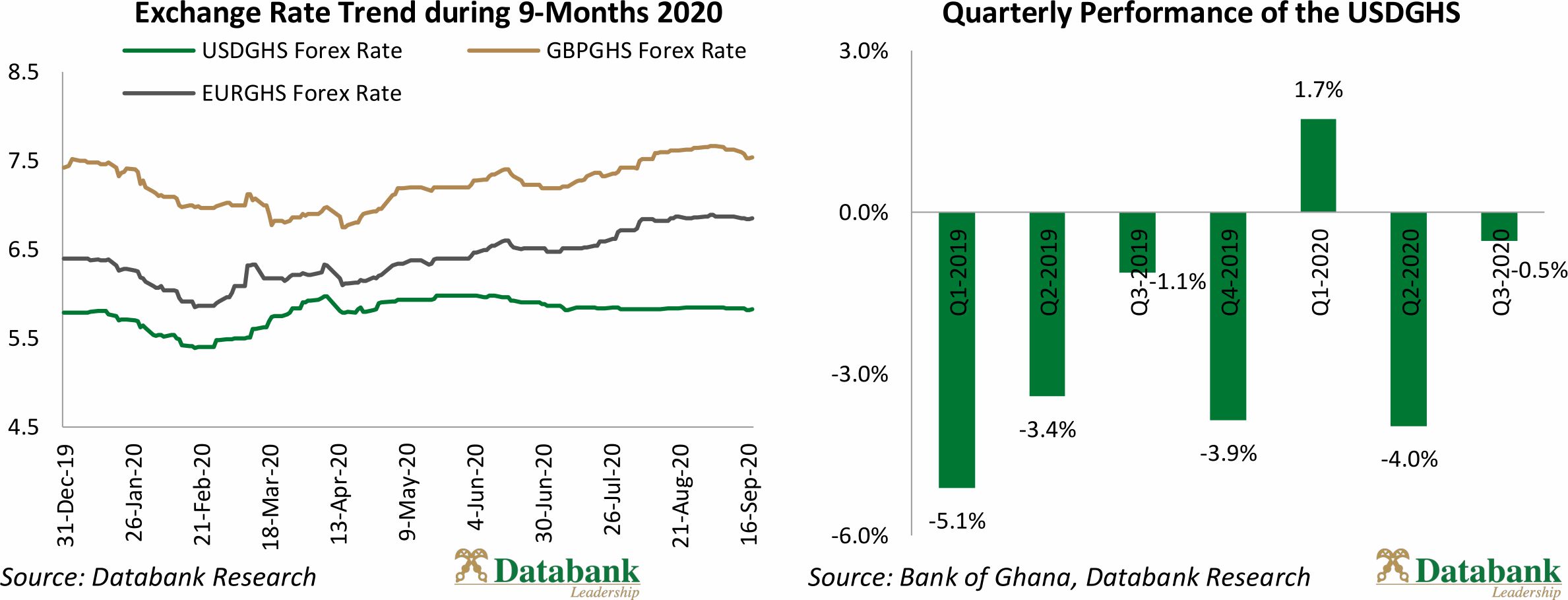

After appreciating against the dollar by 1.2 percent, 4.5 percent, and 1.7 percent in the first three months of the year, the cedi lost its impressive form and started depreciating against its major trading currencies after the coronavirus pandemic pushed foreign investors to withdraw their investments, especially in the money market, to where they consider to be safer havens.

This resulted in a 4 percent depreciation against the dollar in the second quarter, sparking fears that the trend will continue or even get worse for the rest of the year.

But surprisingly, as of the end of September 2020 its depreciation has slowed, recording just 2.9 percent, compared to a 9.3 percent in same period last year.

Cumulatively, the cedi, according to the Databank research, has depreciated by 0.5 percent in the third quarter.

Databank Research, in its third quarter review and outlook report, says the relative good form of the currency is attributable to factors like the US$3 billion Eurobond issued before the COVID-induced tightening of financing conditions for emerging and frontier markets; the about US$2 billion budget funding from multilateral institutions; stronger gold price due to the safe-haven appeal of the precious metal in uncertain times; relatively lower outflow on the services account, which helped to contain the current account deficit; and the Bank of Ghana’s introduction of bi-weekly FX forward auctions coupled with the implementation of the Refinitiv FX trading platform, which has enhanced FX price discovery.

The research firm says these, together with the central bank’s interventions, have made it revise its previous stance of projecting the cedi to hit GH¢6 to a dollar to GH¢5.80 by the end of the year, despite election year threats on foreign capital.

“Potential pressure points include adverse foreign portfolio reaction to political risks ahead of the Dec-2020 election and the Treasury’s high financing needs and its attendant inflationary consequences. However, we view the bi-weekly FX forward auctions, supported by the healthy forex reserves, as a key anchor for the GHS [Ghana cedi] over the short to medium-term,” the report said.

The Databank Research projection of a stable cedi follows a similar confidence expressed by the Bank of Ghana’s Director of Research, Phillip Abradu-Otoo, in an earlier interview with the B&FT who said the bank has enough buffers to cushion the currency against any expected or unexpected external shocks for the remaining months of the year through to the first quarter of 2021.

“The central bank is well-positioned to deal with the pressures that will come. We are also expecting US$1.3 billion from COCOBOD; we are building up in reserves for this year which will provide some buffer to deal with unexpected eventualities; and the US$1billion dollar line insurance from the FED, which has not been utilized will go a long way to provide calm in the markets in 2021

So I expect us to start 2021 with some sizeable build up in reserves to be able to deal with the pressures that will likely come around in the first quarter of 2021. So our outlook is that the currency will continue to be stable even going into 2021. The outlook is positive and the cedi will hold firm going forward,” he said.